This article covers the topic of using ATR for options trading. It will explain what ATR is, How to use the ATR indicator, How to use ATR in options trading, What ATR bands are, and will give examples of how you can use Option Samurai to find the best trades using the ATR strategy.

Key takeaways

- ATR indicator stands for Average True Range and is a volatility measure of a financial asset in Technical analysis.

- ATR options trading strategies revolve around comparing the asset volatility (measured by ATR) to the option’s strike to find trades with a high probability of profit .

- When buying options, you can find trades with a strike price that is one ATR or one ‘average move,’ thus increasing the probability of profit.

- When selling options, you can measure the ‘profit zone’ using ATR bands and compare different assets with different volatilities.

Recently, many users have shared stories with us about their successes with our ‘buy cheap calls’ pre-defined scan. This predefined is available in our scanner for all users (even during the trial). The main component of that scanner is the ATR filter. So, we’ve decided to write this complete guide and share more information about the ATR indicator in Option Samurai and how to use it.

What is the ATR indicator?

ATR, or Average True Range, is a technical analysis indicator to measure the volatility of an asset. Originally developed by J Welled Wilder for commodities, it has gained popularity among technical analysts and is now widely used. The goal of the indicator is to find the “true” movement range for a stock to assess its volatility.

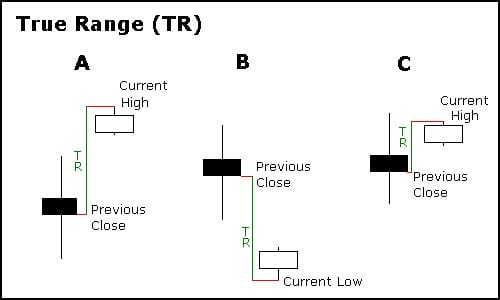

The calculation of the True Range (TR) is:

TR = The maximum of:

- Current High – Current Low

- Yesterday’s close – Current High (Absolute value)

- Yesterday’s close – Current Low (Absolute value)

The ATR is usually a 14-day average of the TR value.

ATR is a Volatility measure of the stock based on past price action. It is a much more intuitive measure than standard deviation, for example.

How do you use ATR in options trading?

One of the most important characteristics when trading options is the assumption of the asset’s volatility. When we use ATR, we can standardize the volatility for different assets and compare trades on different stocks, although the different stocks have different volatility.

For example:

In the following example, we can see Example results from our Options Scanner for NVDA, BABA, DIS, and CCL.

- We can see that NVDA ATR, for example, is $15.01, which is 3.36% of the current price.

- We can also see that Strike NVDA strike 395 is 11.59% below the current market price, and it’s 3.45 “ATR units”. Or 3.45 times the average daily move. This is a good example of how you can use ATR in Options trading – more on this later.

- We can see that BABA and NVDA have almost the same ATR in percent terms but not in dollar terms, as the prices are different. This means that the ATR indicator can help us compare different assets under the same ‘units’.

This is the main power of using the ATR in option scanning – the standardization allows you to compare different stocks and different parameters and adjust the volatility. Because it takes into account the volatility, it is superior to regular percentage measures.

ATR in options trading: How to use the ATR indicator

The ATR will allow us to standardize the volatility of different assets and look at distances in “ATR units” which will allow us an ‘apples to apples’ comparison of different assets. Here are some ATR options strategies we can use:

1. Find cheap options

When we buy options, the option premium should be enough to cover the potential move of the stock so the option seller will have enough margin of safety to expect profit.

Using the ‘ATR VS Break-even Point‘ filter, we can make sure that the premium we pay is relatively low compared with the stock volatility (see more in the example). Since we can’t lose more than the price we paid, buying cheap options can give us a real edge in the market compared with buying the stock. You can check the backtest we did for additional information: The edge of trading with ATR

2. Choose the right strike to sell options

We can also use the ATR with options to find the right strikes to sell. Using ATR, you can find strikes that are N amount of “ATR units” from the current price. This means that the distance depends on the stock volatility – the more volatile the stock, the further away the strike will be.

Using the filter ‘ATR vs. Strike,’ you can easily find strikes that are far X amount of ATR units from the current price. This saves you time and allows you to compare different trades for different stocks and ETFs.

3. Wide profit zone

Another cool way to use ATR in options trading is When trading Iron Condors or other range strategies, you can make sure that the ‘profit zone’ of the iron condor covers what you are looking for. There are 3 filters you can use:

- ATR to Upper Breakeven

- ATR to Lower Breakeven

- Profit range ATR

These filters give you more control when scanning for range strategies, as you can control the distance to the upper break-even point, lower break-even point, and the total width of the profit zone – all in “ATR units” (see examples below for usage).

4. Use our scenario engine to see the future of the trade

Our scenario engine allows you to scan the entire market with an assumption of a future scenario. For example, you can find the best trades, if all assets go up 10%, or fall one standard deviation, or if all stocks will reach their analysts’ target price. Read more in our Knowledgebase. Some of the use cases for ATR Options Strategies are:

- Find the best options to use for hedging your portfolio

- Sort trades by most profitable if the scenario happens

- Find the best position that fits your view (for example, Gold will rise 10% due to money printing).

- Find calls/puts that will explode in value

- And much more.

Example 1: Find weekly options that will explode in value if the stock moves 1-ATR

Using our Scenario engine and the ATR indicator data point, you can find calls that explode in value if the stock moves 1 ATR (or more).

To use it, compose a new scan and choose Long call (or long put). Set in the scenario engine that you want to see 1 ATR up and only profitable trades in the PL column. We then need to adjust the IV rank, liquidity, max loss, and distance to the break-even point to fit our view of the market.

When we run the scan, we can sort by the column and see the options that have the most upside.

We have predefined scans to help you get started. Read here:

- Weekly options that will explode in value use-case

- Predefined scan for call options that will explode in value

- Predefined scan for puts options that will explode in value

Example 2: Using ATR indicator when buying calls

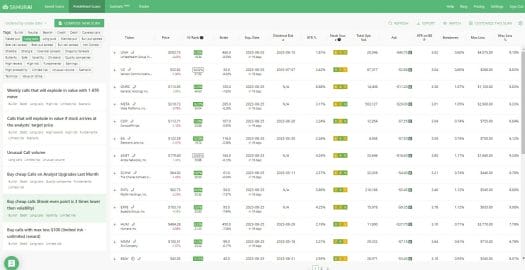

In our predefined section, you can find the ‘Buy cheap calls’ scanner:

This scan is looking to buy calls that have more than 15 days to expiration, a max loss of less than 5% compared to buying the stock (serves as a stop loss), and a break-even point is less than 3% (meaning if the stock rises 3% by expiration, the position is profitable).

The most important parts of this scan are no dividend (which adjusts the price down), and ATR needs to be 3 times the Break-even point (ATR vs. BE point). This increases the probability of exceeding the break-even point and shows a profit. This is a really beginner-friendly trade option as this ATR options strategy has limited loss and high-profit potential.

Some more ideas on how to integrate this into your trading:

- You can sort by ATR vs BE point to see the ‘cheapest’ opportunities

- You can add the ATR vs BE point to your watchlists to see this data column in your results.

- You can change the value from 3 to a higher or lower value in your screens to better adjust your results.

In the picture above, you can also see some other ATR options scans you can try. So go to our Options scanner and try it now for yourself.

Example 3: Using ATR when selling Iron Condors

Iron condors are an exceedingly popular strategy. It allows users to enjoy the time decay of the options (increases the probability of profit) while benefiting from a limited-risk trade.

In this example, we will use our Iron condor filter to check all possible combinations (hundreds of millions of option combinations) and find the best Iron Condors (IC) that fit our criteria.

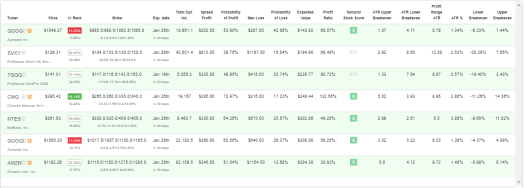

Below are the results for Iron condors:

- Up to 30 days to expiration, any IV rank and total option volume > 5000

- IC profit is above $200, the loss is below $5,000, and expected value is profitable

- We added ATR measures: the break-even point above should be more than 1 ATR, below needs to be more than 2 ATR, and the entire range should be more than 5 ATR.

- We also added the ATR percentage to the table to compare.

This table shows us a variety of results with different volatility. We can pick the strategies that best fit our risk criteria.

For example:

- NTES trade has about a 21% profit zone. About 10% to each side. The expected value is $302, which teaches us that this trade has a high probability of profit. When analyzing this trade in ATR units, We can see that the Break evens are 3 ATRs on the upside and 2.5 ATRs on the downside.

- Due to the earning date, CMG allows for a 9 ATR profit range. 5 ATR on the upside and almost 4 ATR on the downside. The expected value is $248, and the probability of profit is 73% (but this statistic is skewed due to the earning event prior to expiration (so this trade is not for everybody)

Here are some more ideas on how to integrate this into your trading:

- You can sort by the ATR measures to make sure you have enough margin of safety (or no margin if you are buying straddle)

- You can limit results to have more than X amount of ATR and a high IV rank

- Read more about all our ATR filters here: New Feature: ATR filters

Summary

The ATR indicator is a technical measure of the volatility of an asset. We can use ATR in options trading in an effort to compare different trades on assets with different volatility. Using the ATR instead of the normal percent measure helps us to save time as we can focus our analysis on the best trades (risk-reward wise) while taking into consideration the fact that different stocks have different volatility.

When selling options, we are looking to sell options that have the most ‘ATR units’ of distance from the current price.

When buying options, we are looking to buy options that are the closest to the price (ATR-units-wise), and we do it by comparing the ATR to the break-even point and asking the ATR to be as big as possible compared to it.

You can gain instant access to all our features and more here:

(This article was originally published in Dec 2017 and has been updated since)

How did you figure the precent? Close-high / close-low ? eg close 95, high 100, low 90 percent would be 0?

To calculate ATR we first calculate the 3 values in the document separately, and then choose the biggest value out of them (for every day). We then average it over the last 14 days.

After we have the $ value of the ATR we divide it in the last price of the stock (mid price during market times) and we get the % of the ATR.

During the scan I like to compare it against the break-even point.

The calculation you presented is ‘intraday stock position’. We will allow you to filter according to it soon

Great tool. However, I wish the ATR was not only calculated using the daily values(preferably daily, week, monthly, quarterly and yearly). Thanks for the good work.

Thanks for the suggestion. I will add it to the requests list. We keep adding features according to our users’ requests. So I hope we will be able to add it in the future.

I do not see the option to add “ATR VS Break-even Point” on the “Buy Cheap Calls” scan.Can you provide an update screenshot on how to add it if is still available?

Hey Leo,

I assume you are referring to this scan: https://new.optionsamurai.com/scan/edit/134

I’ve added a picture of how to see it. It’s on the left under the ‘option data’ filters.