If you’re wondering about selling options on expiration day versus exercising them, this article is for you. We’ll delve into whether an option can only be exercised on the expiration date, if you can exercise a call option before expiration, and discuss the pros and cons of selling options on expiry day.

Key takeaways

- Selling options on their expiration day is a strategy that maximizes time decay. Trading options with 0 days to expiration leverages the concept of time decay to its fullest potential. As time runs out, the options decay rapidly, making it an optimal strategy for those seeking to profit from this accelerated depreciation.

- The absence of time to expire results in exceptionally dynamic gamma movements. This means that options that are close to the money change in price very rapidly, amplifying the leverage effect. Traders can benefit significantly from these swift shifts, capitalizing on favorable market movements.

- It’s essential to recognize that time decay and gamma can be both advantageous and detrimental, depending on market conditions. While they offer the potential for rapid gains, they also introduce heightened risks, requiring traders to manage their positions and market assessments carefully.

What Is an Option?

Before looking into the possibility of selling options on expiration day, let’s quickly define an option. An option is a financial contract granting the right, but not the obligation, to buy or sell an asset at a set price by a certain date.

This leads us to question if an option can only be exercised on the expiration date. The answer varies; European options are limited to this, while American options allow you to exercise a call option before expiration. So, is it good to sell options on expiry day? The strategy’s effectiveness largely depends on market conditions and individual risk tolerance.

Understanding Selling Options on Expiration Day

In the world of options trading, understanding the concept of selling options on expiration day is vital. It’s a strategic move that takes advantage of two key characteristics: time decay and gamma leverage.

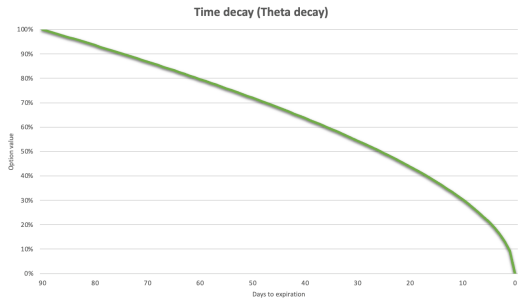

Time decay, or theta, is the rate at which an option loses value as it approaches its expiration date. As seen in the graph below, the rate of decay accelerates as the expiration date nears, making the option less valuable. This phenomenon is particularly pronounced on the last day before expiration. This graph shows how the time decay changes as we get close to expiration:

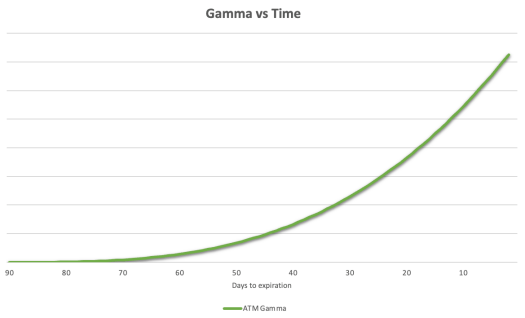

Gamma, on the other hand, measures the rate of change of delta, which represents the rate of change of an option’s price for a one-unit change in the price of the underlying asset. On expiration day, gamma moves very quickly due to the lack of time to expiration, causing delta to also move rapidly. This means traders can gain the most out of the leverage of the options.

For instance, if you buy an out-of-the-money (OTM) option, its value will plummet to zero quickly if the stock remains OTM. However, if the stock goes in-the-money, the delta will rise rapidly, and the option will quickly approach a delta of one. This means that for every $1 move in the stock, the option price will change by $100 (as in the US, equity options represent 100 shares).

This characteristic is depicted in the following graph.

In the graph above, we see how the value of gamma grows higher and higher as we approach to the option maturity for an ATM case. Gamma’s rapid growth brings to a higher value for delta, hence making option prices much more sensible to variations in the quote of the underlying stock when the option is nearing its expiration date.

These two characteristics can be advantageous when they work in your favor but detrimental when they work against you. Therefore, it’s crucial to understand whether an option can only be exercised on the expiration date or if you can exercise a call option before expiration.

In the case of American options, they can be exercised at any time—either on or before the day they expire. However, European options can only be exercised when they expire. Knowing this distinction is crucial for effective options trading.

So, is it good to sell options on expiry day? It can be, but selling options on expiration day can be a viable strategy, but it requires a deep understanding of time decay and gamma leverage.

Can You Exercise a Call Option Before Expiration?

We’ve just mentioned how selling options on expiration day works, but let’s consider the other side of the coin. Can you exercise a call option before expiration? The process of exercising options before expiration involves fulfilling the rights outlined in the contract. For call options, this means buying the underlying asset at the strike price.

American options provide the flexibility to exercise at any time up to and including the expiration date. This means that call options can be exercised before expiration if the investor wishes to buy the underlying asset. However, European options underscore the point that an option can only be exercised on the expiration date itself.

There are pros and cons to exercising options early. On the upside, it allows investors to capitalize on favorable market conditions or lock in profits. It can also be a strategic move to avoid potential losses if the market turns against investors’ option position.

However, by exercising early, investors forfeit the remaining time value of the option, which could still have potential value if the market moves further in their favor.

Scenarios where early exercise might be beneficial include when the option is deep in the money and the time value is minimal, or when there are dividend payments expected on the underlying asset. In these cases, early exercise can capture the intrinsic value of the option or secure the dividend payment.

So, can you exercise a call option before expiration? Absolutely, and, if you’re a long-term investor or are looking for a dividend capture strategy, early exercise may be a great idea.

Is It Good to Sell Options on Expiry Day?

Selling options on expiration day can be a strategic move in options trading. It capitalizes on the rapid decline of time value as the option nears expiry. This strategy allows traders to collect the premium upfront, potentially yielding profits if the option expires worthless or if the underlying asset’s price remains within a specific range. In fact, you may even want to consider selling options after hours if your broker allows you to do so.

However, the merits of selling options on expiration day should not overshadow its potential risks. If the market moves unfavorably, significant losses may occur.

The decision to sell options on expiration day is influenced by various factors. Market conditions play a key role; a stable market with low volatility can favor this strategy. Risk tolerance is another critical factor.

Traders with a higher risk tolerance might find this strategy attractive due to its potential for high returns. Lastly, investment goals matter. If the aim is to generate quick returns, selling options on expiry day could be a viable strategy.

A Practical Example

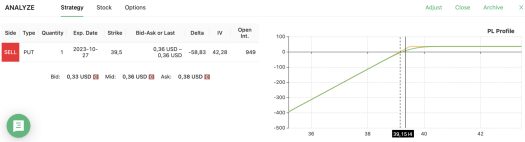

Consider a scenario where it’s Friday, and Citigroup (C)’s stock price stands at $39.34. With options set to expire on this day and positive news for the banking sector, you anticipate that C’s price will rise.

Despite its price not moving upward during pre-market trading hours, unlike its competitors, you believe that C will open the session close to its previous closing price. Specifically, you believe that investors’ optimism about its competitors should drive up C’s price during the day.

Using an option screener like Option Samurai unveils a potential opportunity – selling a $39.5 put option on expiration day.

Note that, if C manages to stay above $39.15 by the time the option expires, you’ll profit.

However, there’s a risk that C could fall below this level during the day, demonstrating the volatility associated with selling options on expiry day. This scenario illustrates a classic naked put strategy and could be an interesting approach for an intraday trader. Of course, we are assuming that you have already analyzed the pros and cons of buying vs selling options (you could have just opened a long call, hoping that time decay would not jeopardize your trade).

Who Should Sell Options on Expiration Day?

Selling options on expiration day is not a strategy for every trader but can be beneficial for certain types. Here’s who might find this tactic advantageous:

- Experienced Traders: These individuals understand the intricacies of options trading and market dynamics. They can proficiently assess market conditions, making informed decisions about selling options on expiration day.

- Risk-Lover Traders: Because there is little time to expiration, there is no leeway for mistakes. Options change in price quickly, and they are very leveraged. This increases the potential profit but also the potential loss.

- Income-Oriented Traders: Traders seeking a consistent stream of income can achieve their financial goals by strategically selling options. Selecting options with a shorter time to expiration, such as those with 0 days left, can be a more aggressive approach, maximizing the potential for rapid decay and income generation.

These traders should consider factors like market volatility and underlying asset price movements when deciding to sell options. It’s also important to note that while it’s possible to exercise a call option before expiration, the decision to do so should align with the trader’s strategy and risk tolerance.

So, to sum up our points, we can say the following:

- Yes, selling options on expiration day is possible. This is true both whether your question concerns the mere sale of an option you own or whether you refer to the shorting of options in general as a means of directly making money on expiry day.

- Yes, you can also exercise a call option before expiration. However, whether this is possible depends on the type of option (American or European), and early exercise may come with trade-offs.

- If you’re not careful, trading (both buying and selling) an option on the expiration day can turn into a nightmare: the value of your contract could change rapidly, potentially leading to significant losses. However, time decay is on your side if you’re an option seller, making it a favorable move in certain market conditions.