Option Samurai

Blog

Learn. Trade. Profit.

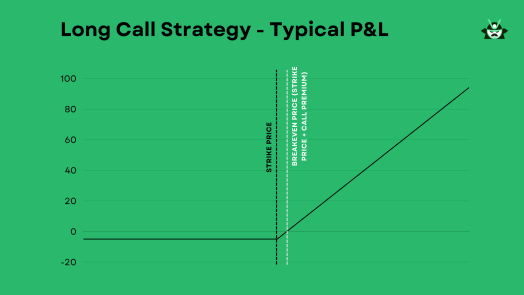

Gaining a Better Understanding of the Long Call Options Strategy

When you first approach option trading, a long call strategy may seem like the most intuitive choice. And for good reason – it’s a…

Samurai Q1 2024 version

It’s the end of March, and it’s time for the Q1 2024 version! We continuously improve our platform and listen to your requests in…

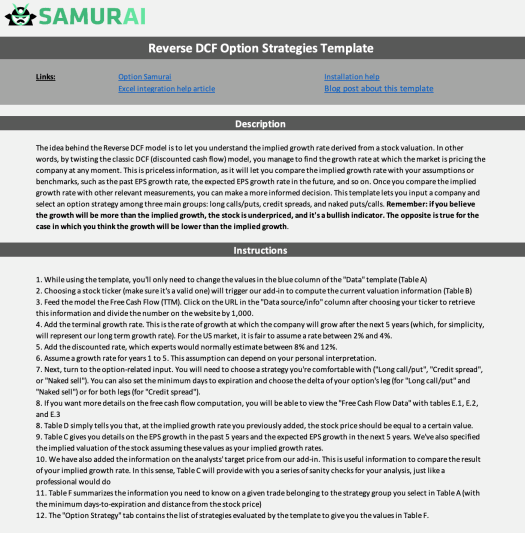

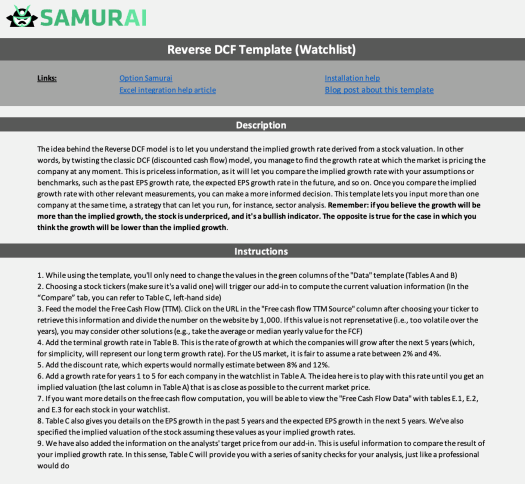

Reverse DCF Option Strategy Excel Template – Back Your Trading Decisions with Data-Driven Insights

Backing your options trading with a fundamental analysis can give you an edge in the market. You can achieve this result in only a…

Reverse DCF Template – Finding Winning Companies with Comparative Analysis

When it comes to stock (and option) picking, a sector comparative analysis can give you very valuable insights into potential investment opportunities. This article…