Learn. Trade. Profit.

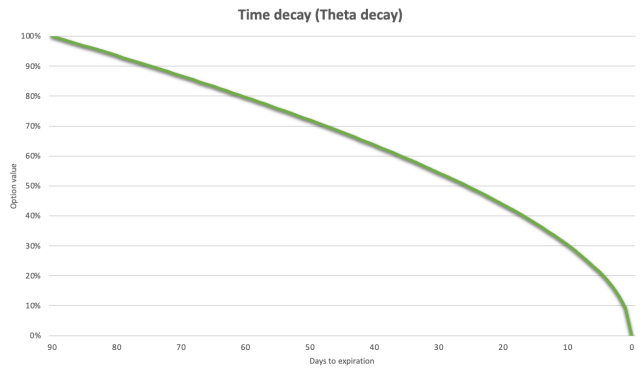

The Basic of Selling Options on Expiration Day

If you’re wondering about selling options on expiration day versus exercising them, this article is for you. We’ll delve into whether an option can…

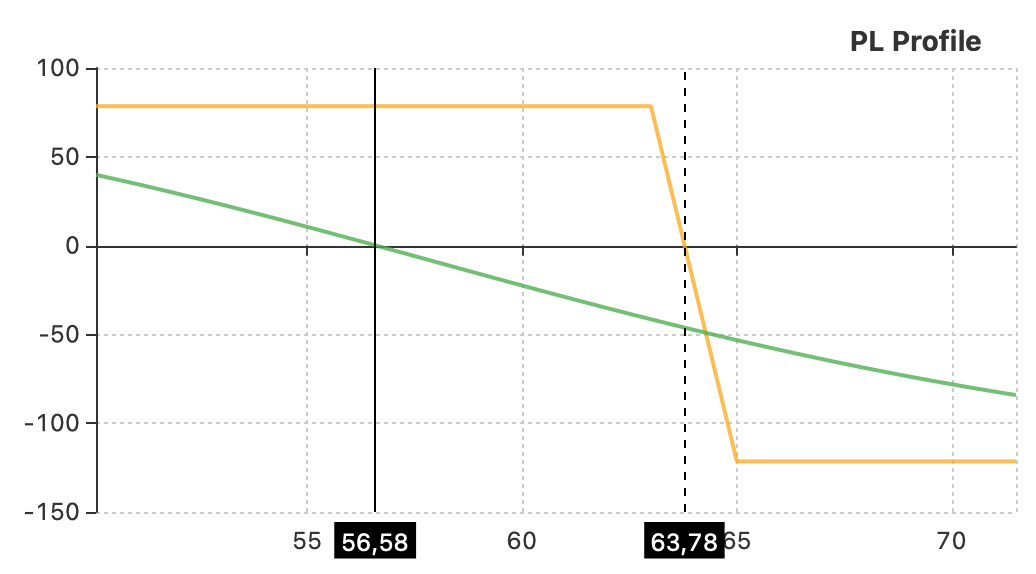

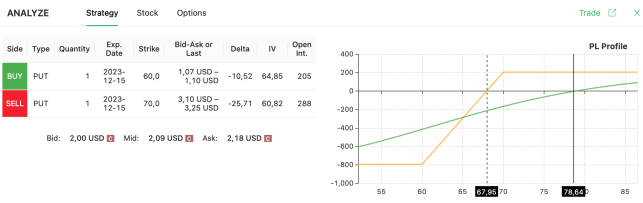

Selling Call Spreads: A Comprehensive Dive into Bear Call Spreads

Among various options strategies, selling call spreads, particularly bear call spreads, stands out. This article provides a deep dive into credit call spreads or…

A Comprehensive Guide to Options Selling Strategies

Selling options can seem daunting, but our comprehensive guide to options selling strategies simplifies it. Whether you’re exploring the best option selling strategy or…

A Deep Dive into Selling Option Premium for a Living

Dive into the intriguing world of selling option premium for a living. This comprehensive guide will explore how selling premium options can yield consistent…

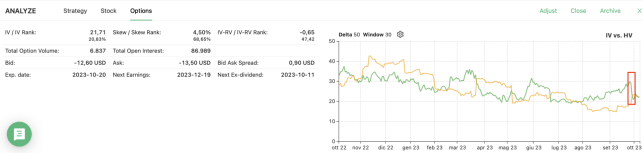

IV in Options: The Role of Implied Volatility in Options Trading

Unravel the complexities of IV in options trading with our comprehensive guide. We delve into what IV is, its impact on high and low…

Recent posts

Categories

Menu