Managing risk is crucial in investing. This article delves into hedge strategy options, exploring key techniques for safeguarding your investment portfolio. From hedging strategies with options to specifics like hedging with puts, we’ll demystify how to hedge options and various option hedging strategies.

Key takeaways

- Some popular hedge strategy options are the long stock hedge, short stock hedge, and delta hedging.

- A hedging strategy will require that, if you go long on a stock, you buy put options to hedge your position. The opposite is true for shorting a stock.

- Options delta hedging is one of the most advanced hedge strategy options that involves rebalancing your portfolio to maintain a delta-neutral position.

How Hedging Strategies with Options Work

When it comes to managing potential losses in the trading world, hedge strategy options play a crucial role. They provide a safety net, allowing traders to prepare for unexpected market downturns. The concept of hedging risk is all about choosing hedge strategy options that can counterbalance possible price drops in your investment.

The long stock hedge is one such strategy involving the use of put options. Here’s how it works: if you’re holding shares and you’re worried their value might go down, you buy put options. This is known as hedging with puts. If the stock price does fall, the gain from your put options offsets the loss. Essentially, it’s an insurance policy for your stock investments.

On the other hand, a short stock hedge strategy is about buying call options. This is particularly useful when you have shorted stock, meaning you’re betting on a price decrease.

By buying call options, you’re protecting your position from the upside risk in the stock price. If the stock price rises contrary to your expectations, the call options you bought will minimize the loss.

Now, let’s talk about delta hedging—one of the key option hedging strategies. Delta is a measure of how the price of an option changes in relation to the price change of the underlying asset.

With delta hedging, your goal is to maintain a delta-neutral position. In simpler terms, you adjust your options position so that overall, price changes in the asset don’t affect your portfolio’s value. It’s like having a seesaw perfectly balanced—no matter which side goes up or down, the total weight remains constant.

If you’re wondering how to hedge options, the table below will provide a quick overview of the hedge strategy options we’ll analyze today:

The Long Stock Hedge Strategy

We would like to start with one of the most intuitive hedge strategy options, the long stock hedge operation. It’s a two-leg trade: you go long on a stock, meaning you buy with the expectation that its price will rise, and simultaneously, you purchase a put option. Considering how the market tends to move upward in the long term, this could be a good SPY options strategy to consider.

This combination gives you a sort of shield protecting your investment from potential short-term market downturns. This is one of the hedge strategy options you can use for added flexibility and risk management.

The benefits of these hedge strategy options are undeniable. By hedging with puts, you limit your potential losses. If the stock price takes an unexpected dip, you can exercise your put option, selling the stock at the higher predetermined price. This lessens the blow of a market downturn and provides peace of mind for your investments.

However, like any hedge strategy options, it has potential drawbacks. Buying a put option isn’t free—it adds to your overall investment cost. Plus, you bought the stock with the expectation of it going up. So if it does go up, your put option could expire worthless. That means you lose the premium you paid for it.

So, when should you use this strategy? Consider it when you have a bullish outlook on a stock in the long run, but want to guard against short-term volatility by hedging with puts. It’s an effective tool in your option hedging strategies toolbox for managing risk, allowing you to participate in potential market gains while keeping a lid on downside risk. Simply put, it’s a smart move for cautious optimism in the stock market.

A Long Stock Hedge Example

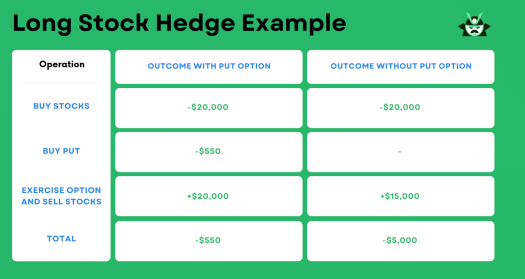

Let’s look at a practical application of hedge strategy options, focusing on a long stock hedge. Imagine you’ve bought 100 shares of a stock at $200 each and simultaneously gone long on a February $200 put option priced at $5.5 per contract, a position you may open after taking a look at an options screener. The total investment here is $20,550 ($20,000 for the shares and $550 for the put option).

Now, suppose the stock price drops to $150. This situation triggers your put option, which goes “in the money.” Acting wisely, you exercise the put option, selling your shares at the strike price of $200 each, thus avoiding a larger loss.

You initially bought the shares with a bullish outlook, hoping to profit from a price increase. However, the market turned bearish, and the share price fell. Without the put option as a hedge, you would have lost $50 per share, totaling a substantial loss of $5,000.

By exercising the put option, you sell the shares at the same price you bought them for, $200, effectively making the buy-and-sell a “wash.” You must, however, account for the cost of the put option, which is $550 ($5.5 premium x 100 shares). So, your overall loss is limited to $550 – a far cry from the potential $5,000 loss.

This example illustrates the power of hedging strategies with options. Even if the market price falls further, your maximum loss is capped because of the hedge. You’re guaranteed a liquidation price of $200 per share, regardless of how low the market price drops, thanks to this option hedging strategy.

If you want to try this strategy by yourself – either on the market or on our paper trade feature – you can refer to Option Samurai’s “Married Put” scan, which allows you to check the market to open this kind of positions.

The Short Stock Hedge Strategy

How to hedge options whenever you’re on the other side of the market? In hedge strategy options, the short stock hedge is a notable strategy involving shorting a stock and buying a call option (so, basically, you add a long call options strategy to your short stock position). When you short a stock, you’re selling borrowed shares in anticipation of a price decrease. Meanwhile, buying a call option grants you the right to purchase the stock at a set price within a certain timeframe.

The advantages of these hedge strategy options are twofold. Firstly, if the stock’s price decreases as expected, your short position earns profits. Secondly, the call option serves as a safety move, capping potential losses if the stock’s price increases. Essentially, it allows traders to profit from downward price movements while limiting upward risk. We can see that limiting the upside risk is very good practice as some of the public blowouts of option traders in recent events, such as $AMC, $VFS, and $GME (GameStop, a famous case that even ended up as a movie).

However, potential pitfalls need to be considered. If the stock’s price increases contrary to your expectations, the short side of your trade will deteriorate your position (even though you’ll have the protection of the call contract you bought). Something else to consider is that the cost of the call option can reduce overall profits.

This strategy has diverse applications in different investment scenarios. It’s ideal for investors who are bearish and seek to protect their short stock positions against potential losses. The hedging strategy is even more important in the case of a short as if you are wrong and the price rises against you – every subsequent percent rise is a higher dollar loss as the stock price is higher.

The short stock hedge is a valuable tool in the niche of option hedging strategies. By combining a short stock position with a call option, traders can effectively manage risk and potentially profit from downward price movements.

A Short Stock Hedge Example

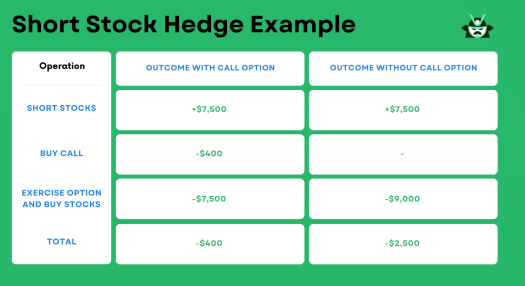

Imagine you’ve shorted 100 shares of a stock at $75 each. To hedge your position, you go long on a February $75 call option, with a premium of $4 per contract. Your total outlay for the call option is $400.

Now, let’s say the stock price rises to $90. This increase would mean a significant loss from shorting the stock. Specifically, your call option is now “in the money,” meaning that you can exercise to buy the shares at the old $75 price.

As you see from the table above, this example is similar to the long stock hedge case. If you bought the call option, you’d only be losing its premium ($400). Without the call option, however, shorting the stock would lead to a $2,500 loss.

Once again, note that you can take advantage of our options screener feature called “Married Call,” which allows you to build these sorts of trades.

The Delta Hedging Strategy

How to hedge options with a more technical approach? Well, let us talk about delta hedging, a technique used in hedge strategy options allowing traders to maintain a delta-neutral position. This involves adjusting the options position so that the overall price changes in the asset don’t affect your portfolio’s value. It can be achieved using options with different deltas or even a mix of options and stocks in your portfolio.

The key advantage of this strategy is its ability to reduce directional risk. By making your portfolio delta-neutral, you’re ensuring that the overall value remains constant, irrespective of the market movements of the underlying asset. This allows traders to focus on capturing the impact of volatility or time decay on options prices, rather than worrying about the market’s direction.

Because the delta of the options changes all the time – Delta hedging is one of the most advanced hedge strategy options strategy, which not everyone could afford to use (just think, for instance, to the time it will take you to rebalance your portfolio constantly).

It’s particularly important for institutional traders and investment banks, as it offers a method to hedge the risk of adverse price changes in a portfolio. By managing the impact of market movements on options prices, it shields profits from an option or stock position in the short-term without unwinding the long-term holding.

However, delta hedging isn’t a set-it-and-forget-it strategy. It demands constant monitoring and adjustment of positions. Failing to do so might lead to over-hedging, offsetting the delta by too much, or unexpected market changes.

Clearly, delta hedging is a versatile tool among numerous option hedging strategies. It allows traders to isolate volatility and time-decay changes, protect short-term profits, and reduce directional risk. But remember, it requires diligent monitoring and timely adjustments.

A Delta Hedging Example

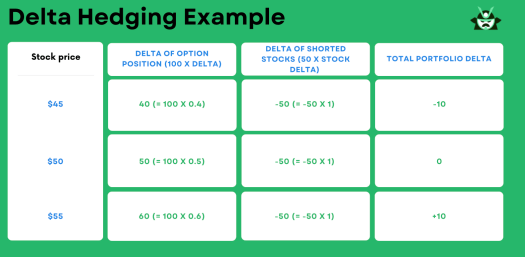

Let’s assume you buy 100 call options of a specific stock. Each option has a delta of 0.5, which indicates that for every $1 increase in the stock price, the option’s price will rise by $0.50. Therefore, the total delta of the options in your portfolio is 50 (100 options x 0.5 delta).

You want to hedge this position to protect against price volatility through one of the most common hedge strategy options – delta hedging. You decide to short 50 shares of the stock, which balances out the portfolio’s total delta (50 from the options – 50 from the shorted stocks = 0), making it delta-neutral.

Now, if the stock’s price changes, the portfolio will need to be rebalanced to maintain its delta neutrality. Here’s how it would look:

In the table, as the stock price changes, the delta of the options also varies. At $45, the options’ delta decreases to 0.4, and at $55, it increases to 0.6. To maintain a delta-neutral portfolio, the investor would need to adjust the number of shorted stocks accordingly, keeping in line with one of the primary principles of hedging strategies with options.

This example underscores the importance of knowing how to hedge options and adjust positions in response to market changes. It demonstrates the process and potential benefits of delta hedging, one of the many effective option hedging strategies. By regularly rebalancing the portfolio, the investor can manage risk and maintain a delta-neutral position.

So, which hedge strategy options should you go for? And how to hedge options in the most clever way? Clearly, delta hedging is an advanced approach that can be costly and time-consuming to implement for retail investors.

However, it’s worth considering if you’re a large institutional investor or investment bank with significant exposure to options. For smaller traders, simpler hedge strategy options like buying a put while owning stocks (or buying a call while shorting stocks) may be more feasible options.