Category: Research

Implied Volatility backtest pt 3: IV and RV

In the past two parts, we saw that IV and RV are both mean-reverting. We also saw that we could use the edge generated…

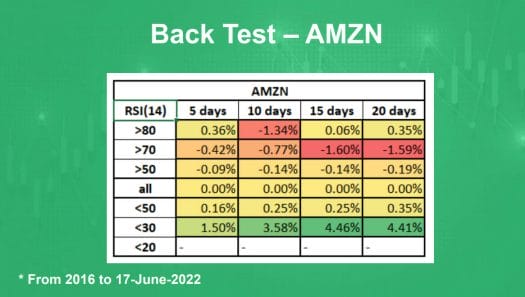

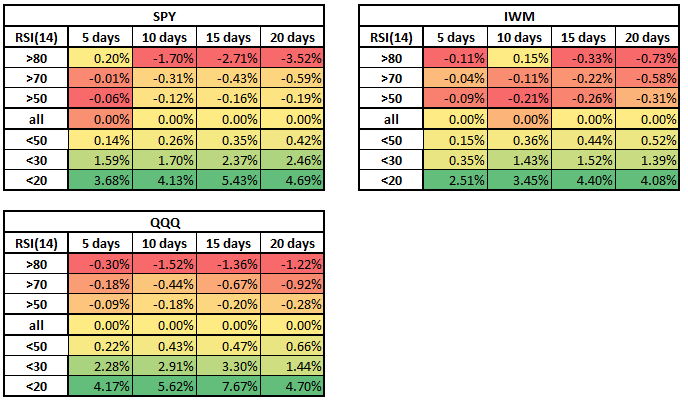

RSI Backtest: Predicting the Stock Movement Using RSI – Part 1.

Option Samurai’s option scanner is designed to help you find the best options trades in the market. To do that, we compile many data points…

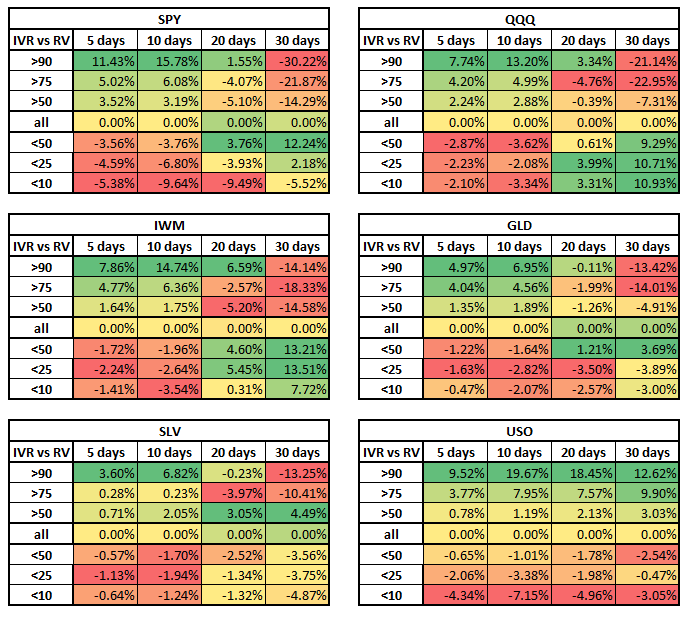

Implied Volatility Backtest 2: Predicting RV Change

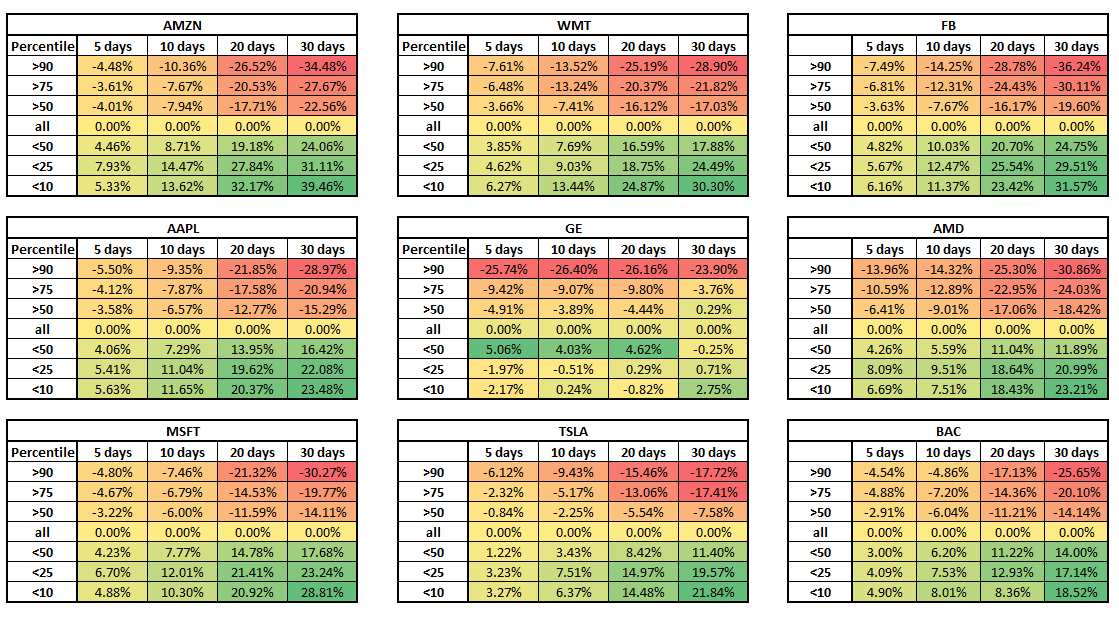

This is a multiple-article series. In part one, Implied Volatility backtest – Predicting IV Change, we discussed how the IV percentile predicts future IV…

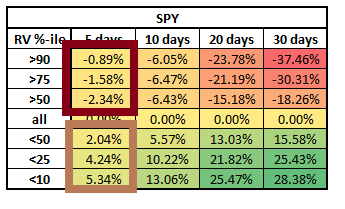

Implied Volatility backtest – Predicting IV Change

[We have just added another article in the series, about the Real Volatility (or Historical Volatility) backtest. Check it at Implied Volatility Backtest 2:…

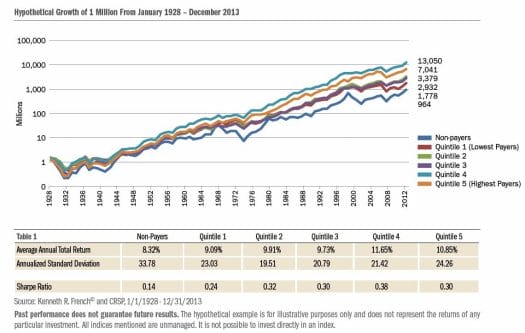

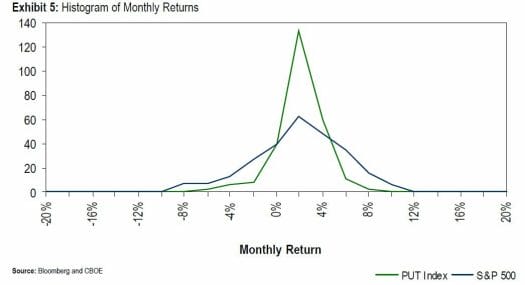

The Edge of Selling Puts

This is the third installment in our series into the edge of selling options. You can see the previous two parts here and here….

Implied volatility drop after earnings

Many traders ask themselves how much the Implied volatility drop after earnings. Since earning release are very volatile – We can see an increase of IV…