One of Option Samurai’s unique features is the ability to scan the Average True Range vs. BreakEven point (ATR vs. BE).

- Average True Range is the average movement a stock makes each day, including after-hours movement.

- The break-Even point is the point where an option position becomes profitable on expiration.

By comparing those variables we can see trades that their average move is more than the breakeven. This means that even a random move could make our position profitable. This is always true for stock positions, but not always true for options as we need to account for the time premium. However, comparing ATR to BE point can help us increase our probability of success when buying options. This is something we need, as more than 90% of options expire worthless.

Backtesting ATR vs BE point

Though it is harder to profit from debit strategies, they often have the potential for unlimited gain, as they are not capped on the upside (or the cap is larger than the risk). To check the edge of trading with ATR vs BE point we backtested our database for the last 9 months. We searched for trades that:

- ATR > 3x Break-even point – We are looking for trades that the average move is 3 times larger than the break-even point.

- Days to expiration > 30 – We look for trades that have more than 30 days to expire. We want to have some time to let our position profit.

- Max loss is 10% – Oftentimes, options that are deep in the money will have little time premium and the BE point will be very close. To limit our risk we look for a position where we don’t risk more than 10% compared with buying the stock itself.

- On the first trading day of the month, we bought the positions, and we sold them at expiration.

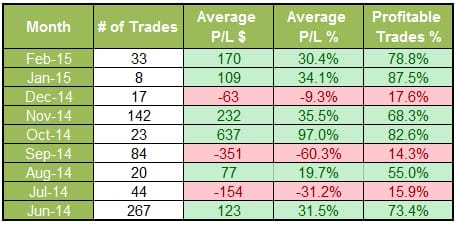

the results:

- Overall we checked 638 trades and 59.2% of them were profitable.

- the average trade yielded 80$ profit (15.8%).

- Not surprisingly, 74% of the trades closed higher at least once, and 98% of the trades traded higher at least once.

The edge of trading with ATR

The backtesting results are positive and highlight important points:

- Even though only 10% of the options are assigned (study conducted by the CBOE), our simple test yielded 60% profitable trades.

- We can also see that the average win-percentage and the average win-amount are greater than the average losses.

These results are very positive and are very impressive when remembering that buying calls are usually considered as a strategy that yields losses.

In this case, by performing a simple scan, we can change the odds to our favor! It is important to note that we don’t expect traders to trade these results, but use them as a watchlist and try to increase their odds from there (shooting fish in a barrel) .

- Try it for free in our Options Screener.

Using ATR on Option Samurai

There are unique ways to use ATR in your options trading. It is a valuable data point to use in a scanner. It automatically adjusts according to the volatility of the asset, market conditions, etc., and allows you to find the best trades according to it.

Over the years, we’ve added more features around that data point. You can read the full article (with examples) here: ATR Option Trading Strategies: Ultimate Guide for Trading Options with ATR.

Here is an overview of how to trade options with ATR:

- Using ATR vs. Break-even point in debit strategies to find cheap options

- Using ATR vs. Strike to find the best stikes to sell.

- Using ATR to create the profit zone of a volatility strategy such as Iron condor

- Using ATR and our Scenario engine to see the future of the trade in different movement scenarios.

- Using ATR to find options that will ‘explode’ with a typical move, or best was to hedge the portfolio and more.

[…] ATR vs breakeven point – compares the ATR to breakeven point to see how many ‘units’ of volatility we need to pass the BE point. This is useful when buying options. and you can read more here https://blog.optionsamurai.com/the-edge-of-trading-with-atr/ . […]