Category: Tutorials

Using MA report in your trading

As part of our premium plan, we send our users a weekly sector report. This report analyzes all sectors of the market from a bird’s-eye view….

Implied volatility drop after earnings

Many traders ask themselves how much the Implied volatility drop after earnings. Since earning release are very volatile – We can see an increase of IV…

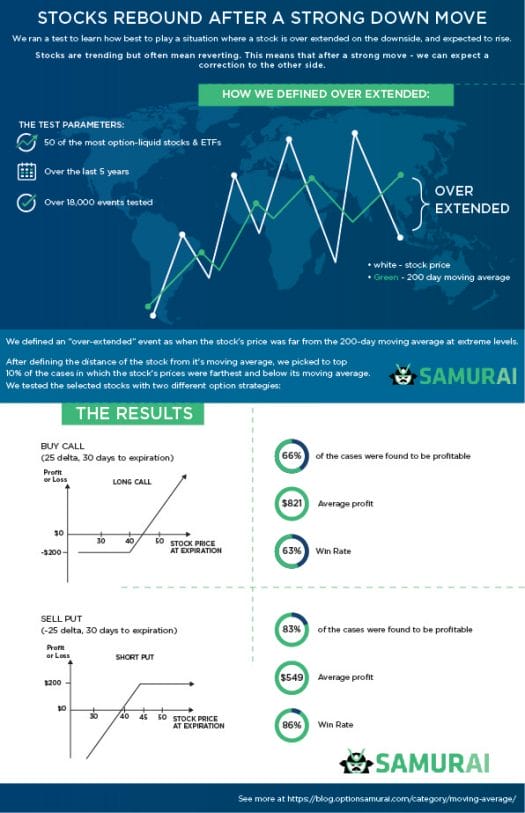

How to trade when a stock is over extended

As traders we are constantly on the look to understand the market’s tendency and how to act on it. One way is by examining…

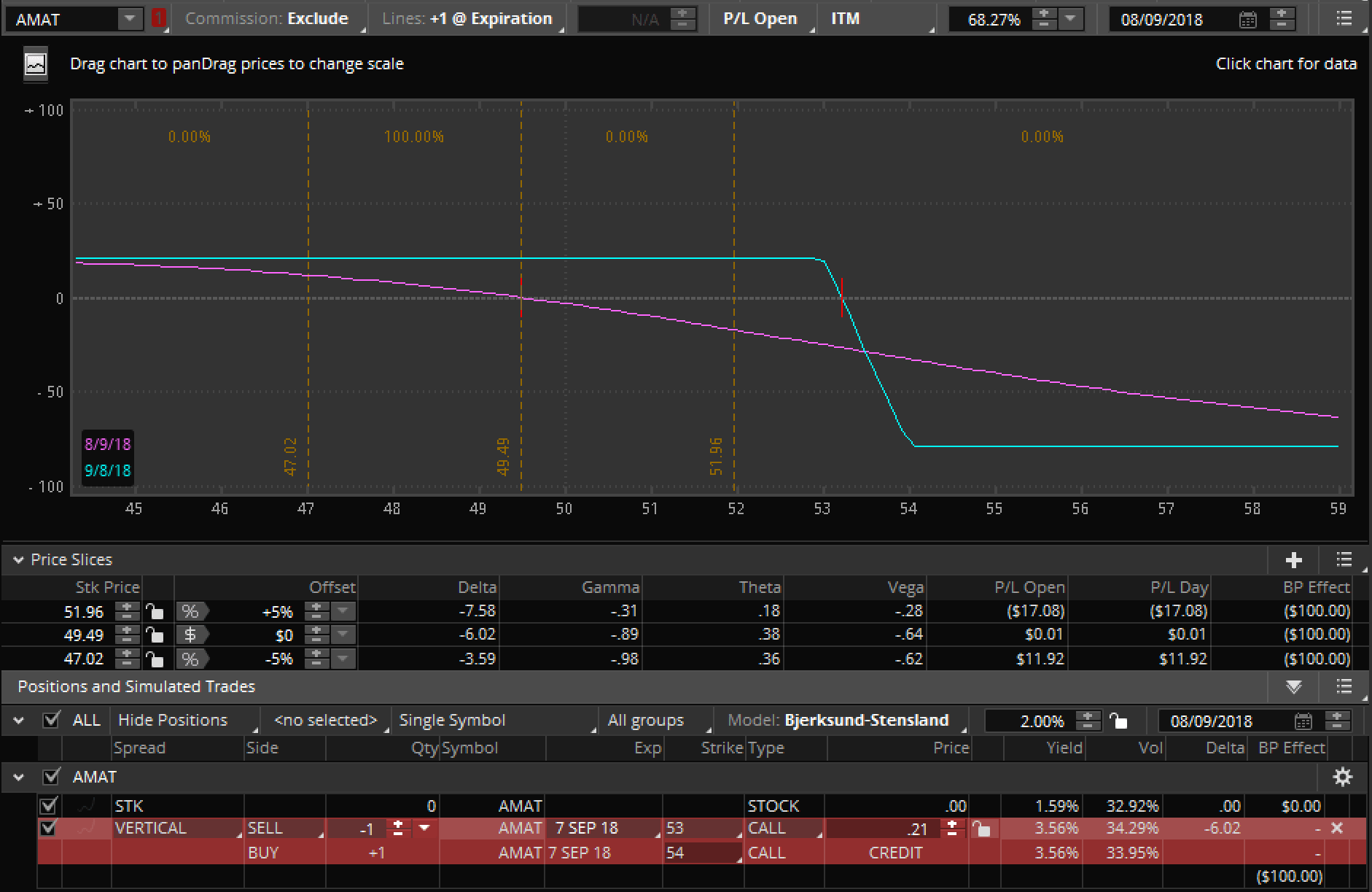

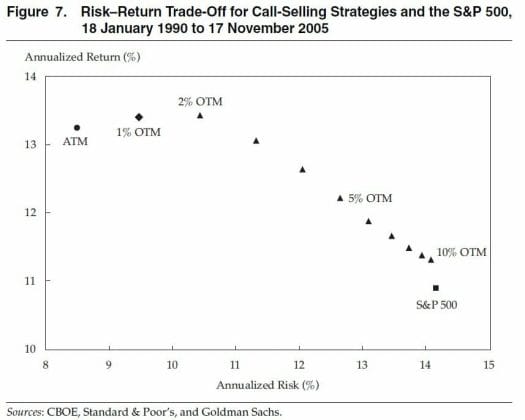

Picking the perfect covered call strike

Covered call is one of the most popular options strategies. Last week we mentioned that option-sellers have an edge when trading, and we talked…

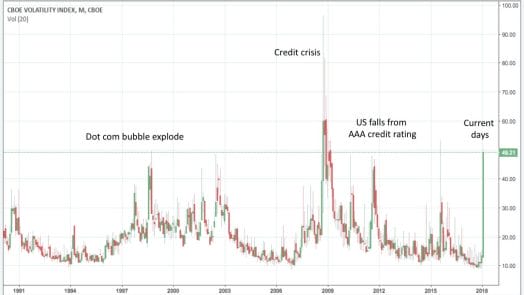

The markets plunge – what does Vix tell us?

(small update: The Vix gave more than 30% and faster than we projected. If you took our idea it might be good time to…

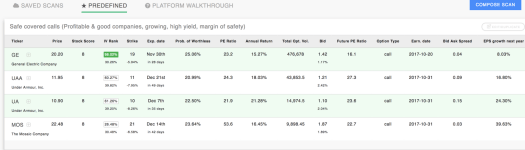

How To Choose A Covered Call Using A Predefined Scanner ($MOS Example)

In this article, we’re going to see how to choose an option for generating income. The strategy we’ll use is covered calls, which means…