Category: Tutorials

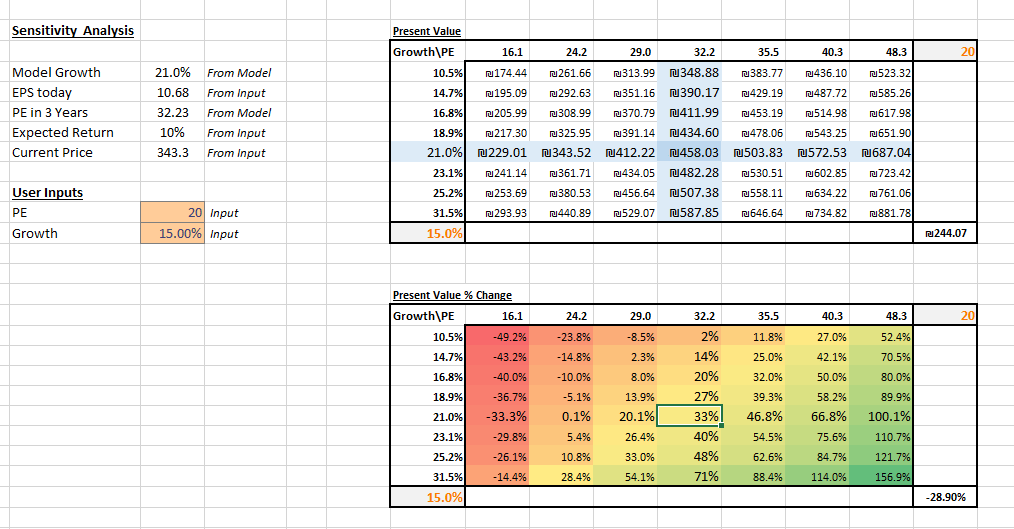

Stock Valuation Model (+Automatic excel import of stock data)

What is Stock Valuation? Stock valuation is the process of estimating the intrinsic value of a stock. The stock valuation model is a simple…

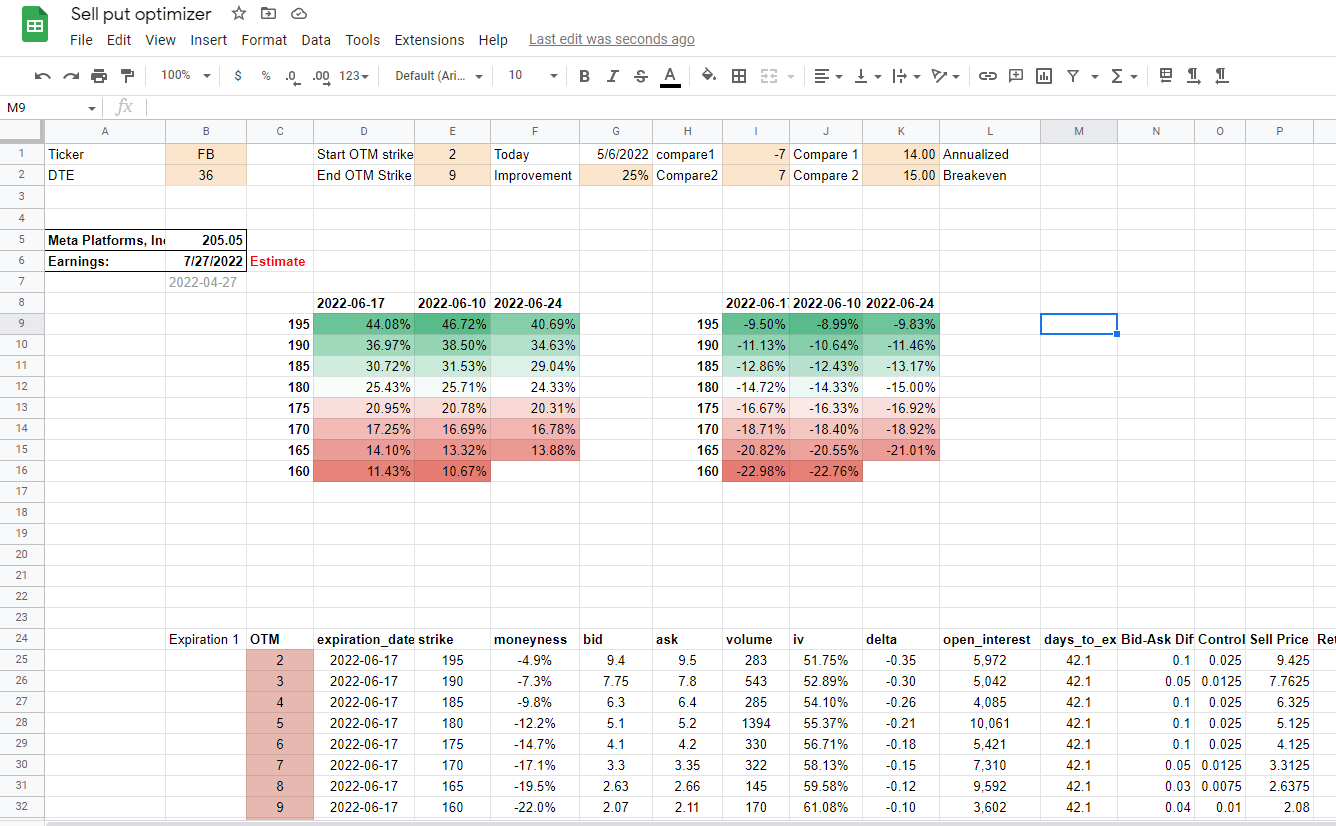

How to Import Options Data to Excel and Google Sheets (Including Templates)

Most traders have spreadsheets they enter data in. This helps them analyze data and improve their workflow. However, importing data to the spreadsheet is…

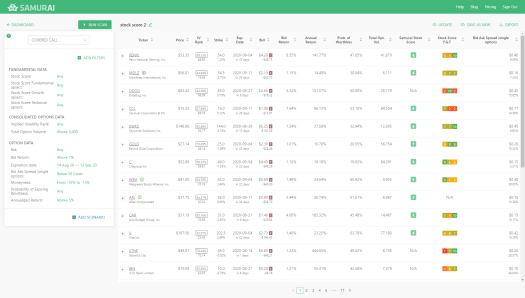

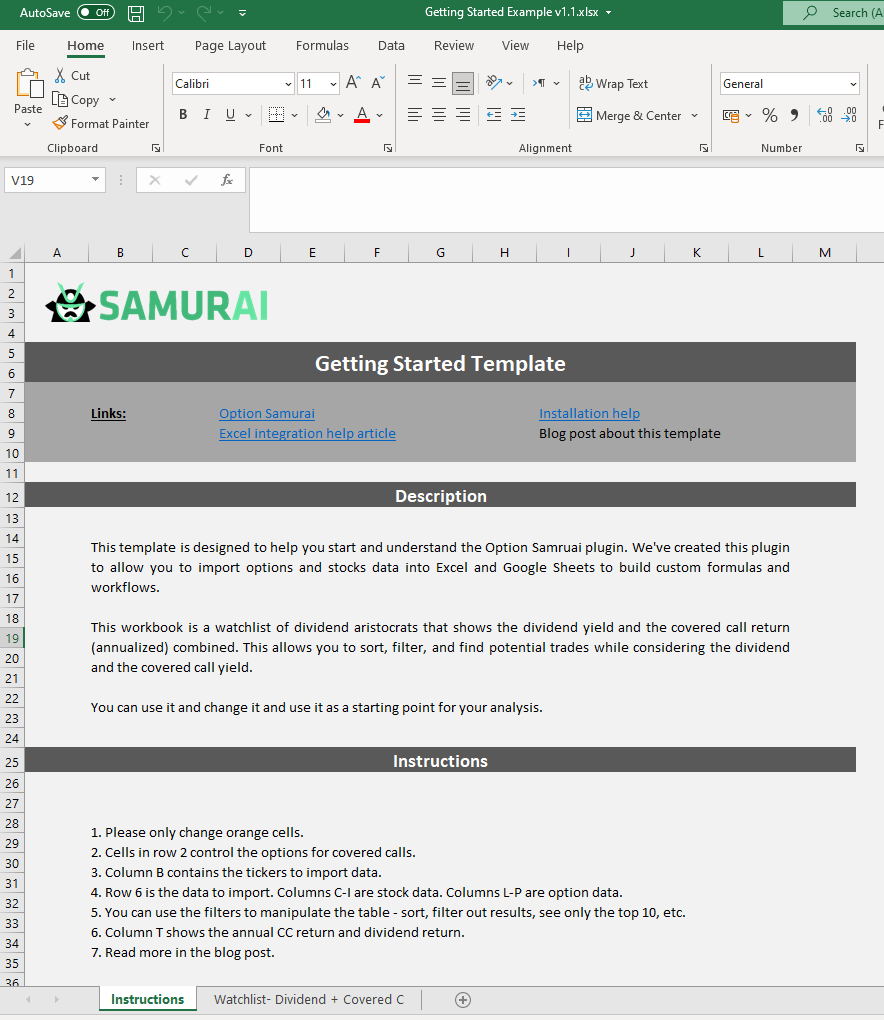

Excel template: Good covered calls trades on Dividend Aristocrats

We’ve recently launched our new Excel and Google Sheet integration with Option Samurai. It allows you to import options data directly from our options…

Tip: Use Scans as Part of Your Investment Process

This article will be a short technical how-to article to help you create scans for your investing process. We use it personally to quickly…

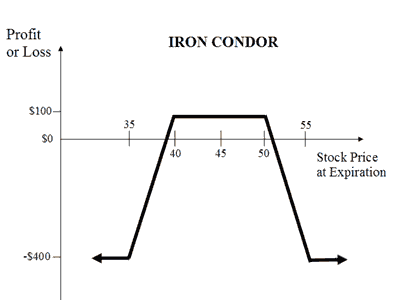

Optimal Iron Condor Strategy and how to find it in Option Samurai

Today we will discuss one of the most popular strategies in options trading: iron condor. The Strategy became very popular due to the limited…

Multi-column sorting

[We have improved the usage of this feature based on your feedback. Here is the updated article: Here] We’ve just launched the Multi-column sorting feature…

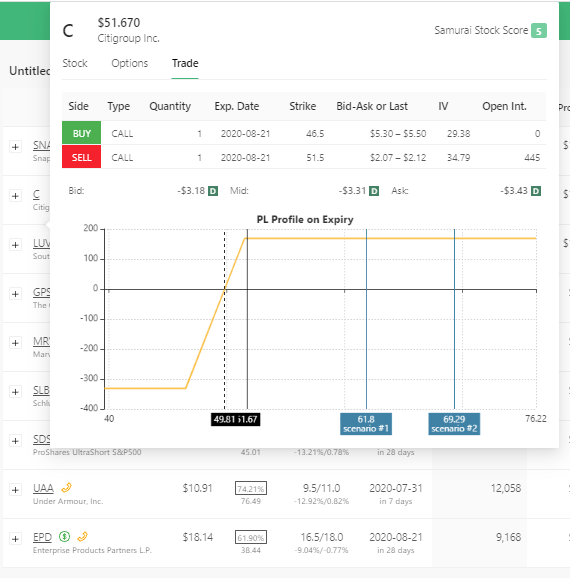

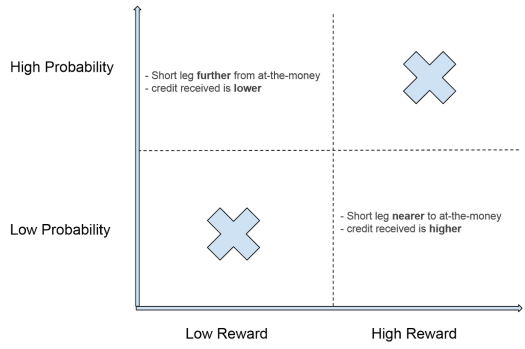

Creating an optimum vertical spread

Update: This article describes what vertical spreads are, considerations on how to build optimal spreads, data points to take into considerations, how to find your…

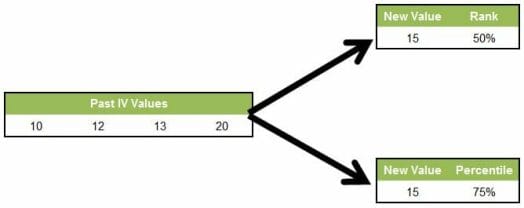

Difference between IV Rank & IV Percentile

In the OptionSamurai Scanner, we use IV Percentile to compare the IV of different stocks and call it “IV rank” as we think it…