When markets go down, bearish option strategies can be a great idea to balance your portfolio. These strategies, which may involve buying put options or using spreads, limit risk while maximizing potential gains. In a bear market, these could be your best option strategy for turning falling prices into profit opportunities. Let’s look at a few bearish option strategies and how to utilize them effectively.

Key takeaways

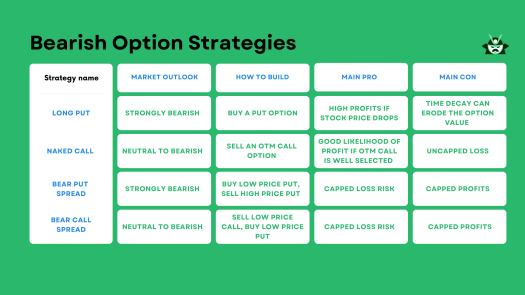

- Four common bearish option strategies are the long put, naked call, bear put spread, and bear call spread.

- For those with strong convictions that a stock will fall, the long put and bear put spread provide an opportunity to gain substantial profits with a known and limited level of risk.

- Traders who expect a stagnant but possibly bearish market can benefit from strategies like the naked call and bear call spread.

Designing an Option Strategy for a Bear Market

In a bear market, where stocks are on a downward spiral, transforming these declines into profits is possible with the right bearish option strategies. We will start by describing the two simplest strategies: long put (debit strategy) and naked call (credit strategy), and then we will describe the protected version of those strategies (bear put spread and bear call spread).

Taking the long put strategy route, for example, is like buying insurance for a stock that is expected to lose value. You buy a put option, giving you the right to sell the stock at a fixed price. If the stock’s price falls as anticipated, you make a profit without owning the stock.

The naked call strategy, meanwhile, is a bit like turning yourself into the insurance operator. You sell a call option on a stock you don’t own, hoping its price will fall and the event that will trigger the insurance payment to your client (i.e., the stock price moving upwards) won’t happen. If the price drops, you keep the premium from selling the call option.

The bear put spread is another viable option strategy for a bear market. It involves buying a put option with a higher strike price and selling another with a lower strike price. This approach allows you to profit from a decrease in the stock’s price while limiting your potential losses.

Lastly, the bear call spread strategy requires selling a call option with a low strike price and buying one with a high strike price. This best option strategy for a bear market lets you benefit from a slight decrease in the stock price (or even from a sideways movement) while capping your potential losses.

Let us recap these bearish option strategies in the table below before discussing them in greater detail:

The Long Put Strategy

The long put strategy is a great tool in the family of bearish option strategies. You’re basically securing an escape hatch to sell a stock at a fixed price, even if its value plummets in the future.

Here’s the idea: you buy a put option, setting a strike price for a stock you expect will decrease in value. This gives you the right (but not an obligation) to sell that stock at the strike price before the option’s expiration.

If the stock price drops below your strike price, you can sell your put option at a profit. The difference between your strike price and the lower stock price is your gain.

Note that, if the stock price remains above your strike price until the option expires, your option becomes worthless. The loss in this case is the premium you paid for the option, which is also the maximum loss you can incur.

While the long put strategy holds the potential for very appealing profits (since a stock’s price can theoretically drop to zero), it’s essential to balance these prospects against the risks involved. The example mentioned in the section below will further clarify this aspect.

Long Put Example

Let’s see an example with Arm Holdings (ARM), a company that has recently seen its stock price double in just three days following a bullish earnings report. While the price growth may seem backed by strong fundamentals, it’s also fair to anticipate early investors cashing in on their profits, which could lead to a price drop. This is especially true as Softbank holds ~90% of the company shares.

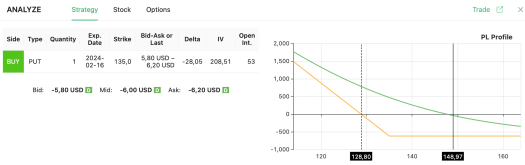

If you predict this scenario, one bearish option strategy you may consider is buying a put option. You can use our options screener to spot a high volume on the $135 put, with ARM currently trading at $148.97.

Looking at ARM’s historical stock price chart, you’ll notice it has experienced significant swings in the past. Therefore, a sudden downward correction isn’t out of the question. To profit from this long put strategy, you’ll want ARM’s price to dip below $128.8 by the time your option expires.

However, if ARM’s stock price doesn’t go down, you’ll lose the premium paid for the put option, which is also your maximum loss.

The Naked Call Strategy

The naked call strategy is another tool in the kit of bearish option strategies. Here’s how it works: You sell call options on a stock you don’t own, meaning you’re betting that the stock price won’t rise above the option’s strike price.

If you’re right, the options will expire worthless, and you keep the premium you collected from selling the options as your profit.

However, if the stock price rises above the strike price, you’ll be obligated to sell the stock at the lower strike price, which will lead to losses.

The potential profits of the naked call strategy are limited to the premium received from selling the options. But beware, the risks can be substantial. If the stock price skyrockets, your losses can be limitless, as there’s no ceiling on how high a stock price can climb.

Note that, from a more realistic point of view, your broker won’t tolerate accounts with unlimited losses. In fact, when you open a trade such as a naked call strategy, you will be required to have a sufficient margin on your account at all times. If your losses erode your capital so much that your equity falls below the margin, you will be forced to close your trade and face a considerable loss.

So, while the naked call strategy can serve as a viable option strategy for a bear market, it’s important to weigh the risks and rewards carefully. The risk for this bearish option strategy is high, so be very careful when using a naked call approach.

Naked Call Example

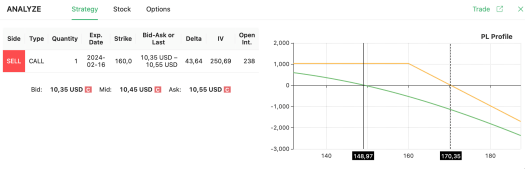

Returning to our ARM example, let’s explore how the naked call strategy plays out. ARM is currently trading at $148.97, and let’s say you’re considering selling a $160 call.

In this scenario, you’d profit if ARM’s price stays under $170.35 by the time your call expires.

But what about the other side of the coin? The worst-case scenario is that ARM’s bull run continues unabated before the option expires. This could result in losses exceeding 100% of the option premium—a stark reminder of the high-risk nature of the naked call strategy.

Earning profits through bearish option strategies like naked calls requires careful analysis and risk assessment. For instance, you might find it safer to implement this strategy on a company that hasn’t recently released a bullish earnings report.

While the naked call can be a fitting option strategy for bear markets, it’s crucial to remember that it’s not a one-size-fits-all solution and may not always be the best option strategy for a bear market.

The Bear Put Spread Strategy

The bear put spread strategy is a great tool among bearish option strategies. When you anticipate a stock price to decrease, you buy a put option at a higher strike price. Concurrently, you sell a put option at a lower strike price.

The premium from the sold option helps offset the cost of the purchased one, reducing your overall investment.

The appeal of this strategy lies in its risk-reward balance. If the stock price falls below the higher strike price, your long put side of the trade starts earning a profit. If it drops even further below the lower strike price, you will manage to collect a profit.

This is a bearish option strategy that caps both potential profit and loss, providing more control over your financial exposure. This option strategy for a bear market gives you a safer position compared to the naked call case mentioned above. However, remember that the safest option trading idea is not necessarily the one that will have the highest likelihood of profit, but simply the trade with the lowest loss risk in the worst case scenario.

Bear Put Spread Example

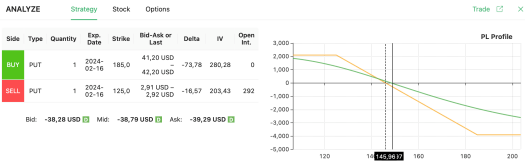

Continuing with ARM, suppose you’re still bearish on the stock. You feel its price ascended too rapidly and anticipate a downward correction. In response, you implement a bear put spread, buying a $185 put and selling a $125 put.

To earn a profit, ARM must drop below $145.96 by the time your puts expire (note that this price is higher compared to the previously mentioned $128, giving you a higher profit probability). If the price remains above this level, you’ll start to incur losses, which will increase in a linear fashion. However, these losses are capped and won’t exceed a certain amount even if the price continues to ascend past $185.

This example highlights the benefits of bearish option strategies like the bear put spread. Not only does it offer a potential profit in a bear market, but it also limits potential losses, making it a potentially best option strategy for a bear market. But remember, every bearish option strategy requires careful analysis and understanding of market conditions.

The Bear Call Spread Strategy

Now, let’s turn our attention to the bear call spread strategy, which excels in mildly bearish market conditions. This strategy involves selling a call option with a lower strike price while simultaneously buying a call option of the same underlying asset that has a higher strike price and shares the same expiration date.

This approach aims to earn profits from a slight dip in the stock price, while also containing potential losses. By selling a lower strike price call and buying a higher one, you’re able to reduce the overall cost of the trade.

Now, it’s essential to understand that your potential profits are limited with this bearish option strategy. The maximum you can earn is the net premium received from the trade. On the flip side, your potential losses are also contained. The most you could lose is the difference between the strike prices minus the net premium received.

Bear call spreads are particularly effective when the stock isn’t expected to surge significantly. It’s a versatile bearish option strategy, potentially the best option strategy for a bear market, if used wisely.

Bear Call Spread Example

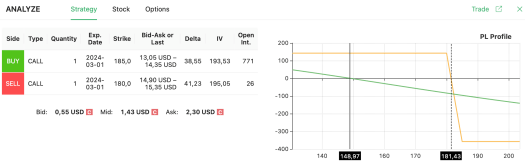

Let’s revisit ARM. You might want a situation where you profit even if the stock price rises slightly and expect the price to stabilize or drop. If this sounds appealing, a bear call spread could be ideal. In this scenario, you buy a $185 call and sell a $180 call.

Now, if you were confident with the idea of capping your profit potential as we did in the naked call example, you may appreciate this approach as it introduces a cap for your losses as well.

Here are the possible outcomes:

- Your maximum profit will occur if ARM closes below $181.43 by the options’ expiration date. This means that the stock, currently trading at $148.97, can still grow significantly without you incurring a loss.

- If ARM closes between $181.43 and $185 when your calls expire, your loss will increase steadily.

- Above $185, your losses are limited as the long call side of your trade becomes profitable.

Looking at the chart, $181.43 seems quite distant, indicating a good chance of profit. This example demonstrates the utility of bearish option strategies like the bear call spread, which can be a handy option strategy for a bear market.

So, after seeing these four bearish option strategies, which one should you choose? Here are our takeaways:

- You’ll choose a long put when you have a firm belief that the stock price would decrease significantly.

- The naked call bearish option strategy, if you choose a sufficiently out-of-the-money (OTM) call, can be a better option trading idea than the long put, as it puts time decay on your side.

- If you’re uncomfortable with the uncapped loss risk of the naked call, either the bear put spread or the bear call spread could be a better choice.

- Specifically, go for the bear put spread if you anticipate a sharp stock price decrease, and the bear call spread if you expect a more moderate drop.

Observe the stock price before implementing these bearish option strategies and evaluate how it evolves. Remember, a flexible approach is crucial for success in trading options in a bear market, and you may consider closing your position before your options expire if you already have a good profit.