Category: Implied volatility

IV in Options: The Role of Implied Volatility in Options Trading

Unravel the complexities of IV in options trading with our comprehensive guide. We delve into what IV is, its impact on high and low…

IV Percentile and What is Implied Volatility Rank?

IV percentile is one of the most important measures in options trading. It is also the most commonly used feature in Options Samurai options…

What is Expected Value and 3 ways to use it

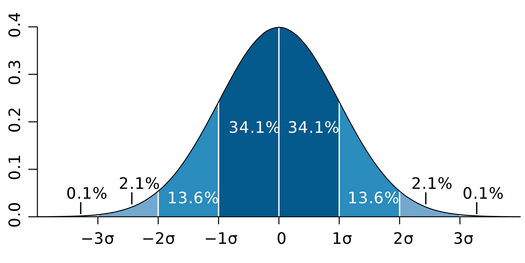

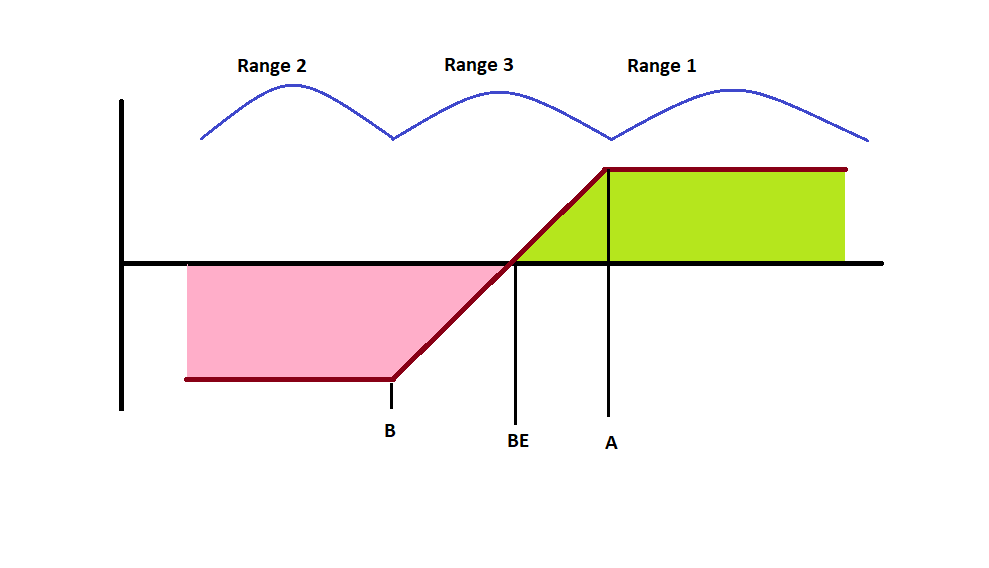

In the realm of trading strategies, Expected Value (EV) is a statistical measure that seeks to predict the potential profitability of a particular strategy,…

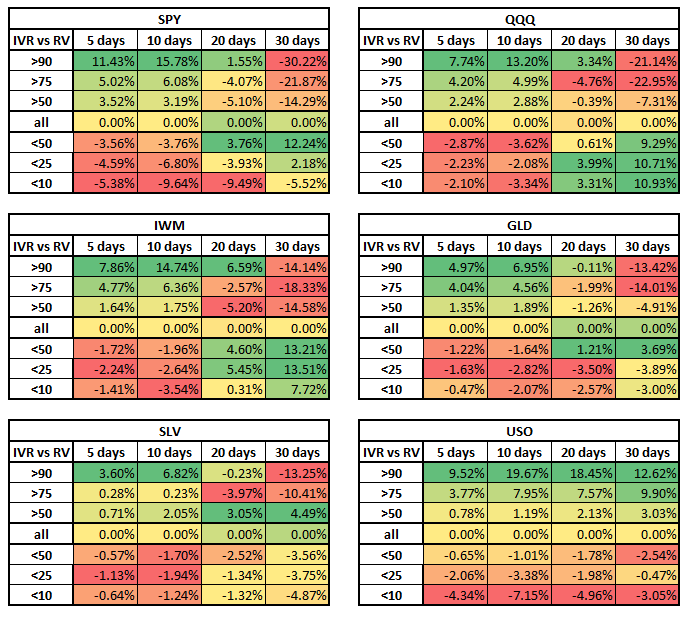

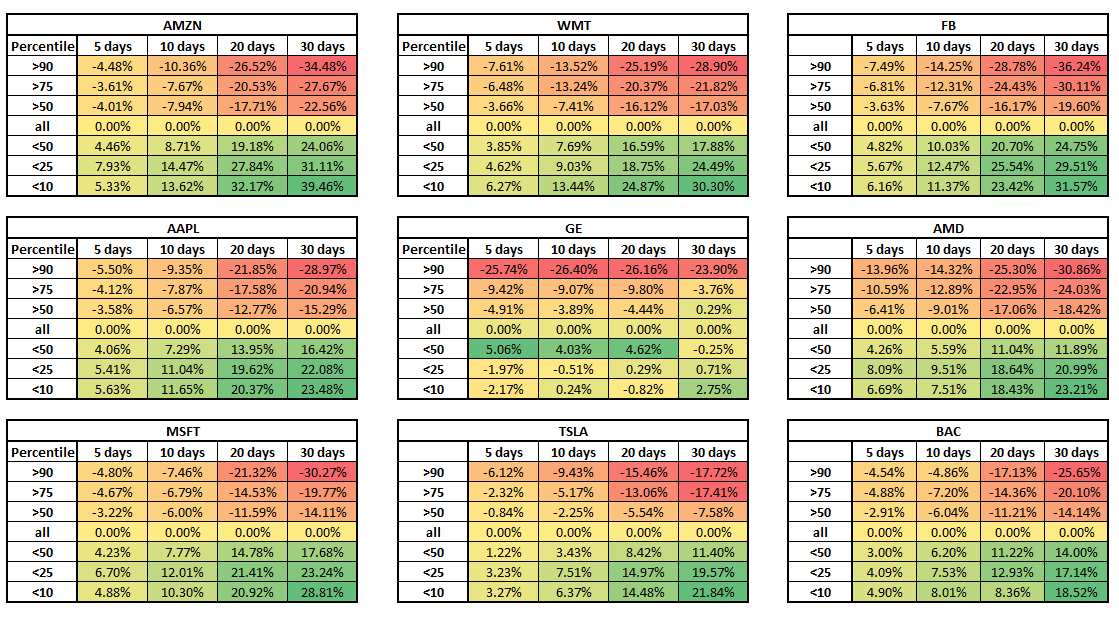

Implied Volatility backtest pt 3: IV and RV

In the past two parts, we saw that IV and RV are both mean-reverting. We also saw that we could use the edge generated…

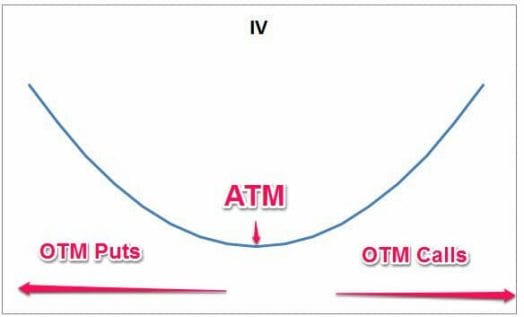

Volatility Skew Rank – Part 1

This will be the first in a series of articles that dive into the advanced applications of implied volatility. You can read the first…

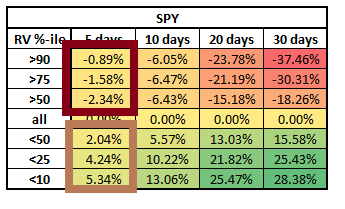

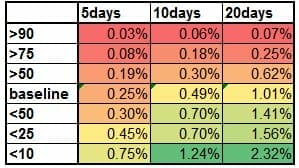

Implied Volatility Backtest 2: Predicting RV Change

This is a multiple-article series. In part one, Implied Volatility backtest – Predicting IV Change, we discussed how the IV percentile predicts future IV…

Implied Volatility backtest – Predicting IV Change

[We have just added another article in the series, about the Real Volatility (or Historical Volatility) backtest. Check it at Implied Volatility Backtest 2:…

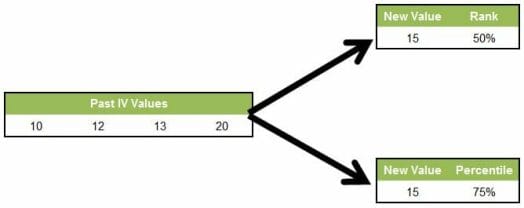

Difference between IV Rank & IV Percentile

In the OptionSamurai Scanner, we use IV Percentile to compare the IV of different stocks and call it “IV rank” as we think it…

Implied volatility drop after earnings

Many traders ask themselves how much the Implied volatility drop after earnings. Since earning release are very volatile – We can see an increase of IV…

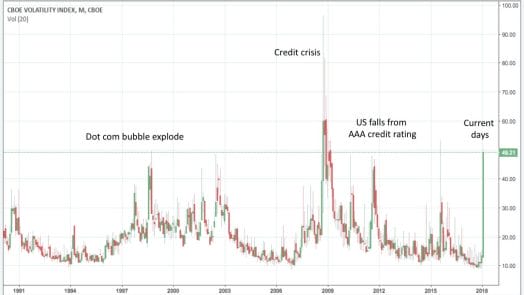

The markets plunge – what does Vix tell us?

(small update: The Vix gave more than 30% and faster than we projected. If you took our idea it might be good time to…

Edge of Skew Rank – Part 2

In the last article, Volatility Skew Rank – Part 1, we talked about what skew is. In this article, we will talk about ranking…