Among various options strategies, selling call spreads, particularly bear call spreads, stands out. This article provides a deep dive into credit call spreads or short call spreads, illustrating a bear call spread example. Discover how to sell a call spread effectively, mitigating risks while generating income.

Key takeaways

- Selling call spreads is a popular bearish options strategy among traders as it offers flexibility and lower margin requirements compared to other strategies.

- Selling a call spread is an options trading strategy that involves trading two call options on the same asset but with different strike prices.

- The downside of the strategy ais limited profit potential and early assignment risk so you the need to time the entry and monitor the trade..

Understanding the Bear Call Strategy

Selling call spreads (or credit call spreads) is a popular options strategy if you have a bearish outlook on the market. This strategy is not only easy to understand, but it’s also simple to execute. It has the added advantage of requiring less margin to execute, translating into limited risk for the trader.

The bear call spread strategy involves selling a call option and concurrently purchasing another call option with a higher strike price. The primary objective of this strategy is to generate premium income based on the trader’s bearish view of a stock, index, or other financial instruments. The premium collected from selling the call option is typically greater than the cost of buying the second call option, resulting in a net credit to the trader’s account.

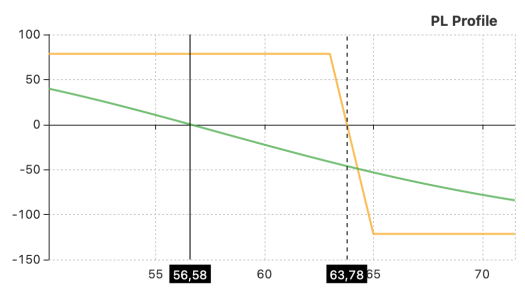

To give you a better idea, here is what the typical PL profile of a bear call spread looks like:

The appeal of the bear call spread strategy lies in its ability to generate income with a lower degree of risk compared to selling naked calls. This strategy takes advantage of time decay, as the value of options decreases over time, all else being equal. Furthermore, the bear call spread can be adjusted according to one’s risk profile, making it an adaptable strategy for different market conditions.

However, like any trading strategy, selling call spreads does come with its set of challenges. The potential gains are capped at the net premium received, meaning traders can’t benefit from a significant drop in the underlying asset’s price. There’s also the risk of assignment on the short call leg before expiration, especially if the stock price increases rapidly. For this reason, the bear call spread works best for stocks or indices with elevated volatility and modest downward movement.

At this point, we can easily understand that the bear call spread is a versatile strategy that allows traders to sell call spreads effectively, generating premium income while limiting risk. Its simplicity and low margin requirement make it a suitable choice for both novice and seasoned options traders. When used wisely, it can be a valuable tool in any trader’s arsenal.

Real-World Bear Call Spread Example

At this point, after a theoretical introduction, a real-world bear call spread example may help solidify the concept.

Consider Goldman Sachs (GS), a prime candidate for such a strategy. Recently, GS stock price has been hovering around $300. Observing the market trends and patterns, we speculate that, although the price might attempt to rebound from this point, it’s unlikely to breach the $315 mark in the near future (in fact, there appears to be a clear upward resistance around that area).

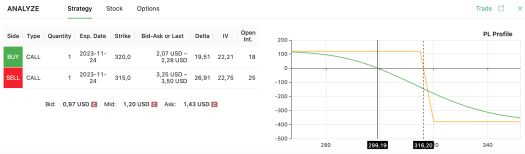

Following this prediction, we may decide to employ a bear call spread strategy, which is also known as a credit call spread or short call spread. We proceed to purchase a $320 call option and simultaneously sell a $315 call option. This move aligns perfectly with the trading opportunity identified by our options screener tool:

If we want to follow this approach, the tool indicates that, to secure a profit, GS would need to close below $316.20 by the expiry date of the options.

In essence, this approach to selling call spreads allows us to capitalize on our bearish outlook for GS. You may argue that it appears rather likely that GS would close below $316.20 in one month if its current price is at $300, but that’s something that would require further analysis. Our goal here is simply to show how we can use a bear call spread to position ourselves for profit if GS declines (or, at least, does not significantly rise).

There are three scenarios to consider in this case:

- Scenario 1: GS closes above $316.20 by options expiry. In this case, the trade would be unprofitable as we could only secure a small profit with the $315 call option’s sale, leading to an overall maximum loss of $380.

- Scenario 2: GS closes below $316.20 by options expiry. In this case, we would make a profit equal to the net premium received. In this specific example, your maximum profit would be $120, as you can see in Option Samurai’s strategy tab.

The takeaways from this illustration? Bear call spreads are relatively simple to set up, but they carry limited profit potential and come with a degree of risk. Keep in mind that, unlike other riskier selling option strategies, such as naked calls, bear call spreads carry a limited risk because the net credit generated provides some protection against losses.

Why and When to Use the Selling Call Spread Strategy

Selling call spreads can be a preferred choice in specific scenarios. Understanding when and why to utilize this strategy can make the difference between its successful execution and missed opportunities. Here are some pivotal situations and reasons:

- The Expectation of a Modest Downside: If you anticipate a slight decrease or stagnation in the price of an underlying asset but are unsure about a significant drop, a bear call spread can be ideal. It allows traders to benefit from small movements without taking on the full risk of other bearish plays.

- Profit from High Implied Volatility: Markets with elevated implied volatilities tend to have overpriced options. This environment provides an excellent opportunity for option selling. Selling call spreads in such a scenario can capitalize on overpriced premiums, which may decline if volatility drops post-position establishment.

- Limited Risk: Risk management is pivotal in trading. Selling call spreads inherently have a defined risk profile. This strategy ensures that even if the market makes an unexpectedly bullish move, your losses are capped to a pre-determined amount.

- Capital Efficiency: Selling call spread provides an avenue to potentially generate profits using less margin, this allows the strategy to be used by smaller accounts or allocate more capital to other trades..

- Hedging the Risk: Another essential aspect to consider is that this strategy lets you add a relatively cheap hedge to your portfolio. In other words, if you end up being wrong about your initial trading intuition, the loss will not be too high.

- High Profit Probability: Selling call spreads typically involve out-of-the-money (OTM) options. This means that to profit from this strategy, the underlying asset generally needs to either decrease in price or remain relatively stagnant. In other words, you can make money if the asset goes down or stays the same. Your losses are limited to a predefined amount if the asset moves in an unexpectedly bullish direction.

In essence, the strategy isn’t merely bearish: it’s bearish with a built-in safety net. By understanding when to implement this strategy, traders can optimize its potential, making it a powerful tool in their trading and risk management arsenal.

Advantages and Risks of Selling Call Spreads

Selling call spreads, a strategy that includes bear call spread and credit call spread, is a double-edged sword. It has its distinct advantages but also comes with potential risks. When deployed astutely, it can be a formidable addition to any trader’s toolkit. Let’s break down its merits and drawbacks.

First of all, there are a few advantages to consider:

- Defined Risk: A key attribute of selling call spreads is its predefined risk limit. Traders can calculate their maximum risk at the outset — the difference between the strike prices minus the net premium received. This feature is particularly evident in a short call spread.

- Premium Income: Regardless of the market’s direction, initiating this strategy results in receiving a net premium. This upfront income can serve as a buffer against minor unfavorable market fluctuations.

- Higher Probability of Profit: Selling call spreads provides traders with a distinct advantage in terms of profitability. The strategy’s design, involving the sale of out-of-the-money (OTM) options, offers a higher likelihood of success. This is because, in order to realize a profit, the underlying asset doesn’t need to make a significant move in your favor. Instead, you can profit as long as the asset’s price remains below the higher strike price or even if it stays relatively stable.

- Time Decay Benefit: As options near expiration, they naturally depreciate – a concept known as theta or time decay. In a bear call spread, time decay is advantageous for the trader. If the underlying asset remains below the lower strike price, the options expire worthless, enabling the trader to keep the entire premium.

- Flexibility: Selling call spreads offers flexibility, allowing traders to customize according to their risk tolerance. They can choose different strike prices and expiration dates to align with their market outlook and comfort level.

- Lower Margin Requirements: Compared to other strategies, particularly naked options selling, call spreads typically require less margin, thereby freeing up capital for other investments.

However, selling call spreads is not without risks:

- Limited Profit Potential for Credit Call Spread: The maximum profit is capped at the net premium received. Even if the market strongly favors the trader’s position, they cannot earn more than this initial credit.

- Early Assignment Risk: Particularly in American-style options, there’s a risk of early assignment. If the short option is deep in the money, the trader may be forced to sell the underlying asset before expiration.

- Monitoring: This strategy isn’t “set and forget.” Market movements, especially those nearing the strike price of the short call, require careful monitoring and potential adjustments. Just like we saw for selling call options in-the-money, you will need to keep an eye on the market.

- Commission Costs: Participating in multiple options contracts could lead to higher commission fees, which can diminish the net profit.

Therefore, while a bear call spread example reveals attractive benefits, especially for those with a moderately bearish outlook, it’s crucial to comprehend and respect its inherent risks. Proper risk management and comprehensive market analysis can empower traders to fully leverage their potential while mitigating pitfalls.

Calculations for Outcomes and Strategy Planning

Selling call spreads, if wielded correctly, can open avenues for consistent returns. To use it correctly – you need to understand the terminology. Here’s a deep dive into the three foundational calculations:

- Maximum Profit: The upfront net premium you pocket when you set the strategy in motion. This is the most you stand to gain.

- Maximum Loss: Determined as the gap between the two strike prices minus the net premium you’ve collected. This figure marks the upper limit of what you could lose.

- Break-even Point: This is derived by augmenting the net premium to the strike price of the short call.

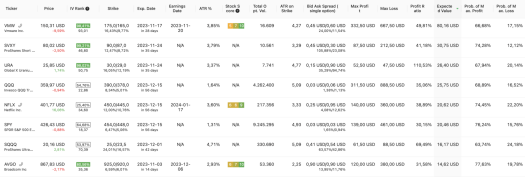

All the details mentioned above are among the columns available in our option screener, as highlighted in the image below.

These metrics aren’t mere statistical data. They’re the compass by which traders navigate. From initial decision-making to ongoing strategy assessment, they ensure that you’re always in the loop, steering the ship with precision.

Now, diving a bit deeper, consider these advanced data points:

- Expected Value: This represents the average amount one can expect to win or lose per trade if the same trade is replicated multiple times. It factors in both profit magnitude and the likelihood of occurrence. By default, our app sorts the trading opportunities by decreasing expected value, but that’s something you can edit by clicking on each column.

- Probability of Maximum Profit: A metric that quantifies the odds of making the maximum profit on this type of trade. It’s an essential gauge of risk and opportunity, informing traders about the likelihood of their strategy bearing fruit.

- Profit Ratio: Essentially, this ratio contrasts the potential profit against the potential loss for a given trade. A higher ratio signifies a favorable risk-to-reward profile, but it’s crucial to consider the probability of profit.

To better understand these intricate details, hovering over filters on the side panel offers concise explanations. For a more expansive understanding, diving into the associated help articles can help you solve doubts such as “what is a short call spread?” or “how is the profit ratio measured?” and so on.

After this theoretical and practical exploration, it’s evident that selling call spreads can be a valuable tool for traders. Most of all, surprisingly for many, this is not an extremely hard concept to grasp. Even better, a trader approaching this market for the first time may choose to use call spreads as their first trade. The bear spread call example we observed clearly highlighted this aspect. Obviously, the risk of losing money is everywhere in the financial market, even when you sell a call spread, but beggining your option journey with a loss-capped product may be the way to go.

Call spreads are a good way to make some money but losses can also be there. No option strategy is fool proof and this means that, even this strategy can incur losses.

The fact that I came across this post by accident led me to believe that it was an excellent one.

Thanks!