If you’re wondering when to sell an option, our guide will shed light on complex market scenarios. When should you sell your options and at what profit? When should you sell a call option? Let’s dive into the various market scenarios and explore when selling an option is the best choice.

Key takeaways

- You should sell an option when both fundamental and technical indicators align in your direction. Look at the market’s direction, and consider that a sideways market can still lead you to profit with this strategy.

- Consider factors such as timing, underlying asset price and volatility when deciding on the right time to sell an option.

- If you want to know when to sell an option, consider its maturity: the shorter its time left, the more its premium tends to decay.

Understanding When to Sell an Option

Options trading is a financial venture that requires strategic thought and timing. One of the most critical decisions in this process is understanding when to sell an option. This decision influences your potential profits and risk exposure, and is influenced by several factors.

The first factor to consider when deciding when to sell option is the outlook on the underlying security. If you have a bullish outlook on a particular asset, selling a put option could be the most beneficial. Conversely, if your outlook is bearish, selling a call option might be the right move. The decision heavily relies on your analysis and predictions of market trends.

Market conditions also play a vital role in determining when to sell an option (in fact, make sure you understand the implication of buying vs selling options before opening a trade). If you feel like having the possibility to earn from a sideways market justifies the risk to lose more than what you invested, selling an option can be a suitable choice.

Another critical aspect is the trader’s desired profit or risk management strategy. You may ask yourself, “When should you sell your options at what profit?” As a rule of thumb, if you see a quick appreciation of your option’s value, considering that selling options cannot lead you to earn more than the 100% of the premium, it may be wise to sell the option and take profits while you can.

Selling options comes with numerous benefits. It can provide a consistent source of income through collected premiums, contributing to overall returns. Advanced strategies like bear call spreads and short straddles often involve selling options, allowing traders to profit in various market conditions.

However, selling options is not without risks. If the market moves against your position, you risk substantial losses. Have an exit strategy, and do all you can to avoid margin calls from your broker. Sometimes, it is just better to accept a loss that is close to 100% of the invested capital rather than waiting for a market reversal that may not come before your options expire.

When Should You Sell a Put Option?

Selling a put option is a strategic decision that can be beneficial in various scenarios, mainly when you have a bullish outlook on a stock and seek consistent income generation.

If you anticipate that a particular stock’s price will rise or stay above the strike price until expiration, selling a put option could be advantageous. This strategy allows you to potentially buy the stock at a lower price.

Essentially, you’re betting on the stock’s price not falling below the strike price. If your prediction holds true, the option expires worthless, and you get to keep the premium—answering the question of when should you sell your options at what profit.

Let us give you a simple answer to this section’s question: you normally want to sell a put when you believe, simultaneously:

- That there’s a good chance a stock price will move up by the time the put option expires (entering a bullish trend).

- That, even if the stock fails to move up, it is still unlikely that its price will decline by the time the put option expires (entering a sideways trend).

- That the real volatility will be lower than the implied volatility, hence providing you with a potentially overpriced option that should decrease in price as it approaches maturity

To understand when to sell an option in this case, we’ll look into an easy-to-read naked put scenario.

A Naked Put Example

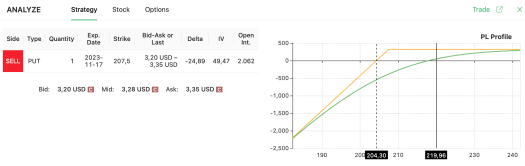

Suppose you’re bullish on Tesla (TSLA), currently priced at $219.96. You predict a sideways movement or a continued bull run, with minimal chances for a bearish correction. Here, an option screener like Option Samurai might highlight the possibility of selling a $207.5 put.

To profit in this scenario—answering “When should you sell your options at what profit?”—you need TSLA to stay above the breakeven price of $204.30 by expiration. This illustrates when to sell an option using a classic naked put strategy.

When Should You Sell a Call Option?

So, when should you sell a call option? Understanding when to sell an option – and, in this case, puts – is vital in the realm of options trading. Selling a call option requires a different approach compared to the naked put case described above.

If you anticipate a decline in the price of the underlying asset or stock, selling a call option can be advantageous. This strategy allows you to collect a premium from the buyer, which you retain if the price of the asset falls below the strike price at expiration. Of course, in this case, the question “When should you sell your options at what profit?” has a different answer.

To better explain the concept, let us give you a simple answer to this section’s question: You normally want to sell a call option when you believe, simultaneously:

- That there’s a good chance the stock price will decrease by the time the call option expires (entering a bearish trend).

- That, even if the stock fails to decline in value, it is unlikely that its price will rise above the strike price by the time the call option expires (entering a sideways trend).

- That, just like we saw in the put case, the real volatility will be lower compared to the option IV

When should you sell a call option? First of all, consider this: naked call strategy is probably less frequent than its naked put counterparty. This is because, in the long term, the market will tend to follow a bullish trend rather than a bearish one. In fact, it is probably more likely that a trader will sell a call option combined with the purchase of the underlying stock, performing the popular covered call strategy.

However, for the sake of clarity, let us look at the naked put specular case on the market: the naked call strategy, a great way to understand when to sell an option.

A Naked Call Example

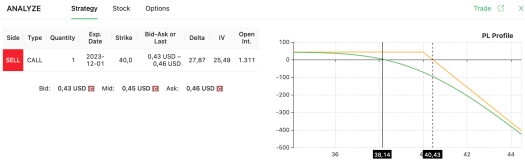

Imagine you’re bearish on Intel (INTC), currently trading at $38.14. Anticipating a potential pullback or sideways movement due to an approaching resistance level at $40, you consider when to sell an option. Option Samurai, through its screening algorithm, might highlight the chance of selling a $40 call, as you see below.

When should you sell your options at what profit? Well, consider this: all you need to be profitable is for INTC to remain under the breakeven price of $40.43 by expiration. In this classic naked call operation, you may expect the profit probabilities to be on your side and, if the $40 resistance holds, you may slowly earn a solid profit as the option’s price decays with time, reaching the expiration date.

The two examples we saw – TSLA and INTC – are two easy-to-grasp cases that explain option selling and when to sell an option. However, a specialized trader may build numerous non-standard strategies by mixing different expirations, strike prices and underlying assets. Our predefined strategies combine multiple options into one single operation, providing a simple and efficient way to leverage the benefits of options selling.

Great article! Really appreciated the detailed examples. Looking forward to more of your content. How about a piece on risk management best practices (e.g delta hedging)?

Thank you!

I’ll Add the request to our article ideas and we will try to tackle it next year.