As the third quarter of the year comes to an end, we are happy to announce our Q3 2023 version of Options Samurai. As mentioned in the last update, we have continuously delivered new features and more value for our users for 4.5 years now 😊. We are proud of that, and the feedback we get from our users keeps us going (Thank you for the kind words).

In this version, we’ve updated many of our backend systems to allow us to scale, continue, and deliver even more features this and following years. We can already announce some improvements and new features we’ve delivered. This post will highlight the most important ones.

This version we’ve added:

- Implied Volatility vs. Historical Volatility Analysis

- Improved earnings logic

- Intrinsic / Extrinsic values

- Improved spreads scanner and butterflies’ scanners

- Bug fixes and improvements

Implied Volatility vs. Historical Volatility Analysis

We’ve significantly improved the IV vs. HV analysis on the details page. Now, you can control the IV expiration and delta to define better the options you want to compare. Previously, the IV was 30 days-to-expiration IV of ATM call and put options. But now you can change it: For example, you can choose to look only at call options IV (to see if calls are over or underpriced) or check long-term IV (or short-term IV) by setting the window to 90 days (or 9 days).

The chart now allows for much more customization so you can define the analysis to suit your trading style better.

Improved earnings logic

Earnings are significant for options traders. We’ve added another data provider for companies’ earnings so we can deliver better earning dates ahead of time – even if they are not confirmed yet.

Intrinsic / Extrinsic values

We’ve added Intrinsic and Extrinsic values to our platform so you can use them in the scanner, trade log, Excel integration, and more. This can help you build a portfolio value of how much time value you have, create scans to find the right options, and many more custom abilities to fit your trading better.

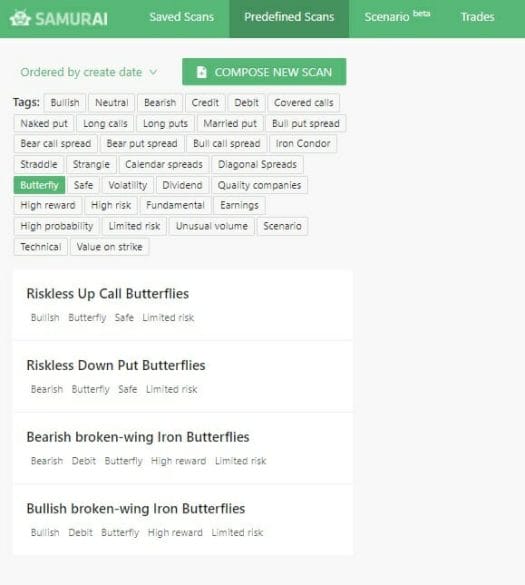

Improved spreads scanner and butterflies’ scanners

We’ve made general improvements in our spreads and butterflies’ scanners. The upgrades increase the speed, defaults, texts, filters, and more. We’ve also created an iron butterfly guide in our blog for free.

You can also use the predefined scans we’ve added for different market conditions.

Bug fixes and improvements

We’ve continued to improve the platform and squash bugs. Some of the work deployed in this version contains better calculations, more accessible export, typos, UI improvements in scenarios, Excel plugin, and more.

The version is now live and available to use.