Many traders look for ways to generate income using a low risk options strategy. This guide unpacks the safest options strategy, explores the myth of zero risk option strategies, and reveals the lowest risk option strategy to maximize your profits. Let’s dive in and start generating income safely and smartly.

Key takeaways

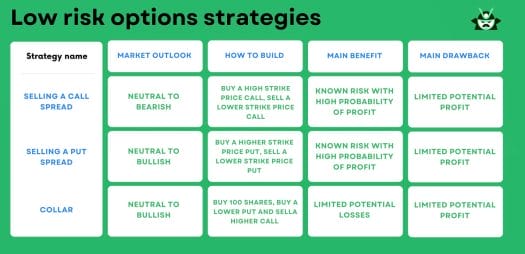

- Some low risk options strategies that we could recommend are selling a put spread, selling a call spread, and relying on a collar strategy.

- Compared to mere options selling, the collar strategy can further protect against downside risk.

Picking the Safest Options Strategy

A low risk options strategy is characterized by minimal potential losses (limited downside risk) and a high probability of success. The safest options strategy should meet these criteria, ensuring that your potential returns are maximized while your potential losses are kept to a minimum.

Selling options spreads is one such strategy that fits the bill. It’s often seen as one of the lowest risk option strategies because it allows you to have a pre-determined capped loss risk when trading.

This way, you’re not only minimizing risk but also generating income. In general, zero risk option strategies are not a reality for individual traders, but adopting a low risk approach can significantly tilt the odds in your favor.

Today, we’ll have the chance to look into the three low risk options strategies mentioned in the table below:

The Short Call Spread vs the Short Put Spread

When it comes to low risk options strategies, selling a call spread and selling a put spread are techniques that traders often utilize. These strategies are characterized by a high probability of profit due to the low probability of loss, and they limit risk in case the trade doesn’t go as planned.

Selling a call spread, also known as a short call spread or “bear call spread,” is a strategy suited for situations where a stock’s price is expected to move sideways or decline slightly during the trade period. This approach offers a limited reward, aligning with the lowest risk option strategy, as it carries less potential risk than the outright sale of a short call. It’s an apt strategy for those predicting subdued price movement in the underlying asset, and who are satisfied with a comparatively moderate profit.

On the other hand, selling a put spread, or a short put spread, is an options trading strategy that involves the simultaneous purchase and sale of put option contracts on the same underlying asset with the same expiration date, but different strike prices. This strategy, often considered one of the safest options strategies, is a neutral-to-bullish trading play. The trader anticipates that the underlying asset’s price will remain flat or increase during the trade’s lifespan.

In a short put spread, which is a credit spread, the investor receives a credit upon opening the position. The trader purchases a put option with a lower strike price and sells another with a higher strike price. The gap between the prices of the two put options results in a net credit, which is the maximum potential profit.

The maximum loss is the difference between the two puts’ strike prices minus the net credit received, giving this zero risk option strategy a defined downside risk.

Selling a Call Spread – An Example

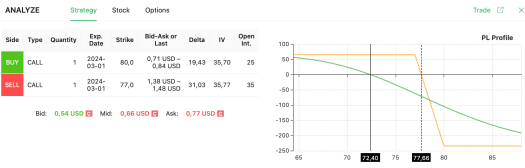

Using Best Buy (BBY) as an example, let’s dive into a practical illustration of a low risk options strategy. At present, BBY’s stock is trading at $72.40. If you were to use an options screener like Option Samurai, it might suggest selling a call spread on BBY.

Specifically, the screener would advise you to buy a $80 call option and simultaneously sell a $77 call option, both expiring in one month. This setup creates a spread, hence the name “call spread.”

Here’s how it works: if BBY’s stock closes below the breakeven priced highlighted in the chart below by the time the options expire, you make a profit.

Now, let’s address the potential profits and losses. You’ll notice that the maximum possible profit from this trade is relatively small compared to the potential loss. However, the beauty of this safest options strategy lies in its limited and capped risk.

Furthermore, the stock is currently quite distant from the breakeven point. This means even a simple sideways movement of the stock price—or better yet, a slight decline—could result in the maximum profit for this strategy.

Remember, your maximum loss in this simple options strategy is defined from the onset—it can’t exceed the difference between the two strike prices minus the net premium received. So, while the profits are modest, the controlled risk makes this one of the lowest risk option strategies available to traders.

You know what you stand to lose, and you have a high probability of pocketing some profit. That’s why selling a call spread is a popular low risk options strategy.

Selling a Put Spread – An Example

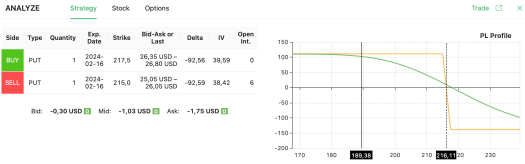

Using Apple (AAPL) as an example, let’s illustrate how a low risk options strategy works. Suppose we want to leverage Option Samurai’s predefined scan for “High probability bear put spreads.” After scanning, we find a suitable setup: buying a $217.5 put and selling a $215 put contract, both set to expire in 2 weeks.

So, what does this mean for us as traders? Well, to make a profit, we need AAPL—currently trading at $189.38—to close below $216.11 by the time the options expire. Given a 2-week period, this would require AAPL to move less than 14.11% upward.

Here’s the main advantage of this safest options strategy: AAPL’s stock price can move lower, it can remain steady, or it can even move slightly upward, and we’ll still make a profit. As long as the price doesn’t surpass the $216.11 threshold, we’re in the green.

This is why selling a put spread is considered one of the zero risk option strategies. Your risk is limited to the difference between the two strike prices minus the premium received when you opened the position.

Even though the potential profit is modest, the controlled risk makes selling a put spread one of the lowest risk option strategies available. It allows you to know exactly what you stand to lose, while providing a high probability of earning some profit. That’s the appeal of this low risk options strategy.

A More Advanced Approach: the Collar Strategy

We mentioned how selling an option spread, but there are also more advanced approaches, like the collar strategy, that you may want to consider. This low risk options strategy is designed to protect against downside risk. It combines buying a put option with selling a call option on a stock you already own or plan to purchase.

Here’s how it works. First, you own or buy a stock. Then, you buy a put option, setting a floor for potential losses if the stock price drops. The put option allows you to sell the stock at a predetermined price within a specific timeframe, acting as insurance against a price decline.

Next, you sell a call option. This step generates income as you collect a premium from the buyer, who gets the right to buy your stock at a preset price within a specific period. The premium you earn from selling the call option can help offset the cost of buying the put option.

However, while the collar strategy is considered one of the safest options strategies, it does have limitations. By selling the call option, you cap your upside potential. If the stock price rises above the strike price of the call option, you might end up selling the stock at a lower price than the market value.

Also, the cost of buying the put option and the potential for capped gains should be accounted for when evaluating this strategy’s net effect.

In essence, the collar strategy is a balanced approach, providing downside protection and income generation while limiting upside potential. Like all strategies, it’s not a zero risk option strategy, but it could be the lowest risk option strategy that aligns with your investment goals and risk tolerance. Note that, just like the rest of the strategies we mentioned today, the collar setup is not a high volatility option strategy.

A Collar Strategy Example

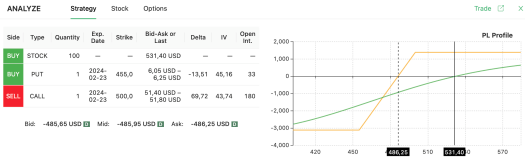

Let’s dive into an example of a collar strategy using Nvidia (NVDA). Suppose you purchase 100 shares at the current price of $531.40. Next, you sell a $500 call and buy a $455 put. This tactic caps your potential gains and losses, offering a safer trade than just buying stocks.

For this low risk options strategy to work, NVDA’s price needs to stay above $486.25 when your put and call options expire. NVDA has been quite volatile since its chips became integral to the artificial intelligence industry. However, this collar strategy might be your favorite low risk options strategy, given these market conditions.

This approach is a strategic move that capitalizes on market volatility while limiting potential losses. But remember, even the safest options strategy requires careful analysis and consideration of potential market fluctuations. So, keep an eye on the market and adjust your low risk options strategies accordingly.

So, which strategy would we choose? If you are comfortable with owning the stock, the collar strategy might be a good fit. However, if you prefer to generate income without owning the stock, selling options spreads could be the best safest options strategy for you. Either way, both strategies offer controlled risk and high probability of profit, making them excellent low risk options strategies to consider in your trading journey.

I’m confused by the put spread example you make with APPL. If you choose both strikes out of the money as you did and the stock price by the expiration date you set does not reach neither of them, you will have both orders executed?, After the two weeks you will spend $21.500 to purchase the 100 apple stocks at the 215 strike you sold. What would happen with the order to buy at $217.5(-21750). I can’t see how the profit is generated or if you have to manually end a leg of the trade once you get the stocks.

Thanks!

Lucas

Hi Lucas,

Thanks for your comment. So, if I understand your point correctly, consider that, if the stock price stays above both the $215 and $217.5 strike prices by the time your options reach expiration, both your puts will expire worthless. Therefore, you won’t actually need to buy or sell any AAPL shares at those prices. Basically, your profit only comes from the net premium you collected initially when you set up the spread (which is just the premium received from the $215 put you’d sell minus what you’d pay for the $217.5 you’d buy). You would not need any manual intervention in this case, if AAPL stays above $217.5 you will simply have a loss given by the fact that the put you bought went to 0, while the one you sold is giving you a full profit (but not sufficient to cover the loss of the bought leg, in our specific example). Hope that’s clear!