When you first approach option trading, a long call strategy may seem like the most intuitive choice. And for good reason – it’s a simple, yet potentially profitable strategy. Which factors can help your likelihood of success, and how can you improve your long call options strategy? Let’s look more closely at these questions.

Key takeaways

- A long call options strategy lets you profit from an increase in the underlying stock’s price.

- The loss potential of a long call option is limited to the option premium, while the profit is uncapped and increases linearly above the strike price.

- Unusual volume, the analysts’ target price, and the potential for explosive gains after a small price change are all factors to consider when designing a long call strategy.

Understanding the Long Call Options Strategy

The long call options strategy is a popular approach in options trading that involves buying a call option on a stock. When you go long on a call, you’re expecting the stock’s price to rise above the strike price before the expiration date.

So, what does going “long” on a call contract mean? It means you are purchasing the right, but not the obligation, to buy a specified amount of shares at a predetermined price, known as the strike price. This is also referred to as the buy call option strategy.

To illustrate this, let’s consider a long call option example. You decide to buy a $100 call contract for company ABC, which comes with a $5 premium. This premium is the cost you pay to have the option to buy the shares. Considering US options trade in multiples of 100s, your total investment here would be $500 ($5 premium multiplied by 100).

Now, let’s look at the outcomes:

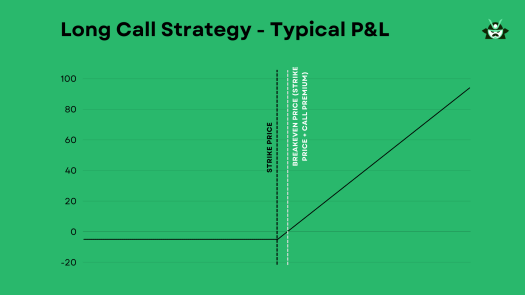

- If the stock price closes below $100, your long call options strategy stands to lose your entire investment of $500. This is because the option becomes worthless as it’s cheaper to buy the shares directly from the market.

- If the stock price lands anywhere between $100 and $105, you will lose part of your invested money. This is because although the option has some intrinsic value, it hasn’t covered the premium cost.

- If the stock price rises above $105, you start making profit, which will increase in a linear way. The higher the stock price goes, the more money you make.

This is visually represented by a typical long call strategy P&L profile graph (as you see above), showcasing how profits increase as the stock price moves beyond the break-even point of $105. Remember, the goal with the long call options strategy is to capitalize on an anticipated increase in the stock’s price.

Long Call Options Strategy Example: Low Loss Potential Call

Among the many ways in which you could build a long call options strategy, you could consider using Option Samurai’s dedicated scan for buying a call with low loss potential.

This scan is designed to search for above-average companies that have the potential to increase in value. It limits the risk to $100, ensuring the trade will be profitable with an increase of less than 3%.

Let’s take a real-life example: at the time of writing this article, using this scan reveals a long call opportunity on United States Steel Corporation (X), which is trading at $47.07.

The options screener shows the possibility to buy a $47 call expiring in 2 weeks. You’d want the stock to close above $47.93 by expiration to profit.

Given the stock’s bullish trend over recent weeks (take a look at the chart below), this might seem like an attractive opportunity. This long call option example illustrates how you can limit your risk (notice the capped loss in the chart above) while keeping the potential for unlimited profit. If you’re interested in learning more about managing your risk, feel free to refer to our hedge strategy options article.

A High Volume Long Call Options Strategy Trade Example

Another predefined scan we offer focuses on buying a call with unusually high volume. High volume in options trading often signals “smart money” trades and suggests increased activity by institutional investors. This can be an effective part of a long call options strategy.

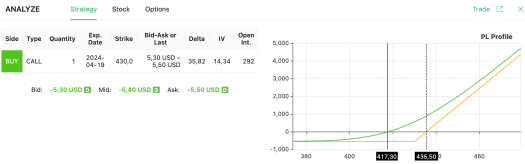

At the time of writing this article, our options screener is highlighting a potential opportunity with Berkshire Hathaway (BRK.B). After releasing earnings that exceeded market expectations, the stock is trading at $417.42.

Many traders are responding by buying the $430 call with a 45-day expiration. To profit from this buy call option strategy, BRK.B would need to close above $435.5 by expiration.

Given the positive earnings report, this scenario might be worth considering for your long call options strategy. This real-life example illustrates how tracking unusual call volumes can identify potentially profitable opportunities for this buy call option strategy.

The Way Time Decay Affects a Long Call

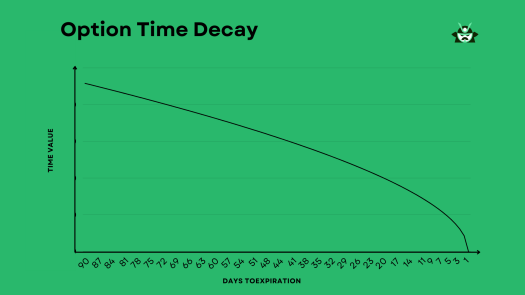

Time decay is a major element to consider in the long call options strategy. It’s an inevitable aspect of options trading that can significantly impact your potential profits and losses. Understanding how time decay affects a long call is crucial for making informed trading decisions.

In options trading, time decay refers to the decrease in the value of an option as it gets closer to its expiration date. This is often referred to as Theta (with theta being one of the greeks in the Black-Scholes model used in derivatives pricing).

Let’s consider a long call option example. Suppose you buy the same call option we mentioned earlier with a strike price of $100 and a premium of $5, expecting the stock’s price to rise. If the stock price remains stagnant and doesn’t move above the strike price as time passes, the value of the option will begin to decay.

The rate at which time decay happens accelerates as the option gets closer to expiration. This means the last few days before the option expires can see significant decreases in value. If you’re employing a long call strategy, it’s important to be aware of this and to consider the impact of time decay in your decision-making process.

While time decay is a risk factor, it’s one that can be managed. Traders using the long call options strategy often mitigate the effects of time decay by buying options with longer expiration dates. This gives the underlying stock more time to move in the favorable direction and the option more time to gain in value.

The Impact of Implied Volatility on a Long Call

You probably cannot afford ignoring the impact of implied volatility (IV) when employing a long call options strategy. Implied volatility is a measure of how much the market expects a stock’s price to move, and it plays a crucial role in determining the premium of an option.

Generally, the higher the IV, the higher the option premium. For a trader using the long call strategy, a higher premium means a higher break-even price, which could potentially limit your profits.

To increase your profit opportunities, you might consider buying a low-IV call. But what does a “low” value for IV mean? One way to determine this is by using indicators such as the IV rank. The IV rank tells you, in percentage terms, how many days during the past year the option’s IV was lower than its current value.

If the IV rank is high, it suggests that the option’s IV is quite high, indicating the option might be overbought. Conversely, a low IV rank might suggest the option is undervalued, presenting a potential buying opportunity.

However, remember that IV is mean-reverting. This means it tends to fluctuate around a long-term average. So while it can spike or dip in response to market events, it will generally return to its average level over time. This mean-reverting nature of IV makes its variation over time far from unpredictable and can be considered while planning your long call strategy.

Understanding the impact of implied volatility on a long call option is fundamental for any trader. With the IV and its rank on your mind, you can make more informed decisions about when to buy a call option, potentially enhancing your profits.

How Does Rolling a Long Call Work?

Rolling a long call is a technique within the long call options strategy used to extend the duration of the trade if the stock hasn’t increased as expected before expiration.

This adjustment provides your trade with more time to turn profitable. However, it’s crucial to note that this comes at a cost, as the longer the timeframe, the higher the options prices typically are.

The rolling process involves selling-to-close the current long call position and buying-to-open a new option with a future date. This action likely results in paying a debit and adds cost to the original position.

Let’s illustrate this with our long call option example. Suppose you purchased a $100 call option with a March expiration date for $5.

As expiry approaches, the stock price hasn’t risen as anticipated. You decide to roll the long call. You sell the March call for $2, resulting in a net loss of $300 on the original position ($3 loss per share times 100 shares per contract). Then, you buy an April $100 call option for an additional $5.

This makes the overall debit of your position $8 (because $5 + $3 = $8), raising the max loss to $800 and moving the break-even point to $108 (which is your strike price plus $8).

Can You Hedge a Long Call?

Before opening a long call strategy, you should know that yes, you can hedge your position. One approach is to sell a higher strike call with the same expiration, building a debit spread (specifically, in this case, you’d be dealing with a bull call spread). This move deviates from a simple long call options strategy, but it can offer some protection while keeping the same “use case” as your original long call position.

Think of it like buying relatively expensive gear to protect yourself from a bike accident. You may think that it’s a useless expense because you doubt you will get hurt riding your bike back from work, but when things go bad, you’ll be glad you made this move.

If the underlying stock price moves below the strike price of the call you bought, the gain on the short call will help offset the loss on the long call. However, this strategy does add complexity to the original trade and adjusts the break-even point.

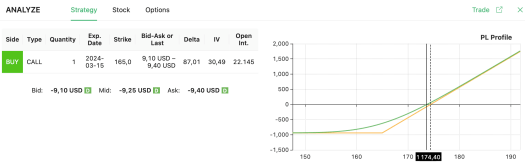

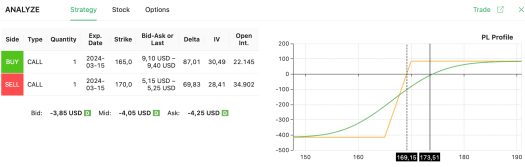

Let’s look at a real-life example to illustrate this. Suppose you are thinking of buying a $165 long call on Amazon (AMZN) with a $9.25 (the mid-point of the bid-ask values) debit, as you can see below from our screener:

With AMZN trading at $173.51 and a breakeven price of $174.40, you may wonder whether you will manage to turn this position into a profit as your option. You may choose to increase your chances of success by evaluating a different approach, such as the hedge we described above.

Therefore, you buy the same long call at $165 and sell a $170 call with the same expiration date. As you can see from the P&L profile below, the situation has changed with a new, lower, breakeven price ($169.15) that may increase your profit likelihood. However, note that your profit potential is now capped (which is the price to pay for the hedge):

If you understand how to hedge, you can add another layer of strategy to your options trading toolkit. Even though it increases the initial cost and caps your profits, hedging may provide the insurance you need against adverse market movements.

So, when do you normally want to use a long call options strategy? Let us answer with 3 practical cases:

- When you anticipate a bullish trend for an underlying stock or index.

- When long call contracts are deemed relatively cheap (in terms of implied volatility).

- When demand is high for the corresponding option contract, as seen from unusually high volumes in the trading day.

The combination of these factors will never give you a 100% guarantee of success, but it may increase your odds of profiting from a long call trade.