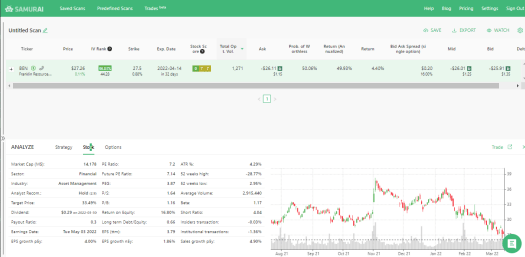

We’ve recently launched our new Excel and Google Sheet integration with Option Samurai. It allows you to import options data directly from our options scanner to Excel and Google Sheets. This will enable you to build custom formulas and workflows.

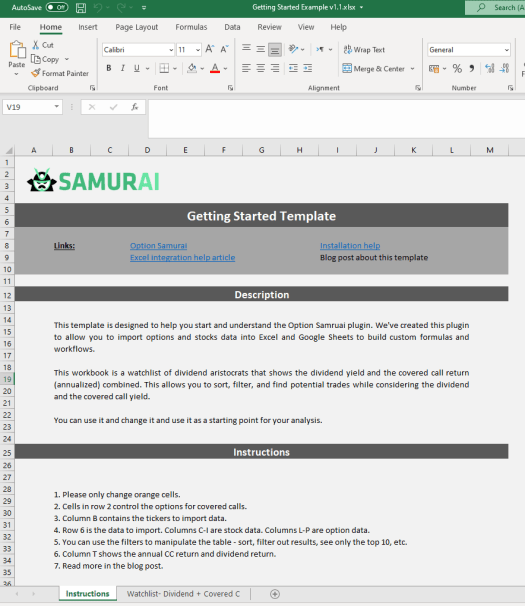

We’ve created an example template to help you get started. This template is a watchlist of Dividend Aristocrats. It allows you to track the current price, dividend yield, analyst target, and COVERED CALL return of those stocks. You can also use Excel’s features to sort, filter, and build custom formulas.

This article will describe how to use the template and give more ideas on what you can do with it.

How to use the template

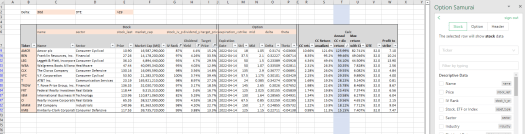

As mentioned, The template organizes Dividend Aristocrats and shows essential information about those stocks. You can use this watchlist to track the changes and see unique calculations. For example, in this template, it’s in Column T – Annual Covered call return + dividend return – It’s the return if you do the covered call every month for a year + the dividend you’ll get. By the way, column U, max return is also unique – It is the position’s profit if the stock arrives at the covered call strike.

Example use-case:

- Notice that in row 2, you can change the delta of the covered call and the Day To Expiration (DTE). By default, these are 30 delta and 30 days to expiration.

- I will use the filters to filter IV RANK below 50%.

- Dividend Yield above 3%

- The target price is above 0. This means analysts this the stock is under-priced.

- Sort column T – Annual CC + Div return.

The top results are AMCR, BEN, LEG, WBA, and CLX when writing this.

While AMCR will have an earnings release, BEN looks very interesting – Cheap, good company, stable dividend, and good return. The whole list is worth checking out.

It will be a great tool to use regularly and see potential trades as we can see companies from various sectors and all give a good yield and have good covered call return.

More use-cases:

Since this is an Excel template, we can change the workbook, get new information, increase our edge, and adapt to the times.

Here are some more examples:

Sort by max return with Covered calls:

Covered calls give us premium but cap our upside. We can sort by a max return to see the max profit we can expect until expiration. We can also change the options parameters in row 2 to receive the results we want.

Change options to Wheel strategy.

The template currently calculates covered calls. But by changing the formulas in columns L-U, we can import option data for puts options and build a wheel strategy. You can check our Wheel scanner in the Samurai options scanner.

Create custom score

A custom stock score can be very useful for sorting stocks when considering different metrics or a ratio between a good metric and a bad metric. If there is a demand, we will create an article about building a custom scoring system. Still, we can give examples: If you want to score risk-reward ratio, you can take a reward metric (max return, for instance) and risk metric (amount invested) and divide them.

Another example is implementing a points system for different metrics and combining them. For example:

- Dividend yield – Below 2% – 0 points, between 2-3% – 1 point, between 3-5% 2 points, above 5% – 1 point.

- Distance from analyst target – below 0% – (-1) points, below 15% – 0 points, above 15% – 1 point

- Covered call return – etc.

Once you create a ‘point system’ for each column, you can sum them and see what stocks have the best score while considering many different data points.

You can implement many more use-cases, and we encourage you to try and adapt this template for your need.

Summary

Option Samurai Plugin allows you to import options data directly to your Excel and Google Sheet workbooks. We also have a floating options formula to import options data with parameters (such as delta, DTE, OTM distance, and more).

This plugin is helpful to create tools, formulas, and workflows that are custom for you and fit best with your trading style. This template was built with customizability in mind, and we encourage you to try and change it to find the best use cases for you.

Read more

- Download the template here.

- How to import Options data to Excel and Google Sheets

- You can see the dividend aristocrats scan in Samurai

- And also, the wheel scanner