One of the prominent features in SamurAI are the predefined screens. The screens (over 20 of them) allow you find trade ideas in one click in different market conditions. We’ve created the screens for 3 main reasons:

- Help users find trade ideas for different market conditions easily.

- Teach users how to use the platform.

- Give ideas on how to improve and find better trade ideas.

When we build predefined screens we pair together an edge or a catalyst (reason to act) with an option structure that can capitalize on that edge/catalyst. Some catalyst are options based and could primarily be capitalize with that option structure (dividend capture + covered calls or buying cheap calls with extreme low break-even vs ATR). Some catalysts are stock based and might be capitalize by different strategies. An example of these could be recent monthly analyst upgrades that, while we paired with buying calls, can be traded with any bullish structure – depends on market conditions and outlook.

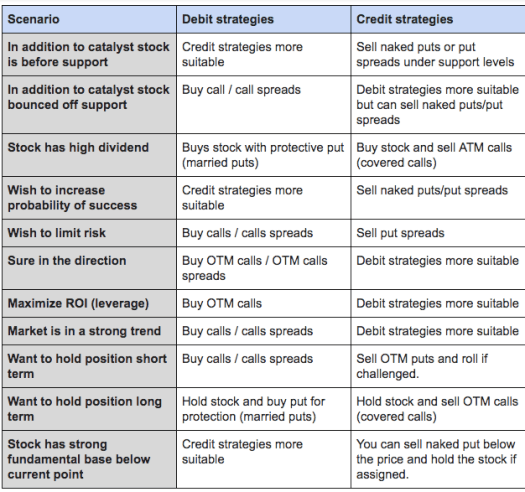

In this article we want to give some guidelines and variables to consider when checking how to implement and edge/catalyst. The following table describes bullish considerations ONLY for clarity reasons. Reversing the rules would work for bearish edges.

Scenarios to consider when analysing trade ideas

The above table describes different aspects you might consider when analysing potential trades in the market. It is not meant as a guide to use as is. The scenarios column represents different aspects you might want to incorporate in your trading. The suggested strategies give you a helpful direction to how you might be able to capitalize on that aspect. If something is not clear please feel free to chat with us or email us (we will cover more on this in future articles).

Example I

If you run the analyst recommendations upgrade scan and saw a stock that distributes high dividend – you might want to consider a covered call instead of the predefined long call. Similarly, if the stock is near support, it might be better to sell OTM put below it to increase your probability of profit.

Example II

If you run a scan for buying cheap calls, the system will suggest options where the breakeven point is really close compared with average volatility of the asset. If you wish to maximize the ROI, or you are sure in the trend, you might want to buy calls that are further OTM but increase the quantity to keep the cost the same. That way if the stock continues up your profit will increase, while the risk will stay the same.

Summary

Our predefined scans pair trading edges with an option structure that can capitalize on it. However, markets are dynamic and you might want to incorporate more advanced concepts in your trading. The table provided in this article gives you thinking points on what to consider and how to capitalize on it when trading.

Check our FAQ article to see how you can change the scan and save it in your dashboard so you’ll be able to access it in one click.