Among the many types of option spreads that can improve your trading routine, diagonal spreads for income are something you should check out. This strategy involves taking a long and short position in two options with different strike prices and expiration dates. This article will provide you with the basic information you need to confidently include these strategies in your trading toolkit.

Key takeaways

- Diagonal spreads for income are an options trading strategy that combines a long and short position in two options of the same type with different strike prices and expiration dates.

- To build a diagonal spread, you can buy a longer-term option (either a call or put) and sell shorter-term options against it.

- A double diagonal spread is another viable strategy where one buys a longer-term straddle and sells a shorter-term strangle.

Leveraging Diagonal Spreads for Income

Vertical and diagonal spreads for income are potent tools in options trading that can significantly contribute to regular income generation.

A diagonal spread for income will combine the fundamental idea behind a vertical spread (i.e., playing with different strike prices) and a calendar spread (i.e., playing with different expiration dates)

One key advantage of this strategy is its ability to limit risk. The maximum loss you could face is known upfront, providing you with a clear picture of your potential risk before entering any trade. This makes diagonal and vertical spreads for income a very appealing strategy among traders who prioritize risk management while seeking steady income.

Using diagonal spread for income can be a profitable strategy due to its limited risk, higher time-decay and potential for regular profits. By the end of this short article, you will have a better idea on how to implement these strategies to employ the options market for consistent income generation.

How Do Vertical Spreads for Income Work?

Before moving on, we should mention that vertical spreads share many points in common with diagonal spreads.

The main appeal behind vertical spreads for income is their hedged profile. Think about them in this way: you are using different strike prices to reduce your loss risk, with still a more than decent profit probability.

Vertical spreads for income offer the potential for profits, particularly if the stock price doesn’t breach the strike prices, and this is true for diagonal spreads as well. For instance, a weekly diagonal spread strategy (or a weekly vertical spread) involves buying and selling options with weekly expirations, allowing for more regular income generation.

The vertical spread for income can be an excellent way to consistently earn from your investments while minimizing exposure to market volatility. Keep in mind that, as we mentioned above, the main difference involved here is whether you want to use 2 different expiration dates (diagonal) or the same date (vertical) when building your spread.

Why Using a Diagonal Spread for Income instead of a Vertical Spread?

There are various reasons why you would choose a diagonal spread instead of a vertical spread.

First of all, diagonal spreads provide a directional bias while ensuring positive time decay due to the shorter leg expiring earlier (note that, typically, this should be your desired scenario).

When it comes to generating income, diagonals function as a cheaper way to build the covered call strategy. This is because you buy options with a longer expiration, then sell options on a weekly basis (often referred to as “Poor man’s covered call”).

This approach offers multiple income opportunities over the options’ life span. Imagine you do this for a month: you will buy an option expiring in 4 weeks and sell another option every week, with 4 different chances to earn income.

An Easy-to-Grasp Example of Diagonal Spread

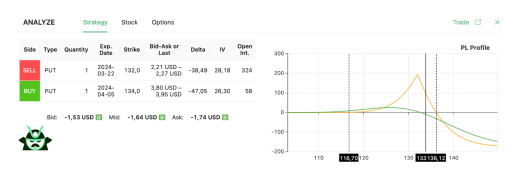

A real-life example will surely help in understanding diagonal spreads for income. Consider Alphabet (GOOG), currently trading at $133.78. If you expect the stock to move sideways or lower in the coming weeks, a weekly diagonal spread can be an excellent trading opportunity. Here’s how it may work: you sell a $132 put expiring in 3 weeks and buy a $134 put expiring in 5 weeks, as you can see in the image from our options screener below:

As shown in the P&L chart above, here’s what could happen:

- If GOOG moves beyond the higher breakeven price of $136.12 by the time both options expire, your maximum loss would be $164 (the debit amount you paid).

- If GOOG moves below the lower breakeven price of $116.70, the two option trades will offset, resulting in no loss or profit.

- The most interesting case occurs between these two breakeven prices. The highest profit, almost $200, will be achieved if the stock closes at $132 by the time the shorter term options expire.

Keep in mind that you’ll still earn a profit between the two breakeven prices, just not as high as at $132. If you look at the price chart below, you will easily see that GOOG is entering a downward market correction to reach a price range in which the stock has often found itself in the past. Therefore, you may like the profit probability of this trade.

This approach demonstrates how effectively diagonal spreads for income, such as this weekly diagonal spread, can generate steady cash flow while managing risk.

When Should You Close Your Diagonal Spread for Income?

After we saw the example, you may wonder which rules to follow when deciding to close your diagonal or vertical spread, including weekly or double diagonal spreads for income. Here are some factors to consider:

Firstly, always monitor the underlying security’s movement. If the stock price moves significantly in your favor or against you, it might be time to close the spread. Remember, the goal in your income strategy is to lock in profits and cut losses.

Secondly, pay attention to expiration dates. As the expiration of the near-month option approaches, evaluate the profit potential of the remaining long option in the trade. If there’s significant time value left in the short options, holding the spread longer could be beneficial.

Thirdly, consider closing the short side of a diagonal trade first. This is especially true if the short options have reached their maximum profit potential or if the stock price moved significantly in your favor. Doing this allows you to manage risk and reassess new positions with better risk-reward profiles.

Lastly, don’t forget to sell the remaining contracts at the right time. If market conditions have changed or if the remaining options have hit their profit targets, it’s wise to exit the position.

A Few Words on the Double Diagonal Spread for Income

In terms of income generation, both simple and double diagonal spreads for income have their benefits.

The simple diagonal spread, involving a long and short position in two options with different strike prices and expiration dates, is less complex. It’s ideal for those seeking a straightforward approach to income generation with limited risk and potential profits.

On the other hand, the double diagonal spread for income is certainly more complex. This strategy involves dealing with four options with different strike prices and expiration dates for both near and far months. This means that, when you wish to close your position early to lock-in profits or limit losses, the complexity of managing four options simultaneously can be challenging.

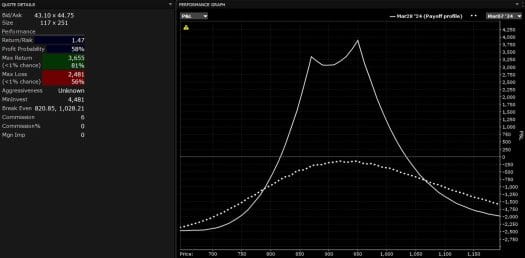

You’re buying a longer-term straddle and selling a shorter-term strangle. This means that your P&L profile will peak twice. Therefore, if the stock gets close to either one of these peaks, you may want to close at least half of your position to capitalize on profits while still having a remaining position that could potentially gain further.

Assume, for instance, that you want to build this strategy on NVDA. You could sell a $870 put and a $950 call expiring in 2 weeks, while buying a $890 put and a $520 930 expiring in a month. With NVDA trading around $920, here is what your P&L would look like:

Therefore, keep in mind that:

- You can use simple diagonal spreads for income when you expect stock price movement to remain within a range.

- Double diagonal spreads for income, while more complex, can offer potentially higher profits due to a dual opportunity for income generation (which leads to higher time decay).

- In any case, both strategies can be an excellent way for consistent income generation in the options market.

- Vertical and diagonal spreads for income share similar characteristics, but the main difference is their expiration dates. Specifically, vertical spreads have the same expiration while diagonal spreads have different expirations. Other than that, the main logic mentioned above applies for both types of spread.

What a fantastic resource! The articles are meticulously crafted, offering a perfect balance of depth and accessibility. I always walk away having gained new understanding. My sincere appreciation to the team behind this outstanding website.