Is it better to buy or sell options? That is the question we tackle in this beginner’s guide to buying vs selling options. We’ll delve into the crucial difference between buying and selling options, comprehend the nuances of selling vs buying options, and determine whether it’s better to buy or sell options in various trading scenarios.

Key takeaways

- Buying vs selling options are two different strategies that may aim to achieve profit from the same event but with different methods.

- An outright bullish or bearish position is created when buying options, while a neutral to bullish or bearish stance can be obtained through selling options.

- While selling options limits potential profits, it also offers a higher probability of success compared to buying options. Buying vs selling options requires, therefore, a different risk-reward analysis.

Buying vs Selling Options – The Two Sides of the Coin

In the world of options trading, it’s crucial to grasp the distinction between buying and selling options, as this understanding can be the key to navigating profits and avoiding losses.

Picture it like a coin – each side represents a different role in the options market:

- Buyers: Imagine you’re buying an option. You’re paying for the right, but not the obligation, to either buy or sell an asset at a predetermined price before a specified expiration date. It’s like booking a reservation at a restaurant; you have the choice to show up or not, depending on the market conditions.

- Sellers: On the flip side, there’s the seller. For every buyer, there’s a seller. If you’re selling an option, you’re taking on the obligation to fulfill the buyer’s request if they choose to exercise it. Sellers collect a premium for taking on this responsibility, similar to receiving payment for offering someone that restaurant reservation.

Now, here’s the twist that makes it interesting: the profit and loss are like reflections in a mirror. If a buyer makes a profit, it means the seller is experiencing a loss, and vice versa. This dynamic is fundamental to options trading – it’s a give-and-take where each side has its own risks and rewards.

Understanding this mirror effect is essential for beginners. It provides an intuitive insight into the interconnected nature of trading options. So, as you delve into the world of options, keep in mind that every transaction involves both a buyer and a seller, each with their own set of expectations and risks.

Buying a Call or a Put

Embarking on the journey of selling vs buying options begins with familiarizing oneself with two key strategies: buying calls and buying puts. Buying a call option is a bullish strategy, signaling an expectation that the price of the underlying asset will rise. This gives the trader the right, but not the obligation, to buy the asset at a predetermined price (the strike price) within a specified timeframe. If the price of the asset increases, the trader stands to profit from this upward movement.

On the flip side, buying a put option is a bearish strategy, suited for those anticipating a decline in the price of the underlying asset. This gives the trader the right, but not the obligation, to sell the asset at the strike price within a certain period. If the price of the asset drops, the trader can benefit from this downward trend.

Essentially, the choice between buying a call or a put option largely depends on the trader’s market outlook and aligns with assertive trading styles that anticipate significant price movements.

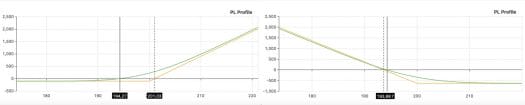

If you’re wondering what the P&L profile of buying a call or put looks like, the picture below summarizes this aspect for Apple (call case on the left, put case on the right).

As you see, buying a call option gives you an uncapped profit chance, with a limited risk of loss. When buying a put option, the risk is equally limited (in the worst case scenario, you’ll only lose what you invested), with a theoretically uncapped profit chance (although, realistically, a stock price will never decline below $0, hence limiting your returns). The downside is that the probability of profit is usually lower.

Selling a Call or a Put

Switching gears to selling options, we encounter two further strategies: selling calls and selling puts. Selling a call option is a neutral to bearish strategy, implying an expectation that the asset’s price will remain stagnant or decrease slightly. This obligates the seller to sell the asset at the strike price if the buyer exercises the option. In return, the seller collects a premium upfront, profiting from the lack of or negative price movement.

Similarly, selling a put option is a neutral to bullish strategy, catering to traders who expect the asset’s price to remain stable or increase slightly. This strategy obligates the seller to buy the asset at the strike price if the buyer exercises the option, allowing the seller to collect a premium upfront and profit from sideways or slightly upward price movements.

Buying vs selling options is not a question of which strategy is better, but rather which strategy aligns with the trader’s market expectations and risk tolerance (in fact, you may even consider selling options on expiration day). We’ll explain this in the section below.

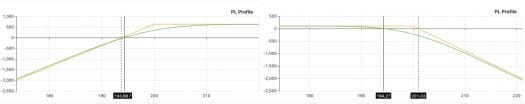

As we did before, here’s a look at what the P&L profile looks like when selling a put (left side) and selling a call (right side).

There’s a clearly uncapped risk in these cases, as option naked sellers risk losing a multiple of the capital involved in the trade. On the other side, there is a higher probability of profit, as you will profit if the stock stays sideways or goes in your direction. Furthermore, if you like selling options on expiration day, you should consider that even a small price movement may create an enormous variation in the value of your trade.

Key Differences Between Buying vs Selling Options

There are so many strategies that you can evaluate when it comes to option buying and selling, each with its own risk and reward profiles. The choice between buying vs selling options is not a one-size-fits-all approach but depends on individual factors such as market outlook and risk management style.

Market Outlook

The main difference between buying and selling options lies in the direction of the market outlook. When considering whether it’s better to buy or sell options, your market perspective plays a pivotal role.

If you harbor a clearly bullish (or bearish) short-term outlook, expecting the price of the underlying asset to rise (or go down), buying options can enable you to partake in potential upside. This strategy aligns with an anticipation of price growth (or decline) and offers the possibility of significant returns if your predictions prove accurate.

Instead, if you are not sure that the price will follow a strong bullish (or bearish) pattern, and suspect that you may face a sideways or slightly bullish (or bearish) market scenario, selling options might be the path for you. Options sellers can benefit from a neutral to mildly bullish or bearish sentiment, profiting from sideways price movements and collecting premiums upfront.

Buying vs selling options does not require guesswork, but rather relies on educated speculation based on a trader’s evaluation of market conditions.

Your Risk Management Style

Beyond market outlook, your risk management style also influences the decision between buying vs selling options. Buying options presents a classic risk approach, as potential losses are limited to the premium paid. However, the entire premium risks being lost if the market doesn’t move in favor of your position.

Conversely, selling options can provide a steady income stream through collected premiums. Yet, this approach comes with the potential for unlimited losses if the market moves significantly against your position. Realistically speaking, your broker will likely limit your losses through a margin requirement, but it’s essential to account for the possibility of sizable losses when considering this strategy.

However, you could choose to see selling options as acting like an insurance operator: collecting small premiums to cover potential losses, but with a limited payout if everything goes according to plan. If you think of selling options in this way, the approach surprisingly aligns with a more risk-averse stance and offers steady income with a higher probability of success.

When you evaluate buying vs selling options, never lose track of the risk-reward equilibrium. You need to know when to sell an option (the same goes for buying), and finding the right balance between risk and reward is crucial, regardless of your trading style or market outlook.

Buying Options: The Pros and Cons Explained Through an Example

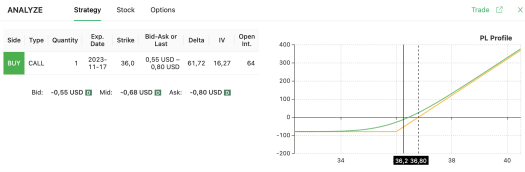

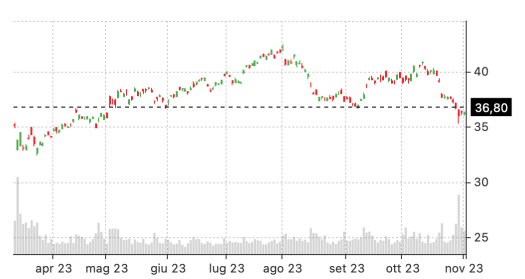

With no doubts, a real-life example can help us put into practice the notions seen above. Assume you’re bullish on HSBC Holdings PLC (HSBC), which is currently trading at $36.26 on the US stock market. An option screener like Option Samurai might highlight the possibility of buying a $36 call option, expiring in 15 days. This is a classic example of a buying vs selling options scenario.

Two potential outcomes can arise from this strategy. First, the stock price might ascend above $36.80, the breakeven point determined by the tool. In this case, you stand to profit, with no upper limit to your potential earnings. This illustrates the potential profitability of buying options when the market moves in your favor.

However, there’s a second scenario. The stock price might end up below the breakeven price, leading to a loss of your entire option premium, plus any trading fees charged by your broker. This underlines the risk inherent in buying options, where time decay is not on your side, especially with a Long Call strategy.

The price history of HSBC shows a support around $36, which might tilt the scales towards a likely profitable trade. However, with time decay playing against you, the stock price would have to appreciate at a relatively fast pace to give you the profit you want.

Selling Options: The Pros and Cons Explained Through an Example

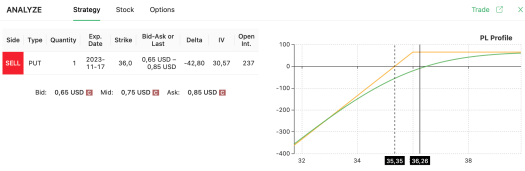

But what if we chose to evaluate a different type of strategy? Assume again that you’re bullish on HSBC Holdings PLC (HSBC), currently trading at $36.26 in the US. Option Samurai may help us locate the chance of selling a $36 put option, expiring in 15 days. This strategy, compared to buying options, presents a few key differences.

Firstly, the maximum profit you can attain is the option premium, minus any trading fees. However, potential losses can be limitless. As mentioned earlier, your broker will likely set a minimum margin for your position, automatically closing it if it falls below this margin.

The most significant difference when selling options is that you can profit from both a price increase in HSBC and sideways movement. As indicated by Option Samurai, for a profitable outcome, all you need is for HSBC’s price to remain above $35.35 by the option’s expiration.

This Naked Put strategy might seem like a high-probability operation, especially considering the clear $36 support level in HSBC’s price. However, you should beware of those scenarios in which the stock’s price may suddenly drop. In this case, your broker could close your position to limit losses, and you might end up with a losing trade. Clearly, buying vs selling options has shown us that both strategies have pros and cons, with different risk-reward profiles.

So, is it better to buy or sell options? We have all the elements we need to answer this question in the section below.

Is It Better to Buy or Sell Options?

Reflecting on the examples above, one might ask: is it worth risking more than the invested capital for the opportunity to earn the option premium? The answer, while counter-intuitive to some, lies in understanding the difference between buying and selling options.

The choice between buying vs selling options is not a simple one. Buying options can offer unlimited profit potential, but at the risk of losing the entire premium paid. Conversely, selling options can provide frequent profits from premiums (meaning higher probability of profit), but with the risk of unlimited losses and limited profits.

If you think about it this way, it all comes down to the way you like trading. If you feel very confident that there will be a trend in the days (or weeks) following your trade, then a long strategy may be what you need.

However, the chance to profit even when the market moves sideways makes selling options a more attractive strategy for some traders. More advanced strategies go beyond the mere “buying vs selling options” dilemma by combining these two ideas and understand when to sell an option, allowing traders to take advantage of different market scenarios. Through paper trading, you can learn more about the strategies for selling vs buying and determine which one suits your risk management style best.