Category: Unique

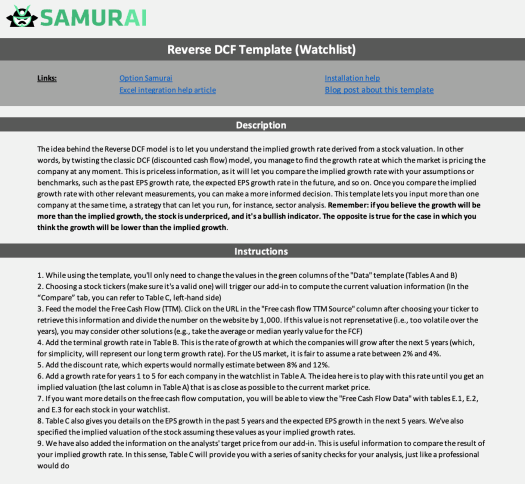

Reverse DCF Template – Finding Winning Companies with Comparative Analysis

When it comes to stock (and option) picking, a sector comparative analysis can give you very valuable insights into potential investment opportunities. This article…

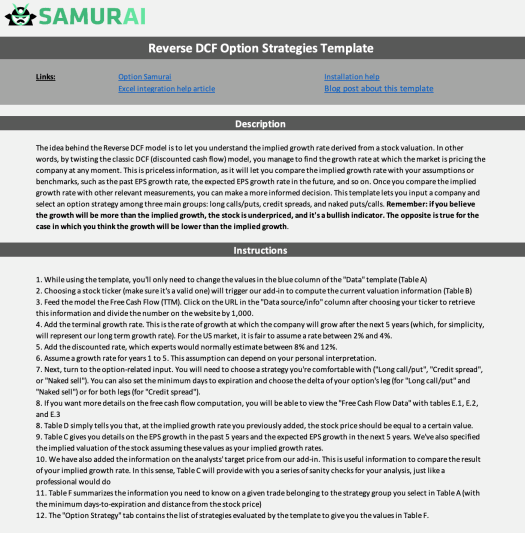

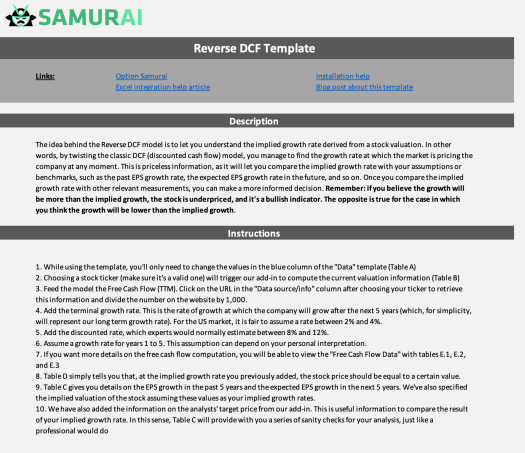

Unlock Financial Insights in Minutes: Your Reverse DCF Excel Template

Among the many tools you should have in your financial analysis arsenal, our Excel Reverse Discounted Cash Flow (DCF) template stands out as a…

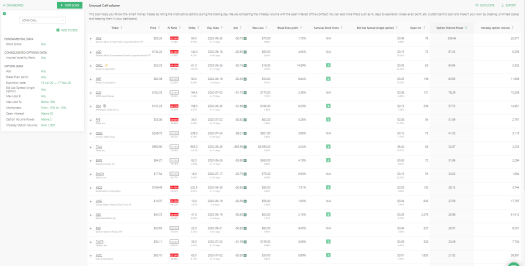

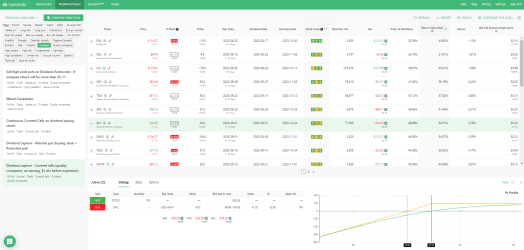

Option Samurai’s Q3 2023 Release – IV vs. HV. Analysis, Improved Spreads Scanner, and More

As the third quarter of the year comes to an end, we are happy to announce our Q3 2023 version of Options Samurai. As…

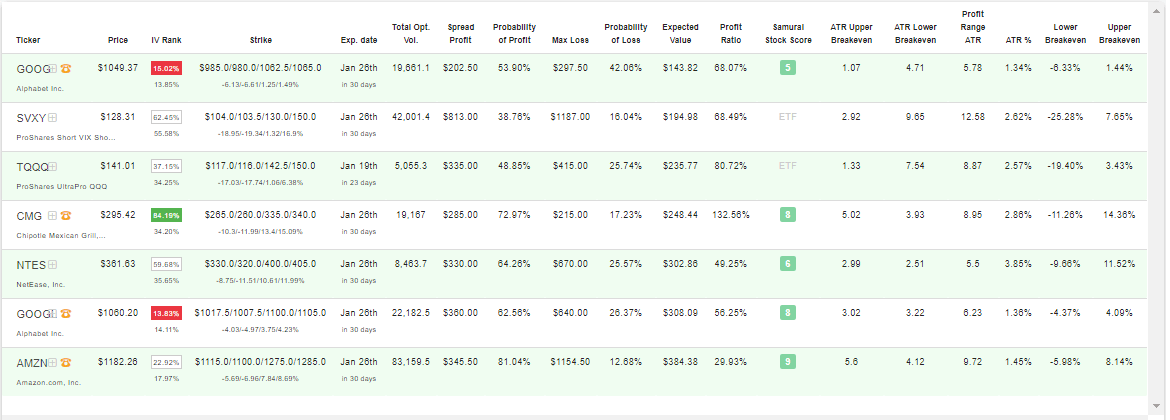

ATR Option Trading Strategies: Ultimate Guide for Trading Options with ATR

This article covers the topic of using ATR for options trading. It will explain what ATR is, How to use the ATR indicator, How…

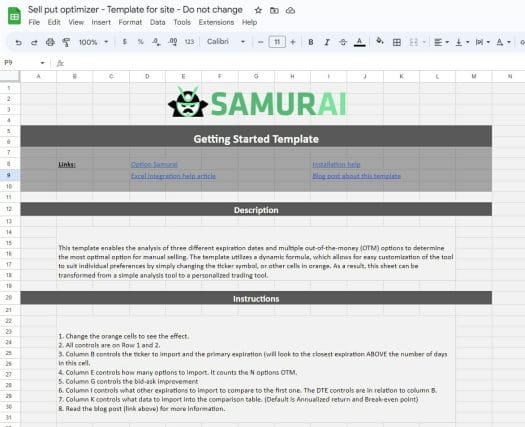

Options Trading – Excel Template: Master Custom Tools Built in Excel and Google Sheets

Options trading can be a profitable and exciting endeavor, but it’s essential to have the right tools at your disposal to make informed decisions…

How to find dividend capture opportunities

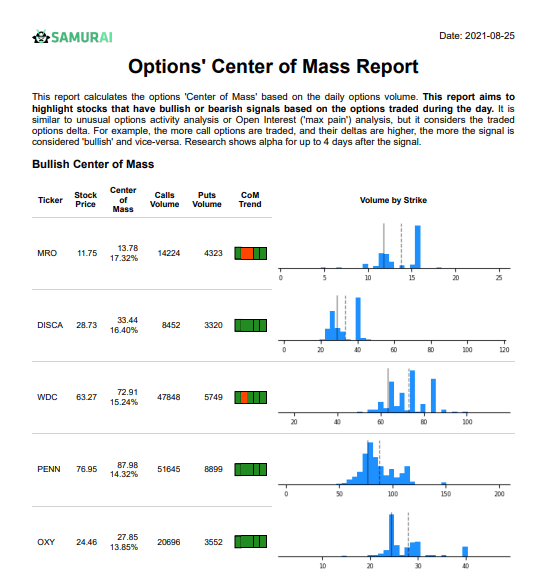

This is a quick post on how I find dividend capture opportunities in the stock market. As part of my weekly process, I like…

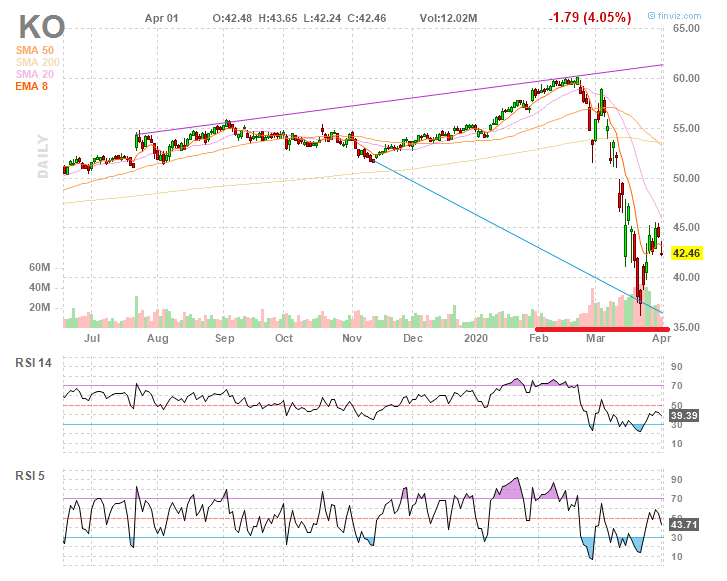

Dividend Yield on Strike – $KO trade

‘Values on strikes’ are unique measures we created to help you find trades that take into account the underlying fundamental or technical situation at…