Dive into the intriguing world of selling option premium for a living. This comprehensive guide will explore how selling premium options can yield consistent income, demystify what the premium on selling options means, and shed light on strategies to make this lucrative practice your full-time profession.

Key takeaways

- Selling option premium for a living is a profitable opportunity, but it has its own challenges and uncertainties, as you must grasp the fundamentals of options trading and what affects the premium.

- Embracing the lifestyle of an options trader requires discipline, resilience, and an appetite for risk. The daily routine is characterized by monitoring market trends, making calculated decisions, and handling the pressures of fluctuating market conditions.

- The ‘premium’ in selling options is an essential concept, affected by factors such as implied volatility, time decay, and strike price. An example in a bullish market scenario is the naked put trade, showcasing how these factors come into play.

Lifestyle of an Options Trader: Selling Option Premium for a Living

Embracing the lifestyle of an options trader, specifically centered on selling option premium for a living, constitutes a unique fusion of strategic acumen and carefully measured risk-taking. Each day in this dynamic journey involves meticulous market analysis, the art of selecting the right premium options to sell, and adept portfolio risk management. It’s more than a mere numbers game; it’s about making well-informed decisions to optimize profits.y

The attraction of this path is strong, offering the potential for a stable income, great flexibility, and the excitement of participating in financial markets. However, within these appealing opportunities, one must face significant challenges, including the unpredictable nature of market volatility, the ongoing need for learning and adaptability, and the constant consideration of the “What is the premium for selling options?” question.

It may sound counterintuitive, but selling an option may, in certain cases, be less risky than buying one. Think of it this way: when selling an option, you’re acting as a sort of insurance company, collecting premiums in exchange for assuming the risk of potential market fluctuations.

You’re also putting time decay on your side, as the premiums buyers pay you continuously lose value as time progresses. However, it’s crucial to never underestimate market risks and to always approach trading with caution: a wrong investment will bring losses regardless of how much you know about the game.

Common Mistakes Options Trader Make

Selling option premium for a living is an appealing strategy for many traders due to its potential for consistent income. However, there are common pitfalls that can hinder success.

One frequent mistake is not understanding what the premium on selling options truly represents. The premium isn’t just a fee; it’s tied to the inherent risk in the option. Misjudging this risk can lead to selling premium options at unfavorable prices, which can eat into your profits or even result in losses. To avoid this error, it’s crucial to trade only when your strategy convinces you that the market’s perceived risk exceeds the actual risk. For instance, this could be the case when you are comfortable holding the asset for the long term or you anticipate a turnaround in the company’s performance.

Another error is the lack of diversification. Some traders focus solely on selling option premium, neglecting other trading strategies. This can leave them exposed if market conditions change unfavorably. To mitigate this risk, you can employ tools such as Option Samurai to identify trades across various sectors, expirations, and strategies, thus enhancing your diversification.

Lastly, many traders underestimate the importance of patience and discipline. Selling option premium for a living requires waiting for the right opportunities, and acting impulsively can result in poor trades. To address this, it is advisable to have well-defined option selling strategies and to only engage in trading when you believe the odds are in your favor. For instance, you might consider trading when there is a high IV rank, markets are overbought or oversold, and avoiding trading around earnings reports, among other criteria.

Furthermore, you may want to keep a daily checklist to methodically assess your positions. In moments when you’re experiencing losses, it can be helpful to ask yourself questions like “Am I still aligned with the prevailing market conditions?” or “Do the original reasons for my investment still hold true?” This practice helps you maintain rationality and discipline, something that many traders often neglect due to emotional reactions when facing losses.

In addition, it’s vital to emphasize the importance of consistency and ongoing performance measurement. Emotions can easily cloud judgment, so maintaining an options trading journal and regularly evaluating your performance is crucial for improvement.

Selling Option Premium: An Overview

Selling option premium for a living is a strategy used by traders to generate consistent income. But what is the premium on selling options? In simple terms, an option premium is the price paid by the buyer to the seller for the option contract. This price gives the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a set timeframe.

When you’re selling option premium, you’re essentially playing the role of an insurance provider. You sell options to buyers who are seeking to hedge their investments against potential market fluctuations. These buyers pay you a premium, which you get to keep regardless of whether the option is exercised or not.

The basic mechanics work like this: you sell an option contract to a buyer, who pays you the premium. If the market moves in the buyer’s favor, they may choose to exercise the option. If not, the option expires worthless, and you keep the entire premium. It’s a balancing act of risk and reward, requiring market savvy and strategic foresight. That’s the essence of selling option premium as a part of options trading.

What Is the Premium on Selling Options?

When selling option premium for a living, understanding the factors affecting the premium is crucial. The premium on selling options is not fixed; it’s influenced by various factors such as implied volatility, time decay, and the strike price.

Implied volatility reflects the market’s prediction of the stock’s potential movement. Higher volatility usually means higher premiums. Time decay relates to the diminishing value of an option as it approaches its expiration date. Lastly, the strike price, or the price at which the underlying asset can be bought or sold, also plays a significant role.

Understanding these factors helps traders make informed decisions, enhancing their strategy and potentially increasing their profitability in trading premium options.

Understanding the Premium on Selling Options

In the realm of options trading, the term ‘premium’ refers to the price paid by an option buyer to the option seller. This price essentially represents the cost for the rights that the option contract provides. When you’re selling option premium for a living, you’re essentially generating income from the premiums buyers pay you to secure potential obligations.

Let’s delve into an example of a naked put trade in a bullish market scenario. A naked put trade is a strategy where you sell a put option without owning the underlying asset. In essence, you’re betting on the stock price to rise or remain steady. Option Samurai, as an option screener, can be a helpful tool in this context.

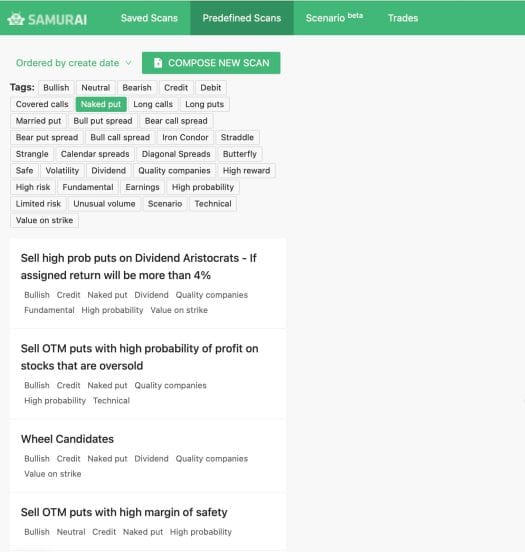

For instance, you could navigate to the “Predefined Scans” section and select the “Naked put” button. The platform will then present potential groups of trades, such as selling high-probability puts on the “Dividend Aristocrats,” or companies with a history of increasing dividends. The idea behind this strategy is that you sell insurance on companies that are relatively stable and should be worth more over time as the dividend yield increases.

Alternatively, you might opt to sell out-of-the-money (OTM) puts on stocks that are clearly oversold. Each subcategory will display different potential trades on the US option market, providing a comprehensive view of your alternatives when selling premium options.

Related

Selling Call Options In-The-Money: A Practical Guide for Intermediate Traders

Profiting from options trading in all market conditions can be a challenge. But in bearish conditions, selling in the money call options can be a consistent way to both generate income and insulate against volatility. Selling call options in the money is an intermediate strategy, but one that can be…

In "Tutorials"

Harnessing the Potential of Options Selling: Tips and Strategies

Among the many strategies in the stock trading universe, options selling reigns supreme. This article demystifies how to sell options, when to sell an option, and contrasts selling vs buying options. Unearth the potential of selling options for income, selling option premiums, and the intricacies of selling options contracts. Embrace…

In "Selling premium"

Selling Call Spreads: A Comprehensive Dive into Bear Call Spreads

Among various options strategies, selling call spreads, particularly bear call spreads, stands out. This article provides a deep dive into credit call spreads or short call spreads, illustrating a bear call spread example. Discover how to sell a call spread effectively, mitigating risks while generating income. Key takeaways Selling call…

In "Selling premium"

Thanks for this post, I’m still learning the world of Options Trading, I have a journal for 2023, and so far I’m up $2350, mainly trading covered calls and some Puts. Your site is very helpful to my journey, thank you!

Thanks Jim! Good luck.