You may have heard that some brokers allow you to trade options even in the after-hours session. While this is a possibility, there are several aspects you should consider before trying this approach. Today’s article dissects the nuances of option trading after hours, answering critical questions like ‘Can you trade options after hours?’ and ‘Can I sell options after hours?’ to guide your after-market trading operations.

Key takeaways

- Selling options after hours is a viable strategy that investors can implement. These transactions predominantly occur between 4 PM and 8 PM ET. Various brokers such as ETRADE, TD Ameritrade, and Charles Schwab facilitate this process, offering a myriad of options contracts.

- There are several advantages to after-hours trading. These include the potential for price gaps, less competition from large institutional traders, and the opportunity to trade competitors based on late-day news that may impact the entire sector.

- Despite the advantages, there are also cons to consider when trading after-hours. They include lower liquidity compared to regular market hours, wider bid-ask spreads, increased price volatility, limited stock availability, potential for extra fees, and fragmented markets due to trading across multiple electronic communication networks.

What is After Hours Options Trading?

After-hours options trading is a method of buying and selling options beyond regular market hours, providing an avenue for investors who are unable to trade during the standard market timeframe. This unique approach to option trading after hours introduces a new dimension of convenience and flexibility in the world of investments.

This form of trading differentiates from regular market hours as it occurs during a specified time window when the stock exchanges, such as the NYSE and Nasdaq, are closed. The extended trading hours typically last between 4 PM and 8 PM ET, a period when investors can submit orders for selling options after hours. These orders are processed by the stock market’s electronic communication network (ECN), which matches buyers and sellers to execute trades. Consider that, in case trades are not executed by 8 PM ET, they will be automatically closed by the system.

However, there are certain considerations to note. As trading volumes are generally lower after hours, executing trades, particularly for less popular assets, may prove challenging. Wider bid-ask spreads could lead to higher costs for those wondering, ‘Can I sell options after hours?’, and price volatility may increase due to fewer market participants.

In essence, after-hours options trading allows for ‘can you trade options after hours?’ to be answered affirmatively, but understanding the associated risks and limitations is crucial for successful participation.

How After Hours Trading Works

Selling options after hours is a strategy used by seasoned traders in the options market. This form of option trading after hours occurs when regular market operations cease, typically between 4 p.m. and 8 p.m. ET.

More specifically, you can refer to the info below for the US market trading day:

| Trading Session | Trading Time (US Eastern Time) |

| Pre-Market | 4 AM – 8 AM |

| Regular Pre-Market | 8 AM – 9:30 AM |

| Regular Session | 9:30 AM – 4 PM |

| Late Close Exception | 4 PM – 4:15 PM |

| After Hours Session | 4 PM – 8 PM |

If you’re wondering about the late close exception mentioned in the table, consider that popular ETFs such as QQQ, SPY, IWM, and more belong to this small category.

Traders who ask, ‘Can I sell options after hours?’ can do so using electronic communication networks (ECNs), which facilitate these trades by matching buyers and sellers. However, it’s worth noting that market makers are less active during this period, potentially affecting liquidity and bid-ask spreads. So, while you can trade options after hours, understanding the mechanics and risks is crucial for successful execution.

Options Trading Hours

Options trading hours typically align with standard stock market operating times, from 9:30 a.m. to 4:00 p.m. ET. However, engaging in options trading after hours, specifically between 4:00 p.m. and 8:00 p.m. ET, can be a strategic move.

It’s crucial to recognize that after-hours trading significantly impacts options prices and strategies. Unlike the robust liquidity and narrower bid-ask spreads during standard trading hours, after-hours present a different scenario. The bid-ask spreads widen, and the available options within those spreads decrease, making it less likely for orders placed between them to be executed.

In essence, while trading options after hours is possible, it introduces a shift in dynamics, with hard-to-predict moments of price volatility due to large bid-ask spreads.

Who Can Trade Options After Hours?

Selling options after hours is not an exclusive trading strategy; it’s accessible to anyone with an online brokerage account that supports this feature.

While there are no strict eligibility criteria, such as a minimum account balance or specific experience level, there can be certain restrictions or limitations for individual traders. These might include confined trading hours, decreased liquidity, and potentially elevated fees.

Thus, those considering option trading after hours should consult their broker to understand any specific requirements. So, while the answer to ‘Can I sell options after hours?’ is generally yes, understanding the potential constraints is crucial for success.

A Look at Brokers Offering After Hours Options Trading

Several brokerages cater to investors interested in selling options after hours. TD Ameritrade and Charles Schwab are examples of such platforms. They provide robust trading platforms and a broad array of options contracts.

ETRADE and TD Ameritrade are known for its user-friendly interfaces, while Charles Schwab is renowned for its comprehensive offerings. Although these brokers offer option trading after hours, it’s crucial to understand that specific requirements or fees may apply. In any case, the choice of the right broker is entirely up to the trader, as this article has the mere scope of providing information on after-hours options trading.

Pros of After Hours Options Trading

- Potential for Price Gaps: Significant events or news that happen overnight can create quite a stir in the market. This often leads to price gaps between the market’s close and the next opening. For a savvy trader, this presents a golden opportunity to potentially make some neat profits.

- Fewer Big Fishes in the Sea: During after-hours trading, those big institutional traders and market makers are often less active than usual. This means less competition for you and possibly more opportunities to catch those profitable trades despite the challenges of lower liquidity and wider bid-ask spreads.

- Chance to Trade Competitors: Imagine there’s positive end-of-day news about Visa (V), with a strong increase in V price during the after-hours session. As you may expect the news to benefit the whole credit card payments sector, you may choose to open bullish trades on MasterCard (MA) or American Express (AMEX) in the after-hours session. Assuming everyone is busy looking at Visa, both MA and AMEX could give you the chance to benefit from an upward price movement once the market aligns with the news about V.

Cons of After Hours Options Trading

- Less Liquidity: One of the downsides of after-hours trading is that there’s generally lower liquidity compared to regular market hours. This means it might be a bit more challenging to execute trades, especially if you’re dealing with less popular assets.

- Wider Bid-Ask Spreads: With less liquidity comes wider bid-ask spreads. This results in higher costs when buying and selling options, which could nibble away at your potential profits.

- Increased Price Volatility: After-hours sessions can be a wild ride with fewer market participants and lower trading volume. This can result in more volatile price movements.

- Limited Stock Availability: Sometimes, not all stocks are up for grabs during after-hours trading, depending on the broker. So, you might not always be able to trade the options you want.

- Possible Extra Fees: Keep an eye out for this one. Some brokers might charge additional fees for after-hours trading.

- Fragmented Markets: After-hours trading happens across multiple electronic communication networks (ECNs), which can lead to fragmented markets and inconsistent price information. This could make it a bit tricky to navigate your trades.

An Example of Selling Options After Hours

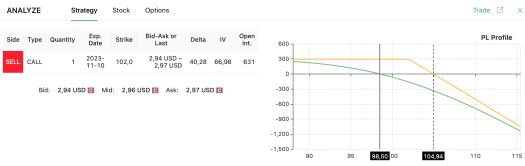

Consider the case of AMD on October 31, 2023, and assume you believe the company will release a weak earnings report after market close. In this case, we’ll also take for granted the fact that you analyzed the pros and cons of selling an option vs exercising it and chose that selling was the best alternative. The stock price declines in the after-hours session, presenting an opportunity for selling options after hours.

Whether you already hold AMD options or choose to initiate a short position, the after-hours market can be advantageous. Let’s say you decide to short a $102 call option while AMD’s price is at $91.51.

Using an option screener like Option Samurai, you learn that for this Naked Call strategy to succeed, AMD’s price must close below $104.94 by November 10, 2023.

Given the negative after-hours reaction to AMD’s earnings, you believe this is a high-probability trade and proceed with option trading after hours. Furthermore, if you are close to the maturity date, you’ll probably want to know more about selling options on expiration day, as we wrote about the topic in the past.

With this example in mind, it’s clear that option trading after hours can yield significant profits, but it’s essential to understand the risks and limitations to make informed decisions. Sometimes, the after-hours market reaction may change significantly by the time markets open, creating scenarios that differ from initial expectations.

In conclusion, selling options after hours is a practice that, while offering potential profits, requires an understanding of specific constraints and risks. Brokerages like ETRADE, TD Ameritrade, and Charles Schwab offer after-hours options trading, but traders must be aware of any specific requirements or fees.

The benefits, such as the potential for price gaps, less competition, and the chance to trade competitors, should be weighed against the potential downsides like reduced liquidity, wider bid-ask spreads, increased price volatility, limited stock availability, extra fees, and fragmented markets.

The example provided illustrates how after-hours trading can be profitable when done correctly, utilizing tools like an options screener. However, as the market reaction may change significantly by the time markets open, traders should remain adaptable and informed.

Hello, just wondering if you know about etrade after hours trading, I tried to place an order to close my options ( sell to close) before hours ( @6am pct) but they dont have the option for that online. Do you know if etrade have after hour or before hour trading for options( not futures) ? thank you.

I don’t trade with Etrade, but It looks like they are offering only regular pre-trading: https://us.etrade.com/l/f/agreement-library/extended-hours-agreement

But you might need to sign additional documents.

I would contact their support to see what they say.

Thank you!

I use think or swim It only allows day orders for options is there a way around this? Your article says Schwab but they do not its only day orders for options they have after hours for most stocks and ETF’s but not options?

Thanks for the comment, I personally do not use Schwab, but it seems every broker has its own rules. For instance, I noticed that users have been saying that after-hours options trading seems to work only on those options using index ETFs as underlying: https://www.reddit.com/r/Schwab/comments/1df7t0m/can_you_close_an_option_after_hours/

I’d personally refer to their support and ask the direct question