A well-thought put options strategy is a must-have in your trading kit. Let’s see how selling put options and implementing precise put strategies can lead to maximum gains on a long put. This article will guide you on how to make money with puts, doing it right and at the right time.

Key takeaways

- Put options strategies are versatile and can be used for bullish and bearish outlooks. The most common include the long put, naked put, protective put, and bear put spread.

- While the long put, protective put, and bear put spread have a capped loss potential, the naked put strategy carries unlimited risk.

- In terms of profit potential, the bear put spread and naked put strategies have a limited profit potential, while the protective put strategy allows for unlimited profits.

How to Make Money with Puts

In simple terms, a put options strategy allows an investor to sell a specific stock or asset at a predetermined price before a set expiration date. This is like having an insurance policy to reduce your losses in case things go south.

To explain the core reason for using a put options strategy, you may think of buying a put as having a plan B during an outdoor trip. You might not anticipate bad weather, but it’s wise to have backup plans. Similarly, buying put options provides a cushion for your money against an unexpected market decline.

Of course, every strategy has its risks. If the stock’s price doesn’t drop as predicted, you stand to lose the premium paid for the put option. Moreover, consider the difference between buying and selling a put: the maximum gain on a long put is capped at the difference between the strike price and zero. While a naked put strategy (in which you sell a put without owning the stock), will potentially have unlimited losses.

But these put options strategies are not necessarily bearish: another way to make money with puts is through a selling put options strategy, which is a bullish type of trade. Here, you sell a put option and earn a premium upfront. However, should the market not perform as anticipated, you could lose money and be forced to buy the asset at a higher price than the current market price.

Here’s a quick look at the strategies we’ll mention today:

The Long Put Strategy

The long put is a basic yet powerful put options strategy. It involves the purchase of put options with an expectation that the price of the underlying asset will fall. The strategy offers a simple and efficient way to profit from a decline in the asset’s price with limited risk.

In essence, the long put works by allowing an investor to sell the asset at a predetermined price (the strike price), regardless of how much the market price drops. This can be especially useful as a protective measure against potential losses in a stock position. When market conditions seem to be turning bearish, a long put provides a safety net.

One crucial aspect of the long put is understanding the maximum gain. The maximum gain on a long put is confined to the difference between the strike price and zero, multiplied by the number of contracts. In other words, the lower the price of the asset, the higher the potential profit.

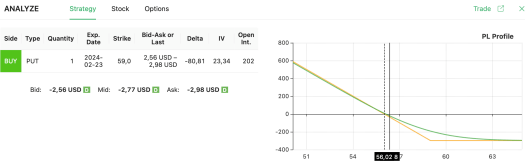

A Long Put Example

Let’s take NextEra Energy (NEE), currently trading at $56.38, as an example. If you’re bearish on NEE, you might consider a put options strategy. Our options screener may highlight the possibility of buying a $59 put. This selling put options strategy could become profitable if the stock price drops below $56.02 before the put expires.

In our articles, we consistently urge you to scrutinize the stock chart (see image below). For instance, given NEE’s recent trading history close to $50, the market might retest this support level. If it does, your trade idea could turn out profitable.

Remember, the maximum gain on a long put is achieved when the stock price falls significantly (your profit will increase in a linear manner at expiration if the stock price falls below $56.02). Put strategies like these can be an effective way to make money with puts when you anticipate a stock price decrease. So, keep an eye on the charts and stay strategic with your moves.

The Naked Put Strategy

After seeing the long put case, another extremely popular put options strategy is the naked put.

Before we proceed, you should know that selling put options strategies represent another approach where investors trade put options. But unlike the long put, this method entails more risk and is typically employed by advanced traders.

Specifically, the naked put, also known as an uncovered put, is the selling of put options with no need to have the cash at hand to cover the portfolio obligations in a leverage-like way. This strategy is typically used when the investor expects the asset price to rise or remain stable.

The naked put works by selling a put option at a strike price believed to be below the asset’s future price. If the asset’s price stays above the strike price until the option’s expiration, the option will expire worthless, and the investor will keep the premium from selling the put option. This is essentially how to make money with puts in a bullish or neutral market scenario.

However, it’s crucial to understand that this selling put options strategy involves substantial risk. If the asset’s price falls below the strike price, the investor could face significant losses, as they are obligated to buy the asset at the strike price.

The maximum gain on a naked put is limited to the premium received for selling the option. Despite its potential for high profit, the naked put is one of the more risky put strategies and should be used cautiously.

Therefore, while the naked put can be profitable, it requires careful monitoring of market conditions and a thorough understanding of the risks involved. From a certain point of view, you may see selling puts OTM puts as a solid income strategy options operation.

A Naked Put Example

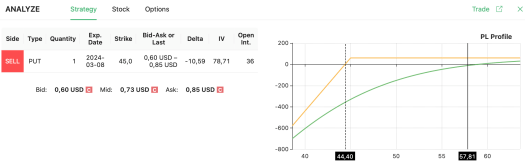

Looking at Western Alliance Bancorporation (WAL), currently trading at $57.81, you might be drawn to a neutral-to-bullish put options strategy like selling a put contract. Our options screener could help spot a potential trade opportunity in selling a $45 put.

So, what does this mean for you? Well, as long as WAL stays above $44.4 by the time the option expires, you stand to make a profit. This profit will equate to the premium of the put option.

Take a glance at the price chart below. Notice that WAL has consistently traded above $45 for several months. Even before that, it never dipped below $45 without resistance. This suggests that your selling put options strategy could be a viable way to make money with puts, given the stock’s track record.

Put strategies like these require careful observation and strategic planning. But, with the right approach, they can effectively boost your trading performance.

The Protective Put Strategy

Another extremely common way to use put options is to employ a protective put strategy. This is a risk-management put options strategy that involves purchasing a put option for an already-owned asset. The intention here is to limit the potential downside loss if the price of the asset decreases.

A protective put works like an insurance policy. If you own shares of a stock and want to protect against a significant price drop, you can buy a put option at a specific strike price. If the stock’s price falls below this strike price, you can exercise your put option and sell the stock at the strike price, limiting your losses.

The selling put options strategy can also be used in this context. However, it’s essential to understand that the maximum gain on a long put is achieved when the price of the underlying asset goes to zero.

At this point, it will be clear to you that put strategies, like the protective put, offer a method of how to make money with puts by providing a hedge against potential losses (speaking of which, you can refer to our focus on hedge strategy options).

The protective put strategy is particularly useful when an investor wants to maintain ownership of a stock due to its long-term potential but is concerned about short-term uncertainties in the market. It’s a straightforward way to provide peace of mind and protect your investment portfolio from unexpected downturns.

A Protective Put Example

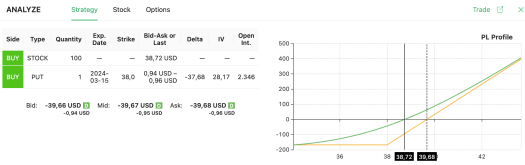

For our protective put options strategy, let’s examine General Motors (GM), which is currently trading at $38.72. Our “Married Put” scanner can offer many protective put trade ideas. Suppose you’re bullish on GM and buy 100 shares. However, you know that a GM price drop can’t be entirely dismissed in the coming weeks.

Ask yourself this question: how can you protect your trade with a capped and relatively small loss without limiting your profit potential? If you’ve followed our theoretical explanation in the previous section, you can see where we’re going: a protective put is the answer.

Picture buying 100 shares at the current GM price, along with a $38 put. If the market rises, you still have potentially uncapped profits, deducting the premium of the put option you bought.

This put option acts as an insurance policy, allowing you to limit losses if the stock price declines. Your shares may lose value, but your put contract will increase in price, capping your losses if GM drops below $38.

This selling put options strategy is one way to make money with puts while mitigating risk.

The Bear Put Spread Strategy

The fourth strategy we want to discuss today is the bear put spread. This put options strategy involves buying put options at a higher strike price while concurrently selling put options at a lower strike price. It’s a well-balanced approach that limits both potential profit and loss.

A bear put spread works by capitalizing on decreases in the underlying stock’s price. The investor profits if the stock’s price low enough, as we will see in the practical example on this strategy. The maximum gain on a long put is the difference between the strike prices, less the initial cost of the options.

However, if the stock’s price rises or does not fall enouth, the investor faces a potential loss. Despite this, the selling put options strategy can help reduce the cost of the trade, allowing the investor to benefit from a downward movement in the stock’s price.

This strategy is most effective when expecting a moderate stock price decrease. In essence, the bear put spread is an efficient put strategy that combines the idea of limited risk with limited rewards, giving you a potentially decent profit potential while managing your risk.

Bear Put Spread Example

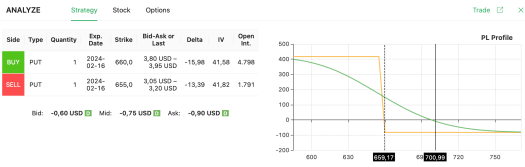

Imagine this scenario with Nvidia (NVDA), currently trading at $700.99. You’re well-acquainted with this stock and wouldn’t be surprised to see it drop to $650 due to its strong volatility. In this case, a put options strategy might be a good idea to consider.

You could buy a $660 put and sell a $655 put. This would create a potential for a significantly higher profit compared to any loss you might incur.

Specifically, you’d need NVDA to close below $659.17 by the time your put options expire to make a profit. If you look at the P&L profile of this strategy, it is fairly easy to understand the rationale behind this trade: you’re basically risking losing $75 against a profit potential above $400.

This options strategy is one of the various put strategies that can be used to make money with puts. It’s essential to remember, though, that the maximum gain on a long put is achieved when the stock price falls considerably. Also, keep in mind that you could build this trade as either a debit or a credit spread option strategy.

After presenting these examples, it is clear that your market outlook should be the main driver when choosing either one of these strategies. Are you definitely bearish on a stock? Then the long put or bear put spread could be the right choice for you. If you’re looking to protect your current holdings, the protective put is an excellent option.

You may also like to have a naked put strategy with high likelihood of giving you a profit, but a lower payoff compared to other trades. Take a look at the P&L profiles of each strategy and ask yourself: am I confident with this uncapped loss potential? Do I prefer to sacrifice a part of my gains to limit my losses? The choice for the right put option strategy will mainly depend on these factors.