Among the many strategies in the stock trading universe, options selling reigns supreme. This article demystifies how to sell options, when to sell an option, and contrasts selling vs buying options. Unearth the potential of selling options for income, selling option premiums, and the intricacies of selling options contracts. Embrace this comprehensive guide to master options selling.

Key takeaways

- Option selling means giving someone else the right to buy or sell an asset at a specific price within a certain timeframe.

- Selling options can provide upfront premiums and regular income but also carry risks, such as the potential for unlimited loss.

- Selling options offer a high probability of profit but the profit is limited to the premium collected. Managing your positions using the Greeks will increase your edge.

Option Selling: A Comprehensive Guide

Options selling, a popular strategy in the world of stock trading, provides an avenue for investors to generate income. Knowing when to sell options and when to buy them can be the difference between gaining or losing money.

The process of options selling revolves around two main types of options: call options and put options. A call option provides the buyer with the right, but not the obligation, to buy an asset at a predetermined price, known as the strike price. In contrast, a put option gives the buyer the right, yet not the obligation, to sell the asset at the strike price. These two types of options form the basis of options selling, and understanding their differences is critical to successful trading.

When an investor engages in selling options contracts, they are essentially selling these rights to a buyer. The seller collects an upfront fee, known as the option premium, from the buyer. This premium can be a lucrative source of income, hence the strategy of selling options for income.

In selling call options, the seller must sell the underlying asset if the buyer exercises the option. The goal of the seller is for the asset’s price to remain below the strike price, which would lead to the option expiring worthless, allowing the seller to retain the premium as profit. This means it’s a bearish strategy.

Conversely, in selling put options, the seller is obligated to buy the underlying asset if the buyer exercises the option. Here, the aim is for the asset’s price to stay above the strike price, enabling the option to expire worthless and the seller to keep the premium. This means it’s a bullish strategy.

Deciding when to sell options requires a keen understanding of market conditions, volatility, and the likelihood of success. It’s a strategic move that leverages time decay, as the value of options typically decreases over time. However, monitoring implied volatility is crucial, as it can significantly impact the premium and the trade’s profitability.

Comparing selling vs buying options, the former generates immediate income through the collection of the option premium. However, it’s important to consider the potential risks. If the market takes an unfavorable turn, the seller could face substantial losses. Hence, having an exit strategy or hedge in place is vital to mitigate risks.

Furthermore, selling vs buying options also differ in terms of mindset. Some say that, if you’re selling options, you’re acting as a sort of mini-insurance company: collecting upfront payments and hoping that the buyers don’t exercise their options and protecting them from big losses. On the other hand, buying options is akin to playing the lottery: lower probability but higher payout. Note that this is a bit of a forced comparison, as both strategies can be profitable if done correctly, but it pictures an interesting perspective.

Therefore, options selling is a trading strategy that allows investors to generate income by selling options contracts. By understanding how to sell options and the differences between call and put options, traders can make informed decisions, manage risks, and optimize their income potential.

Understanding the World of Put and Call Options

With this being said, let’s take a closer look at the mechanics of call and put options and how they can be utilized in options selling.

Put Options

A put option is a type of contract that gives the buyer the right (not the obligation) to sell a specific asset at a predetermined price, known as the strike price, within a specified timeframe.

As a seller of put options, you assume the responsibility of buying the underlying asset if the buyer exercises their right. You receive an upfront payment, the option premium, which forms your profit if the option expires worthless – that is, if the asset’s price remains above the strike price.

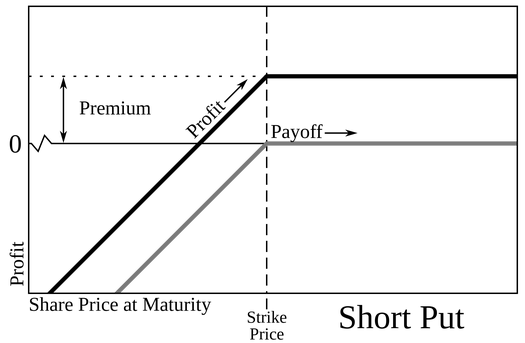

Consider the graph above about the P&L profit of shorting a put option. Here is what you should memorize from it if you imagine placing yourself on the maturity day of the instrument:

- Selling put options is a strategy often employed by those who believe the price of the underlying asset will not drop below the strike price. This method allows sellers to keep the premium as profit (i.e., the right part of the graph) when the option expires worthless.

- However, if the asset price falls below the strike price, the seller may have to buy the asset at a higher price than its current market value. From this moment on, the option seller will face a linear loss (i.e., the left part of the graph), corresponding to what would happen if someone held 100 shares per option.

Call Options

On the other side of the spectrum are call options. A call option is a financial contract granting the buyer the right (but not the obligation) to buy a specific asset at a predetermined price within a set timeframe.

If you sell a call option, you undertake the obligation to sell the asset if the buyer exercises their right.

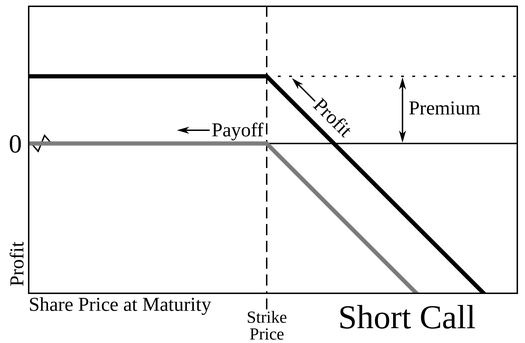

Once again, when shorting a call, here’s what you should retain from the P&L image above:

- Just like with put options, you receive an option premium upfront, which becomes your profit if the option expires worthless – meaning the asset’s price stays below the strike price, as shown on the left-hand side of the chart.

- In the opposite scenario, with the stock above the strike price at the option maturity, you will face the linear loss portrayed on the right-hand side of the chart. The loss will correspond to what you’d face by holding a short position on 100 stocks per each option contract.

Benefits of Option Selling

While theory clearly states that option selling is a strategy providing limited profit and unlimited loss potential, this observation does not adequately encompass the rationality behind these operations. Indeed, option selling carries with it a few key advantages, casting a new light on how to sell options effectively.

One of the primary benefits of selling options is the high probability of profit. The simple fact is that when you’re selling option premiums, you’re essentially acting as an insurance provider. Just as insurance companies often profit from the premiums they charge their customers, option sellers can also benefit from the premiums they collect from buyers. This is especially true when market conditions are favorable, such as during periods of high volatility when option premiums tend to be higher.

Moreover, option selling offers immense flexibility in terms of the assets on which it can be performed. Whether it’s stocks, commodities, or indices, you can sell options on virtually any asset class. This allows traders to diversify their portfolios and spread risk across various markets.

Another critical advantage of option selling is its adaptability to different market conditions. Whether the market is bullish, bearish, or neutral, there are alway option selling strategies that can work. For instance, in a bullish market, a trader might consider selling put options. Conversely, in a bearish market, selling call options could be a viable strategy.

The concept of selling vs buying options can appear daunting initially, but the benefits of option selling often outweigh the risks for seasoned traders. The key is knowing when to sell options. Understanding market trends, volatility, and the underlying asset can make a significant difference in the outcome.

An Easy-to-Grasp Example of Option Selling Strategy

Let’s delve into a practical example to illustrate the concept of options selling. Imagine that we predict a bearish phase for Amazon (AMZN) in the coming weeks. Currently, AMZN is trading at $130, and we believe it’s unlikely that its price will move above this level during the next 10-20 trading sessions.

This prediction is based on recent trends where AMZN has traded below its current price and recorded a lower maximum price compared to several weeks ago. In short, we anticipate a bear market phase.

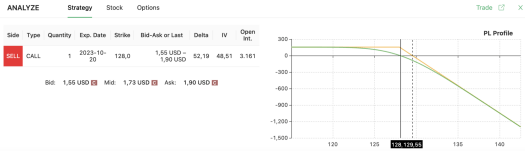

Using an option screener like Option Samurai, we identify the possibility of implementing a naked call strategy to capitalize on this anticipated downward movement in the stock price. Suppose we decide to sell a $128 call contract. In the world of options selling, this means we are selling the right for someone else to buy AMZN shares from us at $128, even if the market price is higher.

The goal here is for the option to expire worthless, which happens if AMZN stays below $128. If this occurs, we keep the option premium, turning a profit from the strategy and successfully selling options for income.

This strategy, while appearing likely to yield a positive return given the current market conditions, is not without risk. If AMZN’s price unexpectedly rises above $128, we would be obligated to sell at $128, potentially incurring a loss. Therefore, knowing when to sell an option and understanding the risks involved is crucial in options selling.

It may sound trivial, but, once you choose when to sell an option, remember to have a risk management plan in place, since an exit strategy is just as important as the entry. Furthermore, you may want to consider more advanced strategies that involve option selling, depending on your risk appetite (e.g. selling call spreads).

The aim of this example is merely to show how to sell options and the potential for generating income through selling option premium. In this context, we care about emphasizing the importance of careful market analysis and risk assessment in options selling.

An option screener is an invaluable tool in this case, but your analysis and ideas (for instance, expecting a bearish phase for AMZN) must be the foundation for your decision-making process.

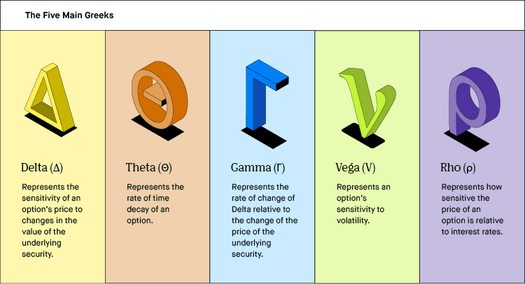

What Are Option Greeks?

In options selling, understanding the Option Greeks is crucial as these mathematical metrics influence the pricing and value of options contracts. The primary Greeks – which are the derivatives of the Black-Scholes model – include Delta, Gamma, Theta, Vega, and Rho. Each plays a specific role in how to sell options and can significantly impact selling options for income.

Delta

Delta measures the rate of price change in an option’s value relative to the rate of price changes in the underlying stock. It is one of the critical factors that option sellers need to consider. A delta is also used as an estimation of the probability of the option to be in the money at expiration. So a delta of 1.0 signifies a 100% probability that the option will be at least 1 cent in the money by expiration, while a delta of 0.50 indicates a 50% chance of the same.

For option sellers, delta is used as an inverse of the likelihood of success. This means that if you sell an option with a delta of 60%, the market thinks the probability of expiring ITM is 60%, and the probability of expiring worthless is 40%. If the trader thinks that the probability of profit is higher than 40% (because of technical analysis, fundamental analysis, or any other reasons), the trader will have an edge in selling that option.

By assessing delta, sellers can better manage their risk when selling options contracts. Understanding delta can assist in deciding when to sell an option, thereby maximizing potential profits from selling option premiums.

Gamma

Gamma measures the rate of change in an option’s delta compared to the rate of change in the underlying stock’s price. In other words, Gamma gauges how quickly delta changes with price movements in the stock.

Option sellers need to be aware of Gamma as it affects the stability of their position. Sellers with short Gamma positions may experience larger losses if the stock price moves against their position. Therefore, managing Gamma exposure and adjusting positions accordingly is essential in options selling.

Theta

Theta represents time decay, measuring the rate of decline in an option’s value due to the passage of time. This Greek is particularly important for option sellers as they benefit from Theta. Since they receive the premium upfront, sellers want the option to expire worthless. As time passes, the option’s premium decreases, allowing sellers to close out positions with an offsetting trade at a lower premium.

Theta is a positive factor for trades in options selling. Sellers earn more money as time decay accelerates, making it a crucial element in selling options for income.

Vega

Vega measures the sensitivity of an option’s price to changes in implied volatility. Implied volatility forecasts the potential movement in a stock’s price. Changes in implied volatility determine the premium sellers will receive for selling options.

Higher implied volatility leads to higher premiums, while lower implied volatility results in lower premiums. Therefore, option sellers can benefit from selling options when implied volatility is high and expected to revert to the mean. Vega plays a significant role in determining the potential profitability of options selling strategies.

Rho

Rho is the measure of an option’s sensitivity to changes in interest rates. While often overlooked, it can influence the premium of long-term options contracts. An increase in interest rates will positively impact the value of call options and negatively affect put options. Understanding Rho can help option sellers in making informed decisions about when to sell options, especially in a changing interest rate environment.

At this point in our article, it should be clear to you that understanding Option Greeks is integral to successful options selling. They provide valuable insights into market movements and the behavior of individual options, aiding in decision-making processes.

Whether you’re deciding between selling vs buying options or determining when to sell options, being well-versed in Option Greeks can enhance your trading strategy and potentially increase your income from selling option premiums.

The Main Differences Between Option Selling and Option Buying

Options trading is a versatile investment strategy that offers two primary perspectives: options selling and buying. An understanding of both is crucial for traders to make informed decisions.

From the perspective of options selling, traders aim to generate income by selling options contracts and receiving the option premium upfront. Sellers hope that the option will expire worthless, allowing them to retain the entire premium without any obligation to buy or sell the underlying security. They benefit from time decay as the value of the option decreases over time, making it possible to close their position at a lower premium.

Option sellers prefer a stable stock price or one that moves in their favor. However, they must be keenly aware of volatility risks and rewards since changes in implied volatility can significantly affect the premium of the option. Sellers use delta to assess the probability of success, with higher probabilities when selling options that are further out of the money.

On the other hand, option buyers pay for both intrinsic and extrinsic (time) value and aim to profit from the stock’s movement in their favor. They need the stock to move significantly to cover the extrinsic value and earn a profit.

Unlike option sellers, buyers are exposed to time decay, which decreases the option’s value over time and can lead to losses if the stock price remains static or moves slowly in the correct direction. Buyers benefit from high implied volatility as it inflates the option’s premium. They use delta to determine how much the option’s value will increase if the stock price moves in their favor.

In summary, the main differences between these two strategies lie in the approach to risk and reward. Options selling focuses on generating income and benefiting from time decay, while options buying aims to capitalize on significant stock movements despite the risk of time decay. Both strategies require careful consideration of market conditions, especially implied volatility and delta, to maximize potential profits.

Selling vs Buying Options: A Comparative Analysis

In the world of options trading, two primary strategies exist: options selling and buying. Each of these approaches presents its unique benefits and risks, and understanding them is crucial for successful trading.

From the perspective of options selling, traders aim to generate steady income by selling options contracts. The seller, or writer, receives the option premium upfront. This strategy relies on the option expiring worthless, allowing the seller to retain the entire premium without any obligation to buy or sell the underlying security.

However, sellers are exposed to potentially unlimited losses if the market moves significantly against their position. Despite this, selling options for income can be a profitable strategy if managed correctly.

On the other hand, buying options offers traders the advantage of limited risk and unlimited potential gain. The maximum loss for the buyer is the premium paid to enter the contract. However, the potential profit is theoretically unlimited, especially in the case of buying call options, as the price of the underlying asset can rise indefinitely. This contrasts with selling options, where the profit is capped at the premium received.

To summarize, let us give you a synthetic table on the key differences between selling and buying options:

| Aspect | Option Selling | Option Buying |

| Risk | Potentially unlimited losses | Limited to premium paid |

| Reward | Limited to premium received | Potentially unlimited reward |

| Objective | Generate steady income | Profit from market movements |

| Time decay | Benefits from time decay | May suffer from time decay |

| Probability | Good success probability | Lower success probability |

| Market outlook | Bullish, bearish, and neutral | Only bullish or bearish |

To sum up, options trading, encompassing buying and selling strategies, offers diverse prospects for investors. While selling options provides steady income and benefits from time decay, buying options allows for unlimited gain with limited risk. Both, however, necessitate an understanding of Option Greeks and market conditions for success. Neither approach is inherently superior, and you must carefully evaluate your risk appetite and market outlook before choosing a strategy.