Learning when to sell call options is crucial for any trader. This article offers a few quick tips on making this decision, whether you’re holding a long or short call position. With a long call, selling before expiration might be wise if you’ve met your profit goals or time decay is affecting the option’s value. On the other hand, selling a short call, or naked call, could be advantageous when expecting the stock price to remain stable or decrease.

Key takeaways

- When deciding when to sell call options, you will need to consider whether you are holding a long call or a short call position.

- When you sell a long call, it may be wise to sell before expiration if you have reached your profit expectations or if time decay is impacting the value of the option.

- When you sell a short call, also known as a naked call, you want the stock price to remain steady or decrease to earn a profit.

Understanding When to Sell Call Options

When to sell call options is a question that many traders face The answer hides within your trading strategy and market conditions:

- If you own a call option in your portfolio, and you wonder when to sell a long call option, selling it before expiration can potentially lock in profits or mitigate your losses. This is known as selling a long call option. How long should you hold a call option? This is one of the questions we’ll address today.

- If you’re shorting a call option (one that you don’t own), timing is crucial. Selling a short call option can yield profits when you anticipate the underlying asset’s price will decrease or will move sideways. When to sell a short call option? We’ll have time to address this doubt later in the text.

Let us begin with the most risk-averse case: suppose you hold a call option in your portfolio. Let us wonder ourselves: when to sell call options before expiration? And how long should you hold a call option?

When to Sell a Long Call Option

When to sell call options is a decision influenced by various factors. Selling a long call option, for instance, requires a precise assessment of the money you are already earning (or losing) and your likelihood of obtaining either a higher profit or a mitigated loss by the time your call expires.

When to Sell Call Options Before Expiration?

If you’re wondering when to sell call options before expiration, we may suggest a practical approach. If you’re already profiting and anticipate a slowdown in the stock’s upward movement and you wonder when to sell call options, it might be time to sell. You might also consider selling if you’re at a loss and believe that time decay — due to the nearing expiration of your call option — will make recovering your money impossible.

How long should you hold a call option? The answer to when to sell a long call option varies, but keep in mind that time decay will always play against you when holding a long call position, and that the closer you get to expiration, the faster your call option price will vary.

Therefore, you will choose to sell a long call option before expiration when:

- You are recording a profit and:

- You expect the market to be close to a downward movement that would hurt your trade

- You are dangerously close to a major announcement for a company and don’t feel like risking ending up with a loss

- The stock is too close to the option’s strike price while nearing its maturity, hence making it easier to turn a slight profit into a deep loss

- You are recording a loss and:

- You see no chance of the stock price moving up above the strike level by the expiration date

- You feel time decay will make it hard for you to turn around your trade, and there’s value left in the option.

When to Sell a Short Call Option

Selling a short call option, also known as writing a naked call, is a strategy you might consider when expecting the stock price to stagnate or decrease.

This approach involves selling an option you don’t own – typically an out-of-the-money (OTM) option. When the stock price doesn’t rise above the strike price before expiration, the option expires worthless, allowing you to pocket the premium initially collected.

You will choose to sell a short call option when you expect it to end up reaching a $0 value, so:

- ITM and ATM case: When you see a relatively high chance of bearish market, which may lead your option to end up out of the money and expire to 0.

- OTM case: When you see a relatively high chance of either bearish or sideways market, which will keep your option out of the money.

Should you close your position in profit before the expiration? There are no rules here, but we generally like closing a naked call before its maturity date in case we manage to observe an 80%+ profit and an option price below $0.10 if we are far from the expiration. This is because, below $0.10, the remaining profit margin is relatively low and it may not be worth the risk.

How Naked Calls Work – An Example

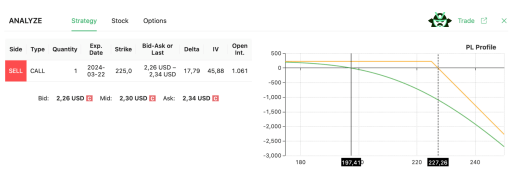

Let’s conclude with an easy-to-grasp example. Believing Tesla’s price will stagnate or drop, you decide it is the right time to sell a $225 call option while Tesla trades at $197.41. Our options screener signals this opportunity, which expires in a month.

As shown above, if Tesla closes under $227.26 by expiration, you’ll profit. The maximum gain is the option’s premium. However, losses increase linearly above $227.26, with no theoretical cap.

Your broker will likely set a minimum margin and may close the trade at a significant loss if your equity dips below it. Always remember to take a look at the stock price chart before opening a trade (as you see below, for instance, the breakeven price of your strategy is relatively far from today’s stock price, and it is close to a clear support and resistance level).

Let us wrap up to better explain when to sell call options:

- You will sell a call option that you own when you believe the price of the underlying stock is going to go down, or fear that its value is going to decrease over time due to time decay.

- On the other hand, you will short sell a call option if you expect the stock price to stay constant or decrease in value.

Remember that closing a profitable trade before expiration can lock in profits and reduce risk, but the same can be said for closing a losing trade to limit losses.