Selling options can seem daunting, but our comprehensive guide to options selling strategies simplifies it. Whether you’re exploring the best option selling strategy or seeking a selling options strategy, we answer the critical question – “Which is the best strategy for option selling?”

Key takeaways

- Understanding options selling strategies is crucial in trading. Some of the popular strategies include the Bull Put Spread, Bear Call Spread, and Short Straddles.

- Options selling strategies are not a one-size-fits-all. The effectiveness of these strategies can vary based on market conditions and individual risk tolerance.

- Selecting the right option selling strategy is a careful process. Key factors such as market volatility, individual financial goals, and trader’s experience level play a significant role in this decision.

Understanding an Options Selling Strategy

Options selling strategies are methodologies that traders use to generate income or hedge against potential losses. These strategies, such as the Bull Call Spread, Bear Put Spread, and Short Straddles, involve selling options contracts to take advantage of various market conditions.

The best option selling strategy for a trader largely depends on their risk tolerance, market outlook, and individual objectives. However, determining which is the best strategy for option selling can be complex. This article will delve deeper into these selling options strategies, providing you with the knowledge to make informed trading decisions.

Choosing the best option selling strategy is crucial in options trading. It determines your ability to maximize profit and minimize risk. These strategies are not one-size-fits-all; they should align with your financial goals, market outlook, and risk tolerance.

Among the most popular options selling strategies are the Bull Call Spread, Bear Put Spread, and Short Straddles:

- The Bull Call Spread is ideal when expecting a moderate rise in the price of the underlying asset.

- The Bear Put Spread is used when anticipating a moderate drop.

- Short Straddles, on the other hand, work best when expecting a sideways movement in the market.

Determining which is the right selling options strategy requires a deep understanding of these and other strategies, which we will explore further in this article.

Specifically, we will look into three different examples – one for each market scenario mentioned above – to help you find the best options selling strategy that will fit your trading style.

Which is the best strategy for option selling? As we explain below, the first aspect you need to understand is whether to prefer to take a bullish, a bearish, or a neutral stance on the market.

Bullish Options Selling Strategies

Bullish options selling strategies are designed for traders who anticipate a rise in the price of an underlying asset. These strategies help to capitalize on potential profits while limiting risk exposure. They include the bull put spread, selling puts, and covered call strategies.

Bull Put Spread

The Bull Put Spread is another bullish strategy that involves selling a put option and buying another put option with a lower strike price but the same expiration date. Traders use this strategy when they expect a slight increase or stability in the price of the underlying asset. The profit is made from the premium difference between the two options.

Selling Puts

Selling puts is another strategy used by bullish options traders. This strategy is similar to the bull put spread in that it involves selling put options, but it offers some distinct advantages. Like the bull put spread, selling puts allows traders to profit from an expected increase in the underlying asset’s price. However, it’s often considered a more flexible approach.

One advantage of selling puts is that it’s easier to close early or roll over to a future expiration date. Additionally, you can choose to sell puts with different strike prices, providing you with a wider margin of safety. This flexibility can make it a preferable choice over the bull put spread in certain situations.The main downside is that this strategy requires more margin and has a higher loss potential so it’s suitable to more seasoned investors with bigger accounts.

Covered Call

The covered call strategy is another approach for bullish trader. Investors typically execute a covered call when they expect moderate increase or decrease in the underlying stock price for the life of the option. This strategy involves an investor holding a long position in an asset and then writing (selling) call options on that same asset.

Covered calls are often employed by those who intend to hold the underlying stock for a long time but do not expect explosive growth. This strategy is easy to implement and good for long term investors and dividend stocks.

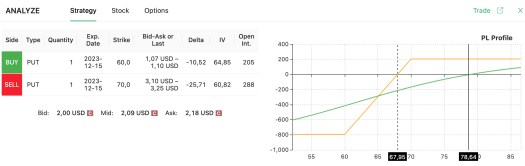

Example: Bull Put Spread

Among the various options selling strategies, a classic example is the bull put spread. This option selling strategy is typically employed when one expects a moderate rise in the price of an underlying asset. Let’s illustrate this with a practical case using MRNA shares, currently trading at $78.64.

For a bullish stance on MRNA, a Bull Put Spread strategy could be an effective selling options strategy. As suggested by an option screener like Option Samurai, you could buy a $60 put and sell a $70 put.

The mechanics of this best option selling strategy are such that you would pocket the premium (~$209) if, by the time the options reach their expiration day, MRNA price remains above the $70 threshold. The break-even point is $67.96.

Given that MRNA has been trading consistently above this level for several consecutive months, you might consider this a high-probability trade.

Therefore, the question, “Which is the best strategy for option selling?” largely depends on your market outlook, risk tolerance, and investment goals. In this case, the bull put spread presents a compelling argument.

Bearish Options Selling Strategies

Bearish options selling strategies are designed for traders who anticipate a decline in the price of an underlying asset. Some examples include the bear call spread, selling calls, and the short synthetic future strategies.

Bear Call Spread

A Bear Call Spread is an options selling strategy used when a moderate decrease in the price of the underlying asset is expected. It involves selling an At-The-Money (ATM) call option and simultaneously buying an Out-Of-The-Money (OTM) call option. The aim is to profit from the difference in premiums between the two options. This strategy limits both potential profit and loss, and is a good ‘entry-level’ strategy for options traders into short-trading.

Selling Calls

Selling calls is another strategy employed by bearish options traders. This approach involves selling call options on an underlying asset. The decision to use this strategy often depends on the trader’s outlook and the specific market conditions.

Selling calls can be particularly useful when you have a strongly bearish view of an asset and expect a significant price decline. It allows you to collect the premium from selling the call option, but you may be obligated to sell the underlying asset at the strike price if the option is exercised. Traders may prefer selling calls over bear call spreads when they have a high level of conviction in their bearish outlook and anticipate a substantial decline in the underlying asset’s value.

Short Synthetic Futures

The short synthetic futures strategy is a bearish option selling strategy that offers a more nuanced approach compared to other strategies.

This strategy has unlimited profit and unlimited loss. It is comprised of buying a put option and selling a call option on the same underline for the same strike and expiration.

This strategy is particularly useful when you are bearish on the market and uncertain about volatility. It effectively eliminates the impact of changes in volatility, allowing you to focus solely on the market’s directional movement. This strategy is relatively easy to manage (close early, roll, etc.) and is similar to short selling.

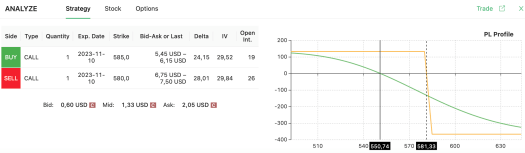

Example: Bear Call Spread

Let’s dive into an example of a Bear Call Spread, a popular option selling strategy. Take Adobe (ADBE), currently priced at $550.74. In a slightly bearish scenario, we might employ a Bear Call Spread strategy. For instance, we could sell a $580 call and buy a $585 call, as shown below.

This best option selling strategy will generate profit if ADBE trades below $581.33 at the option’s expiry date. ADBE failed to breach this price multiple times over the last few months. making this strategy an interesting one to consider.

Neutral Options Selling Strategies

Options, unlike other instruments, give you the unique chance to benefit from neutral market scenarios. Neutral options selling strategies are designed for situations where traders expect minimal price movement of an underlying asset. Below, we will look into short straddles, short strangles, and the basic iron condor strategies.

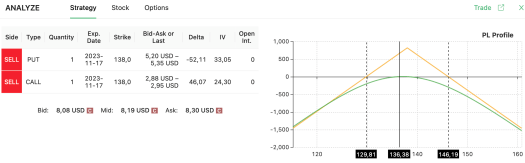

Short Straddles

Short Straddles involve selling both a call and put option on the same underlying asset with the same strike price and expiration date. This strategy is used when the trader expects the underlying asset’s price to remain stable, profiting from the premiums collected. This strategy offers high time decay and will usually be closed early.

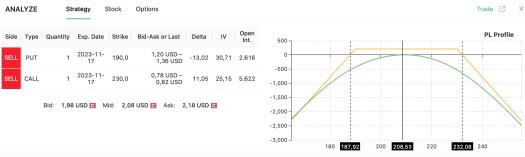

The image below shows the P&L profile of a classic short straddle strategy performed on IBM:

Short Strangles

A Short Strangle involves selling a put and call option on the same underlying asset with different strike prices but the same expiry date. This strategy is preferred when the trader expects the price of the underlying asset to remain within a certain range, profiting from the premiums collected. Similar to the straddles described above – this strategy has a high time decay but a bigger profit zone – which makes it easier to manage.

The image below shows the P&L profile of a short strangle strategy that can be executed on NFLX:

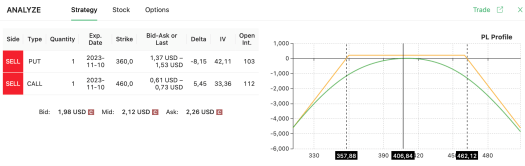

Iron Condor

The iron condor is a very popular option strategy that is easy to learn but hard to master. It has a limited loss on both sides and high time decay, allowing users to increase their profit ratio and close the trade early. This strategy is built from selling call and put credit spreads out of the money (OTM), and collecting the premium as long as the stock stays within a specific profit range. It has the benefits of strangles (above) with a large profit zone but with limited risk.

The concept of the iron condor is easy to understand and implement, making it a favorite among options traders. Many useful edges can be applied, such as considering the Implied Volatility (IV) rank, assessing the probability of profit, and more.

However, it’s important to note that this seemingly straightforward strategy can become more complex when attempting to generate profits in different market conditions. Factors to consider may include navigating earnings seasons, managing unbalanced iron condors, addressing volatility skews, and making informed decisions about closing trades early, among other nuances.

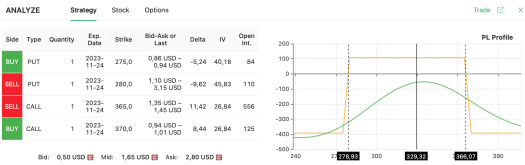

Here is a typical P&L profile of a basic iron condor strategy performed on MSFT:

Example: Short Strangle

Let’s consider Salesforce Inc. (CRM), which has seen relatively stable movement in recent months. With CRM trading around $210, an investor might bet on this stability continuing. Using Option Samurai, we find an opportunity to sell a $190 put and a $230 call simultaneously, a typical short strangle strategy.

This best option selling strategy would yield a profit if CRM trades between $187.92 and $232.08 by expiry.

Given the stock’s past performance, you may consider this to be a high-probability trade.

Considering the three examples for different market scenarios included in this article, you have now an additional tool in your option trading kit. Selling options premiums for a living may not be an easy technique to master, but it can certainly lead to consistent returns when your investment intuition is correct.