In this article, we will discuss the essence of IV Crush in options trading. We will understand its impact post earnings announcements and learn strategies to sidestep it. We’ll delve into the phenomena of volatility and implied volatility crush, complete with a couple of illustrative examples of an IV Crush scenario. If you want to know how to avoid an IV crush, we have a few suggestions for that as well. What is an example of an IV crush? To answer this question, we’ll share a couple of recent real-life examples from the market.

Key takeaways

- IV Crush is a significant drop in implied volatility that typically occurs after the announcement of earnings or significant corporate events. This rapid decrease can greatly affect the price of options.

- The effect of IV Crush is particularly noticeable post-earnings, where implied volatility often rises before the announcement as investors expect larger than normal stock price movements.

- To mitigate the impact of IV Crush, strategies such as avoiding earnings announcements and implementing risk-defined plans and proper position sizing can be employed.

What Is an IV Crush?

When it comes to IV in options trading, one term that often crops up is “IV crush”. But what does this term mean? The IV in IV crush stands for implied volatility, and the term ‘crush’ signifies a rapid drop. Thus, an IV crush in options refers to a swift decrease in implied volatility, typically following significant corporate events, such as earnings announcements.

The IV crush meaning becomes clearer when you look at its cause and effects. Before an earnings announcement or similar event, implied volatility tends to rise. This increase is due to investors anticipating a larger than normal price movement in the stock, which in turn leads to higher options prices. However, once the news is out and uncertainty diminishes, the implied volatility drops rapidly, leading to a decrease in options prices. This phenomenon is what’s known as an IV crush or “implied volatility crush.”

Observing an IV crush after earnings is quite common. For example, Apple (AAPL) and Nvidia (NVDA) have both exhibited IV crushes in options following their earnings announcements, and this is true for a large number of companies. Despite a sometimes minimal change in their stock prices, there was a noticeable drop in implied volatility, reflecting the market’s reduced uncertainty about these companies’ future performance.

While an implied volatility crush can lead to lower options prices, it also presents opportunities for astute options traders. When implied volatility is high, options are costlier. Therefore, a drop in implied volatility and options pricing can benefit options sellers. However, it’s worth noting that trading during periods of high volatility can be risky.

So, how to avoid an IV crush? Some traders use automation or risk management strategies to mitigate its effects. Others rely on risk-defined strategies, proper position sizing, and combining high implied volatility opportunities with other indicators to profit from an IV crush.

In essence, understanding the dynamics of an IV crush is vital for successful options trading. It’s a phenomenon that carries both risks and opportunities, and its careful navigation can potentially lead to profitable trades.

IV Crush After Earnings – A Classic Scenario

One of the classic scenarios we will look into is that of an IV crush after earnings. Prior to this type of announcements, uncertainty tends to build up, inflating the implied volatility and, subsequently, the price of options.

However, once the announcement is made, the uncertainty dissipates, causing the IV to plunge. This phenomenon, known as an IV Crush, can leave option holders nursing significant losses if they’re not prepared.

Volatility Crush in Option Trading

“Volatility crush” and “implied volatility crush” are two sides of the same coin. While IV crush refers specifically to the rapid decrease in implied volatility of an option, volatility crush is a more generalized term that describes the reduction in uncertainty following a significant event. Both these terms underline the same phenomenon – the swift deflation in option prices due to a decrease in volatility after an event.

What Is an Example of an IV Crush?

If you wonder, “What is an example of an IV crush,” let us walk you through two scenarios that illustrate the impact of IV Crush on option prices.

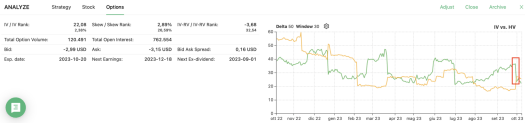

Firstly, let’s consider Accenture (ACN). On September 28th, 2023, Accenture published its latest earnings report, which unfortunately disappointed the market. However, the focus here is not on the company’s performance per se but rather on the consequent reaction in the options market.

As the graph below clearly shows, there was a sudden, significant decline in implied volatility immediately following the earnings report. This is a textbook example of an IV crush in options. Despite the negative earnings report, the removal of uncertainty surrounding the company’s performance led to a sharp decrease in option prices, illustrating the IV crush phenomenon.

Our second example is Nike (NKE), which also released its earnings report on the same day as Accenture. Unlike Accenture, Nike managed to positively surprise the market with its earnings report. Yet, interestingly, this radically different situation led to the same outcome in the options market: a strong decline in implied volatility.

The graph below illustrates this IV crush post-earnings announcement. Even though the earnings surprise was positive, the resolution of uncertainty led to a decrease in option prices, highlighting the counterintuitive nature of the IV crush phenomenon.

These examples underscore the meaning of IV crushes in options trading. Regardless of whether the earnings announcement is positive or negative, the resulting decline in implied volatility post-announcement can lead to a crushing effect on option prices.

So, when asking yourself what is an example of an IV crush, you can think of these scenarios where a swift drop in volatility led to losses for options holders and opportunities for sellers.

Understanding this phenomenon is crucial for options traders, as it helps them strategize on how to avoid an IV crush after earnings. It’s clear that the impact of IV crush extends beyond just volatility crush, reaching into the realm of implied volatility crush and shaping the dynamics of options trading.

The Implications and Meaning of IV Crush for Options Traders

The world of options trading is rife with intriguing phenomena that can drastically affect a trader’s strategy and profit margins. One such phenomenon is the IV Crush, which has significant implications for options traders. In this section, we’ll delve into what an IV Crush means for options traders, how it impacts the pricing of options, and how traders can navigate this event.

At its core, an IV Crush, also known as an implied volatility crush, refers to a rapid drop in implied volatility after a significant corporate event such as an earnings announcement. This change can greatly impact the pricing of options, creating both counterintuitive scenarios and profitable opportunities for traders.

How IV Crush Can Impact the Pricing of Options

When implied volatility is high, options prices tend to be inflated. This is because options sellers demand a higher premium for taking on the increased risk associated with high volatility. However, once the uncertainty surrounding an anticipated event dissipates, implied volatility drops rapidly, leading to a decrease in option prices – this is the essence of an IV Crush. It’s worth noting that while high IV in options often resolves lower, this isn’t always the case, as volatility tends to cluster.

Counterintuitive Scenarios on IV Crush Options

IV Crush can sometimes lead to counterintuitive scenarios in options trading. To illustrate, consider a case study involving call option behavior in a rising stock market. Once again, we ask ourselves “what is an example of an IV crush?”. In this case, a theoretical case study will help us understand this concept in a quick and effective manner.

A Case Study: Call Option Behavior in a Rising Stock Market

Imagine a scenario where a trader buys a long call option on Stock XYZ, priced at $100, expecting a positive move following an earnings announcement. Let’s say they purchase a call option with a strike price of $103 for $5.

Now, if the stock indeed jumps significantly, but the option’s price remains flat or even declines, it can be attributed to a decrease in implied volatility – a phenomenon caused by IV Crush.

| Scenario | Stock price | Option IV | Option (call) price |

| Before earnings | $100 | 25.9 | $5 |

| After earnings | $107 | 40.3 | $4.5 |

In this hypothetical scenario, even with a 7% increase in the stock price, the option price might not reflect the expected profit. This is due to the impact of IV Crush, where the implied move priced into the options before earnings is higher than the actual move in the stock.

The compression in option prices following the earnings announcement can lead to unexpected outcomes for traders, emphasizing the importance of understanding and accounting for implied volatility in options trading.

Strategies to Profit from IV Crush

In the world of options trading, the term ‘IV Crush’ often stirs up a sense of dread among traders as it can lead to significant losses. However, savvy traders can flip the script and profit from an IV Crush by employing strategic approaches.

This section will delve into various strategies that options traders can use to exploit an IV Crush, discuss the risks associated with shorting high volatility options, and introduce a powerful tool – Option Samurai – that can assist in effectively trading IV Crush.

Overview of Various Strategies Options Traders Can Use to Exploit IV Crush

- Selling Straddles: This involves selling both a call and put option with the same strike price and expiration date. If the underlying security’s price remains relatively stable, the rapid decrease in option prices post-event can generate profits for the seller.

- Iron Condors: This strategy involves selling a call spread and a put spread simultaneously. Traders can profit from the decrease in implied volatility while limiting their risk exposure.

- Calendar Spreads: By selling short-term options and buying longer-term options with the same strike price, traders can benefit from the rapid decrease in implied volatility following an earnings announcement.

- Butterfly Spreads: This strategy involves buying a call spread and a put spread with the same strike price and selling further out-of-the-money call and put options. Traders can profit from IV crushes if the underlying security’s price remains within a specific range. It also has limited risk, so even if you are wrong, it will have limited effect.

As a general note, you should also consider that you may simply want to buy an option and close it before the company’s earnings. If you think about it, IV tends to move upwards as we approach earnings, right before crushing. This tendency – which is not always true, but it represents a frequent case – can lead option premiums to increase before earnings.

Risk Considerations

While these strategies can yield substantial profits during an IV Crush in options, it’s crucial to be aware of the potential risks.

Shorting high-volatility options can be profitable during an IV Crush. However, it’s important to remember that high volatility can lead to higher volatility, and volatility tends to cluster. Therefore, shorting high-volatility options can be ruinous in the wrong market environment. Implementing risk-defined strategies, proper position sizing, and other risk management techniques are crucial to mitigate potential losses.

Leveraging an Option Screener

Navigating the world of IV Crush can be challenging, but an option screener like Option Samurai can make the process easier to grasp.

Option Samurai is a powerful tool that assists traders in identifying opportunities to profit from IV crush. It offers comprehensive data and analysis on implied volatility, option prices, and various option strategies, helping traders make informed decisions.

Option Samurai’s features include:

- Option Scanner: Allows traders to scan for potential IV crush opportunities based on specific criteria.

- Implied Volatility Analysis: Detailed information on implied volatility levels for different stocks and options, including IV percentile, historical graphs, skew, and more.

- Stock scenario: The feature will check – through Monte Carlo analysis – which is the best option strategy assuming a scenario you can input in the tool.

Furthermore, you will be able to see important information about the options in the database, such as their IV rank and a company’s next earnings date.

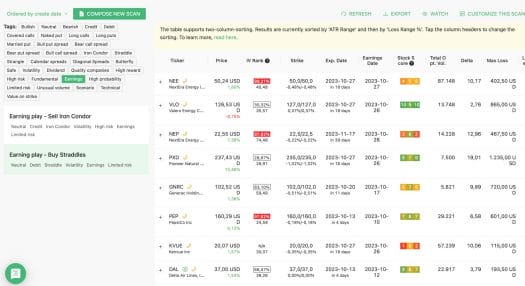

Let’s consider an example using Option Samurai to illustrate how one might execute an IV Crush trade.

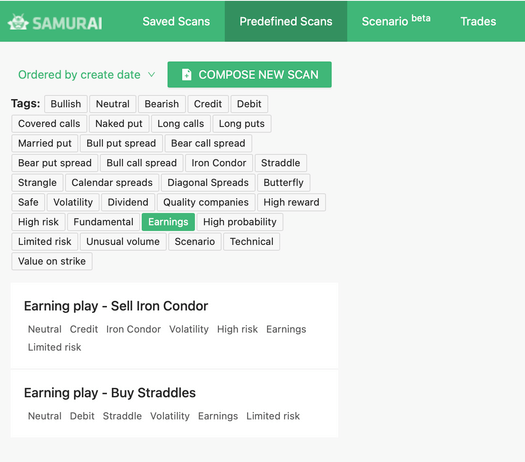

Step 1: Leverage the “Earnings” Predefined Scan

Kickstart your trading journey by clicking on “Earnings” in the predefined scan section. This feature will allow you to filter out options with upcoming earnings announcements, a key trigger for an IV crush.

Step 2: Choose the Strategy that Fits Your Needs

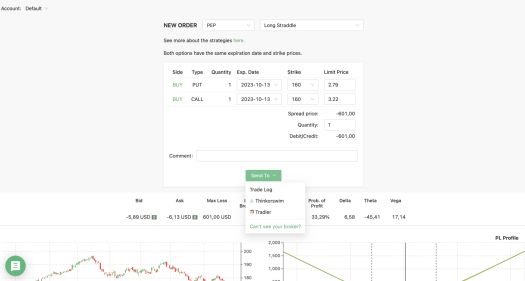

After running the scan, Option Samurai will present you with a list of potential strategies. You can choose between selling iron condors or buying straddles based on your risk tolerance, market outlook, and trading preferences.

Step 3: Start Trading

Once you’ve selected a strategy, navigate through all the options located by the screener. Evaluate each option carefully by sending it to your trade log for further analysis.

When you’re ready, you can execute the trade by sending it directly to your broker or simply entering it into the platform’s trade log. Harnessing the power of Option Samurai, you can effectively strategize to profit from an IV crush. We suggest entering paper trades as well so you will have statistics you can analyze and improve for the next earnings season.

How to Avoid IV Crush

In the volatile world of options trading, the phenomenon of IV Crush, characterized by a rapid decrease in implied volatility following a significant event like an earnings announcement, can pose significant challenges for traders.

When looking for “how to avoid IV crush” online, the most common advice you’ll find is to avoid trading options around earnings or significant corporate events. However, this approach can significantly limit trading opportunities for traders who rely on volatility to generate profits.

In this section, we will delve into several risk management strategies that will assist you in comprehending the implications and meaning of IV Crush within the realm of options.

Managing Your Risk

The main answer to how to avoid an IV Crush lies in adopting robust risk management strategies. These can include implementing risk-defined strategies, coupling high implied volatility opportunities with other indicators, and carefully considering expiration dates.

Importance of Risk-Defined Strategies

Risk management is paramount in options trading, especially when facing an IV Crush scenario.

Define the Best Strategy and Find the Proper Position Sizing

One of the most critical aspects of this planning involves defining the best strategy and finding the proper position sizing to

manage risk effectively. This is especially crucial when dealing with phenomena like IV Crush, where rapid decreases in implied volatility can significantly impact trade outcomes.

The secret to an effective risk management in options trading is the implementation of risk-defined strategies. These strategies involve setting a limit on the maximum risk exposure for each trade. This means that before entering any trade, traders need to establish clear risk parameters. These parameters act as a safety net, ensuring that potential losses are kept within acceptable bounds.

Position sizing is an integral part of this risk management approach. Appropriate position sizing means determining the number of contracts or the amount of money you are willing to put at risk in each trade. This decision should be based on a careful evaluation of your risk tolerance and overall investment goals. By employing proper position sizing, traders ensure they do not overexpose themselves to risk in any given trade.

Implementing risk-defined strategies and proper position sizing can provide a robust defense against the potential pitfalls of an IV Crush in options. When facing an IV crush after earnings, option prices can plummet. This can lead to substantial losses for traders. However, by capping potential losses through risk-defined strategies, you can navigate these turbulent times more effectively, ensuring you never risk more than you’re prepared to lose.

Another crucial element to consider is the risk-reward ratio. This ratio is a measure of the potential profit from a trade compared to the potential loss. A favorable risk-reward ratio means that the potential profit outweighs the potential loss. By carefully evaluating the risk-reward ratio before entering a trade, you can steer clear of trades that offer poor returns relative to the risk involved.

In conclusion, defining the best strategy and finding the proper position sizing are key to successful options trading. Through the implementation of risk-defined strategies, appropriate position sizing, and careful evaluation of the risk-reward ratio, traders can navigate the challenges posed by events like an IV Crush. This approach allows traders to manage risk effectively, protect their capital, and increase their chances of profitable trading in the volatile world of options.

Considering Expiration Dates

The significance of expiration dates in your options contracts becomes evident when grappling with the dynamics of IV Crush. Consider these guiding principles to comprehend how expiration dates are influenced:

- Options with expirations before a significant event will remain largely unaffected, as the implied volatility will already reflect the known information.

- Options expiring closest to an event triggering IV Crush, such as an earnings announcement, will experience the most substantial impact of IV Crush – as there is new information and not much time to expiration.

- As you move further in time from the event, the effect of the IV crush diminishes gradually.

- Options with more than three months to expiration tend to be minimally affected, if at all. This is attributed to the likelihood of another earnings event occurring within that time frame.

Therefore, while IV Crush can be intimidating, understanding its dynamics and employing smart risk management strategies can help you navigate its challenges effectively.

Conclusion

Understanding IV Crush (implied volatility crush) is crucial for options traders, given its potential to significantly impact the profitability of a trade. A steep fall in implied volatility following a major event, like an earnings announcement, can turn a promising position into a loss.

However, the strategies discussed in this guide, including implementing risk-defined strategies, leveraging indicators, and careful consideration of expiration dates, can help traders not only mitigate the risks associated with an IV Crush but also potentially profit from it.

Now that we know what is an example of an IV crush and how to manage it, it’s time to put this knowledge into practice and strive toward success in the world of options trading. Finding a good implied volatility level, for instance, is a fundamental aspect to grasp in your daily options trading activity.

Hi my loved one I wish to say that this post is amazing nice written and include approximately all vital infos Id like to peer more posts like this