Happy December, everyone! We are already at the end of the year, and it is time to announce our Q4 version. We are continuing to develop our software based on your feedback, and we have even more things coming next year to improve the watchlists and a custom strategy scanner (more details on that will come in the future).

In this version, we’ve added more information for the scanner to help you quickly find what you are looking for. The data covers both stocks and options, and we also improved our scanner to allow you to control Iron Condores and other neutral strategies better.

This version we’ve added:

- Added more fundamental data (debt, sales growth, etc.)

- Intraday Change to options prices

- Better control of Iron Condors and range strategies

- Bug fixes and improvements

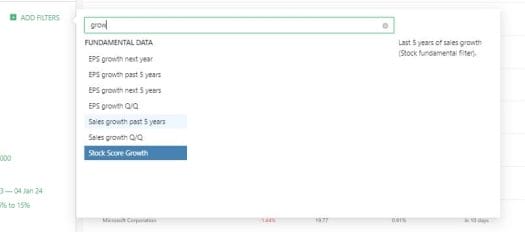

More fundamental data

We’ve added more fundamental data to our scanner. This data will allow you to define your stock list better and find better trades according to different market conditions. For example, when investors fear debt, you can scan for high/low debt; when they look at sales growth, you can use that instead of profits.

The information added:

- Sales growth in the past 5 years

- Sales growth Q/Q

- EPS growth Q/Q

- debt to equity

- LT debt to equity

Intraday Change to option prices

We’ve added an option intraday change data-point to the scanner. This is very useful for short-term trading. You can use this to scan for abnormalities in options prices or mismatches between stock price and option price – for example, Stock that moves up but call options that still haven’t moved.

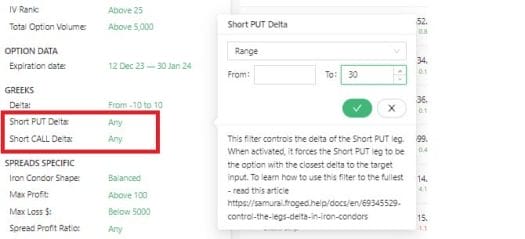

Better control of Iron Condor and range strategies

Many traders asked for better control for Iron Condors and straddles, and we’ve listened and improved our delta filters to allow for better control of the legs.

Now, the filters allow you to control the legs according to delta with range or closest to function.

For example, if you want to find Iron Condors with 1:2 risk and a delta of the sold legs of less than 30 – you can adjust the filters to find those trades across the entire market in seconds.

This is a very powerful tool to control range strategies that will allow you to define better what you are looking for.

Bug fixes and improvements

We’ve continued to improve the platform and squash bugs. Some of the work deployed in this version contains better calculations, improvements to our earnings logic, better calculations of dividends and interest rates, UI improvements, and more.

—

One more thing

We are currently running our Christmas promotion. So, if you want to get a good deal on our annual plans and sharpen your trading in 2024, go to our pricing page and pick the right plan for you.

It was great seeing how much work you put into it. The picture is nice, and your writing style is stylish, but you seem to be worrying that you should be presenting the next article. I’ll almost certainly be back to read more of your work if you take care of this hike.