Unravel the complexities of IV in options trading with our comprehensive guide. We delve into what IV is, its impact on high and low IV options, and how to interpret IV rank. Whether you’re a novice or an expert trader, understanding IV’s role can significantly enhance your trading strategy.

Key takeaways

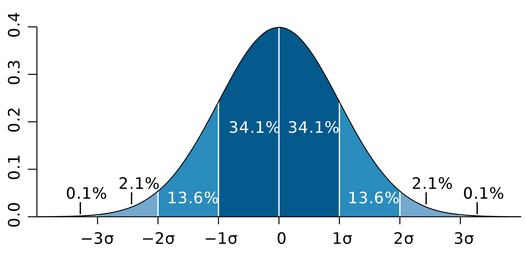

- IV in options trading refers to the market’s projection of potential price movement, typically measured as a one standard deviation (SD) range, expected within a year.

- Option pricing models like the Black-Scholes and Binomial models are used to calculate IV (Option Samurai uses Black-Scholes).

- High IV suggests the market expects large price movements, while low IV indicates smaller expected movements.

What Is IV in Options?

In the realm of options trading, understanding the concept of Implied Volatility (IV) is crucial. So, what is IV in options? IV is a metric that reflects the market’s forecast of a stock’s potential price swing over a certain period, usually one year. It’s expressed as a percentage and plays a pivotal role in options pricing.

To comprehend IV in options, it’s beneficial to explore the concept of standard deviation, which is inherently linked to IV. Standard deviation measures the extent to which individual data points deviate from the mean in a set of data. In the context of IV, it’s used to quantify the expected variability in a stock’s price.

To illustrate IV in options, consider a stock priced at $100 with an IV of 20%. This implies that the market expects the stock to fluctuate by about $20 over the next year, representing a one standard deviation move. In statistical terms, there’s approximately a 68% probability that the stock will trade between $80 and $120 over the next year. However, remember that IV doesn’t predict the direction of the movement.

Now, let’s delve into the implications of high IV options and low IV options. High IV indicates that the market anticipates substantial price swings. Consequently, options with high IV are more expensive due to the increased extrinsic value, which is the portion of the options price not determined by the stock’s current price. Therefore, low IV suggests smaller expected price swings, resulting in cheaper options due to lower extrinsic value.

Understanding the difference between a high IV rank and a low IV rank for options can significantly impact your trading strategy. A high IV percentile indicates that the current IV is near its highest level for a given period, suggesting a higher likelihood of significant price changes. On the other hand, a low IV rank suggests that the current IV is near its lowest level, indicating a lower likelihood of substantial price changes. This is why IV in options is essential to consider when selecting which options to trade.

In conclusion, IV in options is a critical concept for every options trader. It provides a statistical measure of a stock’s potential price volatility, influencing the pricing of options and thereby shaping trading strategies. Whether dealing with high IV options or low IV options, understanding the relationship between IV and standard deviation can help traders make more informed decisions and manage risk effectively.

How Does Implied Volatility Work?

IV in options plays a pivotal role in financial trading. But what exactly is iv in options? Essentially, it is a metric determined using a complex mathematical formula to anticipate the possible movement of a stock’s price.

To be clear, IV in options doesn’t predict the direction of the price change, but rather the potential degree of movement in a security’s price. High IV options indicate greater expected volatility, and conversely, low IV options suggest less expected volatility. So, what is a high IV rank for options? A high IV rank usually exceeds 75%, indicating significant expected price fluctuation. What about a low IV rank for options? Well, a low IV rank, typically below 35%, suggests minimal expected price movement.

IV can also be used to calculate a stock’s expected move over a given expiration cycle. For instance, if you want to calculate the 1 Standard Deviation (1SD) expected move of a stock using IV, you’d multiply the stock price by the IV and then by the square root of the time to expiration.

In the coming section, we will delve into two popular option pricing models that further illustrate the application and importance of IV in options trading.

Option Pricing Models

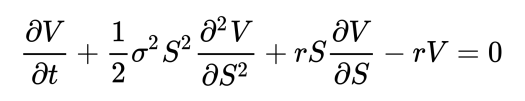

In the realm of options trading, understanding how to calculate IV in options is essential, and two models play a crucial role in this calculation: the Black-Scholes model and the Binomial model.

Black-Scholes Model

The Black-Scholes model, widely recognized in the financial world, is a mathematical model that calculates the theoretical price of an option. It was developed by two economists, Fischer Black and Myron Scholes, with contributions from Robert Merton. The model is notably used to calculate implied volatility in options, making it a crucial tool for traders.

The model is based on a variety of inputs, including the current stock price, the strike price of the option, the time until the option’s expiration, the risk-free interest rate, and the implied volatility. The calculation assumes that the asset prices follow a lognormal distribution, which means that the prices are continuously compounded returns. The model also assumes continuous risk-free rates, meaning that there is a constant rate at which you can lend or borrow money.

In the Black-Scholes model, several parameters, such as the strike price, current stock price, and time to expiration, are known and measurable. However, one crucial factor remains unobservable – volatility. This is where the concept of implied volatility comes into play. Implied volatility is the level of volatility that needs to be present in the market for the Black-Scholes equation to align with the real market price of an option.

Implied volatility is instrumental because it profoundly influences option pricing. In high implied volatility environments, options tend to be more expensive, reflecting the increased likelihood of significant price movements. Conversely, in low implied volatility environments, options are generally more affordable, as the market anticipates smaller price fluctuations.

It’s important to bear in mind that while the Black-Scholes model provides valuable insights, it’s not infallible. It does not predict the direction of price movements, and it cannot account for sudden, unforeseen events, such as natural disasters or political upheavals, which can dramatically impact stock prices.

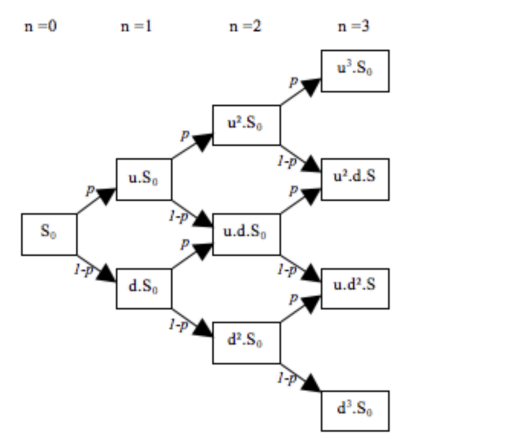

Binomial Model

The Binomial model, another critical model for calculating IV in options, offers a more flexible approach compared to the Black-Scholes model. This model breaks down the time to expiration into potentially a very large number of time intervals, or “steps”. At each step, the model calculates the price of the option, taking into consideration factors like high or low IV rank for options.

The flexibility of the Binomial model lies in its allowance for fluctuating interest rates and dividend payouts, making it a more realistic representation of the market. The model follows a binomial tree where each node represents a possible price that the underlying security can take over time, creating an array of potential outcomes.

In the context of implied volatility, the Binomial model is particularly useful. It helps traders understand how changes in IV, whether high or low, can affect the price of an option over time. For instance, when the implied volatility is high, options are generally more expensive, reflecting the market’s anticipation of larger price swings. On the other hand, when the implied volatility is low, options are cheaper as the market predicts smaller price movements.

How Does Implied Volatility Affect Options?

IV plays an instrumental role in options trading, notably in determining the pricing of options. When we ask, “What is IV in options?” we refer to a metric that contributes to the value of an option, taking into account its current value and the future expected change of its underlying asset. This estimation gives us valuable context around option prices and what these prices predict in terms of potential stock price movements.

The relationship between IV and options can be categorized – for simplicity – into high IV options and low IV options. High IV options suggest that the market anticipates significant price movement. In other words, a high IV indicates that an option’s underlying stock is expected to swing dramatically in either direction. This volatility can affect risk assessment and determine an options strategy, as high IV options tend to move around a lot.

Conversely, low IV options imply smaller price swings, meaning the underlying stock’s price changes are expected to be less dramatic. Understanding what a high and low IV rank for options can significantly influence a trader’s decisions.

It’s also crucial to note that extrinsic value and IV in options prices always share a positive relationship. The demand for an option directly influences its extrinsic value premium, which in turn drives IV higher. Therefore, a surge in demand can result in an increase in an option’s IV, subsequently raising its price.

Understanding High IV Options

In the complex world of options trading, understanding the concept of IV is paramount, particularly when it comes to high IV options.

High IV options suggest that the market anticipates substantial price movement in the underlying stock. In simpler terms, the higher the IV, the greater the expected fluctuation. This heightened volatility can be due to various factors such as upcoming earnings announcements, economic reports, or significant company developments.

Understanding what is a high IV rank for options is crucial as it can influence a trader’s decisions significantly. A high IV rank, typically above 75%, indicates that the current IV is near its highest level for the given period. This suggests that the option’s price is relatively high, and the underlying stock is expected to have significant price changes.

So how does one identify high IV options? Traders often use a metric known as the IV Rank. The IV Rank compares the current IV to its historical highs and lows, providing a relative measure of the current IV. If the IV Rank is high, it means the current IV is near its historical peak, indicating high IV options. Furthermore, comparing implied volatility vs historical volatility in options can be extremely helpful.

But what does this mean for options traders? How should we read IV in options? High IV options are associated with higher option premiums. While this could mean higher costs for those buying options, it could present potential opportunities for those selling options. In high IV environments, option sellers may benefit from inflated premiums due to the increased risk of price swings.

However, it’s important to understand that high IV also implies higher risk. The larger the expected price swing, the greater the risk for the trader. Therefore, traders need to balance the potential profits from high premiums against the increased risk.

Strategy-wise, in high IV environments, traders might employ strategies like selling credit spreads or iron condors. These strategies involve selling options and can potentially benefit from the higher premiums associated with high IV options.

On the contrary, when discussing what is a low IV rank for options, it typically suggests minimal expected price movement. Hence, strategies for low IV environments may differ significantly from those suitable for high IV scenarios. These are just examples of how you may employ IV in options trading.

Therefore, understanding high IV options and their implications on trading strategies can prove advantageous for traders. It allows them to make informed decisions, potentially benefiting from high premiums while being mindful of the increased risk.

A Look at Low IV Options

After seeing the case for high IV in the previous section, it’s important to understand its counterpart: low IV options. When we ask, “What is IV in options?” we should clarify that low implied volatility indicates that the market expects relatively small price movements in the underlying security.

Low IV options typically suggest that the market anticipates less dramatic shifts in the underlying stock’s price. This could be due to a variety of factors such as a lack of significant upcoming news or events that might impact the stock’s value. In fact, this is what we often observe after a company’s earnings report is published, with the so-called IV crush phenomenon. When we talk about what is a low IV rank for options, we often refer to an IV rank of less than 35%. This indicates that the current IV is closer to its minimum level within a specified period, hinting at smaller expected price swings.

Identifying low IV options can be achieved by looking at the IV rank. If the IV rank is low, it suggests that the current IV is near or at its lowest point compared to historical data, indicating low IV options. Traders often use this information to guide their trading strategies, especially when they anticipate a relatively calm market with fewer price fluctuations. IV in options, in this case, can influence the choice of options strategies.

The impact of low IV on options trading is considerable. Because the expected price movements are smaller, the premiums for these options tend to be lower compared to high IV options. For traders buying options, this could present a more affordable entry point. Conversely, for those writing or selling options, the potential returns might be less enticing due to the lower premiums.

In terms of strategy, low IV environments might call for long strategies such as buying calls, puts, or debit spreads. These strategies involve purchasing options, and the lower premiums associated with low IV options can make these strategies more attractive. However, it’s crucial for traders to remember that while the expected price swing might be smaller, the risk of unexpected price movements still exists.

By contrast, as mentioned in the previous section, when we examine what is a high IV rank for options, we normally deal with larger expected price movements in the underlying security. Strategies suitable for high IV environments may differ significantly from those appropriate for low IV situations. High IV options often command higher premiums due to the increased risk associated with more substantial price swings.

So, is considering IV in options sufficient for financial trading? The answer is no. While IV can provide valuable insights into market expectations, it should not be the only factor considered when making trading decisions. Traders need to analyze a multitude of factors, including fundamental and technical analysis, to create a well-rounded trading strategy.

In summary, understanding low IV options and how to identify them is pivotal in options trading. It allows traders to tailor their strategies to the market conditions, potentially capitalizing on opportunities presented by lower premiums. However, as with all trading decisions, thorough research and careful risk assessment are essential. Traders must be aware that while low IV suggests smaller expected price swings, unforeseen market events can still lead to significant price changes.

What Is a High IV Rank for Options?

In the complex world of options trading, understanding implied volatility or IV in options is essential. IV reflects the market’s expectation of potential price movement in an underlying security. When we discuss high IV options, we’re referring to situations where significant price fluctuations are anticipated.

So, what is a high IV rank for options? It’s really hard to define a threshold that universally applies to all markets, but consider this: the higher the IV, the higher the chance that an option premium is overpriced. It is in this context that, previously in this article, we identified the 35% and 75% thresholds (while they are not universal, these are common benchmarks).

These values indicate a general reference point for IV in options, and anything below or above may be seen as low or high IV, respectively.

The significance of a high IV rank in options trading cannot be overstated. It has a direct impact on options pricing, with high IV leading to higher option premiums due to the increased risk of price swings. This inflation in price can provide opportunities for certain trading strategies.

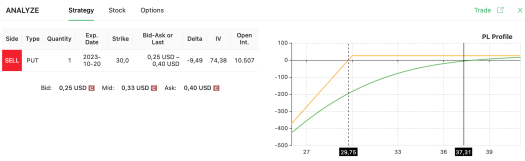

Let’s take the naked put strategy as an example. This strategy involves selling a put option without owning the underlying asset. Theoretically, this strategy can benefit from high IV because it leads to an overbought premium.

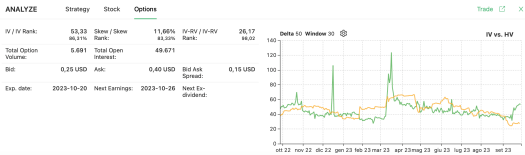

For instance, using the Samurai option screener, we can identify a trading opportunity for Axos Financial Inc. (AX) with an IV rank of 86.31% for a put at a $30 strike price expiring in three weeks.

The high IV rank, as highlighted in the picture below, suggests that in 86.31% of the days during the last year, the IV for AX was lower than its current value.

Given that IV tends to revert to the mean – as highlighted in our IV backtesting series of articles – selling this option could be a good operation, especially since the breakeven price for this trade would be slightly below $30—a price point AX hasn’t seen in quite some time. Thus, this scenario spotted by Samurai presents a high probability trade.

A high IV rank for options signals larger expected price movements and, consequently, higher option premiums. Understanding this concept can guide traders in adopting suitable strategies, potentially capitalizing on the opportunities presented by high IV situations. However, as with all trading decisions, it’s critical to conduct thorough research and careful risk assessment, given that a high IV rank also implies increased risk due to anticipated price volatility.

Clearly, whenever we’re dealing with an IV in options above 85% or 90%, we’re talking about high IV options. In this case, it’s highly likely that the market is pricing in some significant event, such as an earnings announcement or economic news. Traders need to be aware of these potential catalysts and adjust their strategies accordingly.

What Is a Low IV Rank for Options?

In the intricate world of options trading, understanding the concept of implied volatility (IV) is crucial. IV in options signifies the market’s forecast of potential price fluctuations in an underlying security. Specifically, low IV options denote scenarios where the market anticipates minimal price changes.

So, what is a low IV rank for options? A low IV rank typically falls below 35%, indicating that the current IV is closer to its lowest level relative to the past year. This means that in more than half of the days within the last year, the IV was higher than its present value.

The importance of low IV rank in options trading is multi-faceted. It directly impacts options pricing, with low IV leading to lower option premiums due to the decreased risk of price swings. This deflation in price can provide opportunities for certain trading strategies.

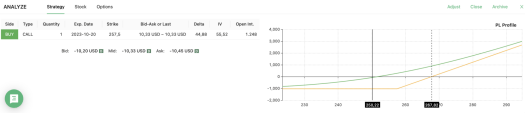

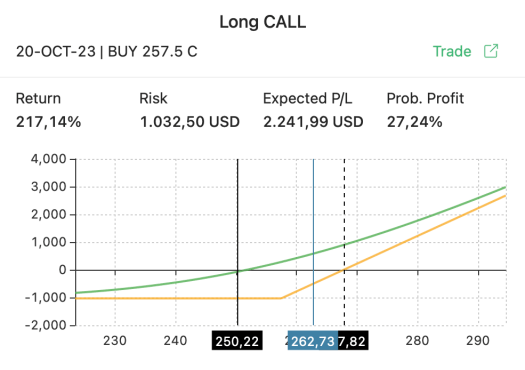

Let’s consider a practical example using the Samurai option screener. If you believe a stock price will rise, you might be looking for a long call strategy with a call option having a low IV rank. Remember, a low IV rank could suggest an oversold option with a low premium.

For instance, let’s take Tesla Inc (TSLA). Suppose you expect a 5% increase within the next three weeks in TSLA, currently trading above $250. In this case, the “Scenario” feature of the Samurai option screener would highlight the possibility of buying a $257.5 call.

The expected return for this trade is 217.14%, and the probability of profit is 27.14%.

The breakeven price of $267.82 is a threshold TSLA has touched multiple times over the last three months. Thus, this could be seen as an interesting trading idea.

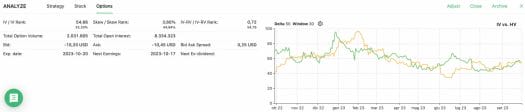

Note that, in this case, the option’s IV rank is below 35%, being equal to 33.33%, as shown in the picture below. A low IV rank for options signals smaller anticipated price movements, leading to lower option premiums. Understanding this concept can guide traders in employing suitable strategies, potentially capitalizing on the opportunities presented by low IV situations.

With a lower than 35% IV in options, it’s highly likely that the market doesn’t anticipate any significant event or news impacting TSLA in the near future. However, as with all trading decisions, it’s crucial to conduct thorough research and careful risk assessment.

Once again, as with all trading operations, it’s essential to conduct thorough research and careful risk assessment. While low IV suggests smaller expected price swings, unforeseen market events can still lead to significant price changes.

Conclusion

In conclusion, understanding the role of IV in options trading is paramount for devising effective trading strategies. Both high and low IV scenarios can present lucrative opportunities. IV in options is a variable that traders should always consider when evaluating potential operations alongside other market indicators and risk management strategies.