If you wish to profit in a neutral and directional market, a good credit spread option strategy may be what you’re looking for. This guide will focus on the credit spread trading concept, providing clear examples and beginner-friendly tips. Let’s learn how this strategy can give you profits while protecting your investments.

Key takeaways

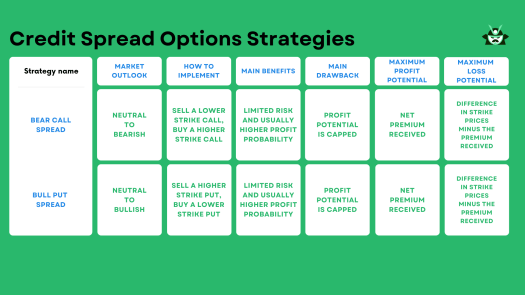

- There are two main types of credit spread option strategies: the Bear Call Spread Strategy and Bull Put Spread Strategy.

- A credit spread option strategy is a type of options trading strategy that involves simultaneously buying and selling options contracts with different strike prices.

- In a bullish scenario, a Bull Put Spread Strategy can be one of the best risk-management techniques, while a Bear Call Spread Strategy can be beneficial in a bearish market.

Credit Spread Options for Beginners

A credit spread option strategy involves the simultaneous buying and selling of two options with different strike prices. This creates a net credit in your trading account, hence the term “credit spread trading.”

One of the main benefits of a credit spread option strategy is its limited risk. The maximum loss you could incur is restricted to the difference between the strike prices minus the net credit received. This makes credit spread options an attractive choice for beginners, as it helps manage potential losses while still offering a profit opportunity.

However, there are risks involved, too. If the underlying asset’s price moves significantly against your position, you could face losses. Also, the profit potential is limited to the net credit received. Hence, it’s crucial to understand these risks and manage your positions effectively.

Think of this as placing a bet on the Super Bowl. If you bet on two opposite events happening at two different moments in the game, you may reduce your risk (for instance, you may think that a team will score more in the first half, while the other team will lead at the end of the game).

Here is a quick look at the two strategies that we will analyze in today’s article:

The Bear Call Spread Strategy

Let’s begin with analyzing the bear call spread strategy. This approach is a credit spread option strategy where you sell a lower strike call option and simultaneously buy a higher strike call option on the same underlying asset. This credit spread option strategy is implemented when you have a neutral to bearish outlook on the market.

To implement this, you first sell a call option with a lower strike price and collect a premium. Simultaneously, you buy a call option with a higher strike price. The premium from selling the lower strike call option offsets the cost of buying the higher strike call option, resulting in a net credit to your account.

Now, let’s consider a real-life credit spread option example. Assume we have a bearish outlook on Stock XYZ, currently trading at $100. We could sell a call option with a strike price of $105 and collect a premium of $5. At the same time, we buy a call option with a strike price of $110 for a premium of $2. This results in a net credit of $3 ($5 – $2).

The potential outcomes depend on the price of the stock at expiration. If Stock XYZ stays below $105, both options expire worthless, and we keep the net credit of $3 as profit. This scenario represents the maximum profit for the strategy.

However, if Stock XYZ rises above $105, the sold call option may be exercised. In this case, we would be obligated to sell Stock XYZ at $105. But remember, we also hold a call option with a strike price of $110. If the stock rises above $110, we can exercise this option to buy Stock XYZ at $110, limiting our losses. The maximum loss would be the difference between the two strike prices minus the net credit received, which would be $2 ($5 – $3).

The bear call spread strategy is an excellent example of how credit spread options for beginners can be used to generate income and manage risk. It’s a simple, straightforward credit spread option strategy that allows for a defined risk and profit potential. However, it’s essential to remember that market conditions can change rapidly, and it’s crucial to monitor your positions closely.

A Real-Life Example of a Bear Call Spread

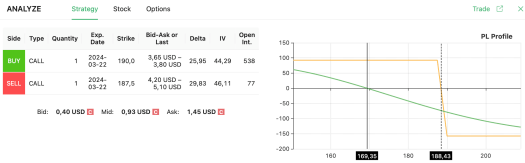

Let’s go into a practical credit spread option example using Advanced Micro Devices (AMD). Suppose you predict that AMD’s bullish streak, with the stock currently priced at $169.35, will soon take a break. To capitalize on this forecast, you might consider implementing a bear call spread, a type of credit spread option strategy.

If this is your belief, our options screener hints at the possibility of opening a bear call spread on AMD. You’d do this by purchasing a $190 call while simultaneously selling a $187.5 call. The goal here is for AMD to close below $188.43 by the expiration date of your call contracts to secure a profit.

But why choose this approach? If you examine AMD’s stock chart, you’ll notice that the stock failed to surpass this threshold a few weeks earlier. This resistance level provides an indication that AMD may struggle to break above this price point anytime soon. Also, consider that the profit probability for this operation is quite high, with a likely positive expected value. Keep in mind that if you ever happen to be wrong on this trading idea, you’ll face a limited loss with a profit ratio close to 67%.

This setup is a good example of how credit spread trading can work effectively. By using the bear call spread strategy, you’re setting up a position that profits from a stagnant or slightly bearish market. It’s an excellent way to generate income in such market conditions, making it a valuable tool in any trader’s arsenal.

Remember, this credit spread option strategy isn’t without risks. If AMD’s stock unexpectedly surges past your sold call’s strike price, you could face losses. Therefore, it’s crucial always to monitor your positions and adjust them as necessary.

This real-life example illustrates how beginners can use the credit spread option strategy to their advantage, even in a neutral or slightly bearish market.

The Bull Put Spread Strategy

Another case that we recommend to explore is the Bull Put Spread strategy, a type of credit spread option strategy. In this strategy, you buy a lower strike put option and simultaneously sell a higher strike put option. Let’s illustrate this with a real-life example.

Suppose you’re neutral to bullish on XYZ stock, currently trading at $100. You decide to implement a Bull Put Spread strategy. You sell a put option with a strike price of $95 for a premium of $3 and buy a put option with a strike price of $90 for a premium of $1. This results in a net credit of $2 ($3 – $1) to your account.

The potential outcomes depend on the price of XYZ stock at expiration. If XYZ’s price remains above $95 (the higher strike price), both options expire worthless, and you keep the net credit of $2 as profit. If XYZ’s price falls below $90 (the lower strike price), you’ll be obligated to buy the stock at $95 (due to the sold put) but can sell it at $90 (due to the bought put), resulting in a loss of $5 per share.

After considering the initial net credit of $2, your maximum loss would be $3 per share. If XYZ’s price ends up between the two strike prices at expiration, the sold put will be in-the-money, and you may have to buy the stock at $95. However, the bought put will expire worthless. Your overall profit or loss will depend on the exact ending price of the stock.

This credit spread option example illustrates how the Bull Put Spread strategy can generate income while managing risk. The maximum profit is limited to the initial net credit received, and the maximum loss is capped, making this credit spread option strategy appealing for beginners.

However, like any other trading strategy, it’s crucial to understand the potential outcomes and risks associated with it. The Bull Put Spread strategy is a tool that can be effectively used in bullish or neutral market scenarios. Remember to monitor your position closely to ensure it aligns with your market outlook and risk tolerance.

A Real-Life Example of a Bull Put Spread

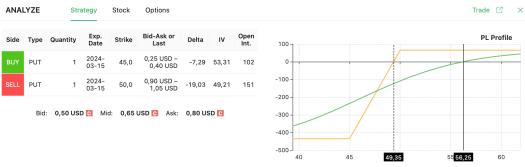

Let’s examine Rambus (RMBS) and suppose you anticipate the current downtrend (with the stock at $56.25) nearing its end. In this situation, a credit spread option strategy known as a bull put spread might be your go-to move with RMBS.

Our options screener suggests buying a $45 put while selling a $50 put. This credit spread option strategy banks on RMBS staying above $49.35 by the time your puts expire to turn a profit.

If you observe RMBS’s price history, you’ll find it has hit this price level thrice in the past year, each time rebounding to higher levels. This pattern makes this trade idea particularly appealing.

This bull put spread is an example of credit spread trading, where you sell a higher strike put and buy a lower strike put. The goal is to capture the premium difference between the two, provided the stock price remains above the higher strike price at expiration.

This credit spread option strategy is ideal if you have a moderately bullish outlook on the stock. It allows you to profit from a flat or slightly rising market, making it a potent weapon for any trader’s arsenal.

However, it’s important to remember trading always involves risk. If RMBS’s stock unexpectedly dips below your sold put’s strike price, you will have to face losses.

This real-life credit spread option example demonstrates how beginners can utilize these strategies effectively, even when the market isn’t strongly bullish.

The Pros and Cons of Credit Spread Option Strategies

Before wrapping up, let us consider the main pros and cons connected to credit spread option strategies:

Pros:

- Limited risk: One of the main advantages of these strategies is their ability to limit risk. By establishing a credit spread, your maximum loss is known upfront, providing peace of mind and helping manage risk effectively.

- Income generation: Credit spreads can generate income, as the premium received from selling the higher premium option can offset the cost of buying the lower premium option.

- Flexibility: The flexibility of these strategies is another advantage. By adjusting strike prices and expiration dates, you can tailor your approach to your specific market outlook. This flexibility allows for potential profit in various market conditions, including neutral or slightly bullish or bearish scenarios.

Cons:

- Limited profit potential: While these strategies offer limited risk, they also cap profit potential. The potential profit is limited to the difference between the strike prices minus the net premium received.

- Assignment risk: If the options in the spread aren’t closed or adjusted before expiration, you could be assigned the underlying stock. Traders should have a plan in place to manage this risk, even with these credit spread options for beginners.

Despite the limited profit potential and the risks involved, including the possibility of assignment, credit spread option strategies can be a useful tool in certain market conditions and can be tailored to individual trading goals and outlooks.

When dealing with a credit spread option strategy, the choice between a bear call spread and a bull put spread clearly depends entirely on the market outlook. Just keep in mind that you won’t necessarily need a stock to move either down (for the bear call spread) or up (for the bull put spread) to earn a profit, as even a neutral market outlook can result in a gain.