Among the many ways to profit from options trading, the iron condor earnings strategy is a standout. This approach lets you capitalize on earnings volatility crushes with iron condors. If you’re wondering, “How do I make money on an iron condor during the earnings report season?” then this guide will provide you with the answer.

Key takeaways

- A short Iron Condor earnings strategy can help you make money. It works best when the options market becomes less volatile after companies announce their earnings.

- To spot a good chance to use the Iron Condor earnings strategy, you need to look at the level of Implied Volatility (IV) before the earnings announcement. The IV rank can help you do this.

- Look at how much the stock price changed after past earnings announcements and compare it to the IV. This can help you figure out if the market is correctly predicting how much volatility there will be.

The Short Iron Condor Earnings Strategy

The Short Iron Condor strategy is a practical technique to capitalize on earnings volatility. It combines two credit spreads: a bear call spread and a bull put spread, designed to maximize profit if a stock’s price stays within a certain range after an earnings announcement.

To understand this strategy, you need to grasp the concept of IV rank (percentile) or implied volatility rank. This is a statistical measure that compares an option’s current implied volatility to its historical levels.

For instance, an option screener like Option Samurai may show an IV rank of 90%, which implies that the option’s current implied volatility is higher than 90% of its historical daily data in the past year. This often indicates that an option is overpriced (and we showed with backtets that it tends to decrease after).

After an earnings announcement, a phenomenon called IV crush often occurs. This refers to a swift decrease in implied volatility, leading to a drop in option prices. This is where the Short Iron Condor strategy shines. The value of the iron condor spread can diminish during an IV crush, creating a potential profit opportunity.

Example of Iron Condor Earnings Strategy

Let’s delve into a detailed example of a Short Iron Condor trade using Lennar Corp. (LEN) as our subject. Assume LEN is announcing its earnings tomorrow, and you’re looking to devise a strategy with a good probability of profit.

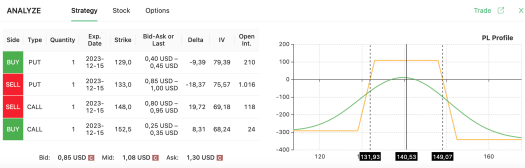

Option Samurai might highlight the chance of setting up an iron condor for options expiring the day after the announcement. If LEN is trading at $140.53, you could buy a $129 put, sell a $133 put, sell a $148 call, and buy a $152.5 call.

This configuration would potentially yield a profit if the stock stays within the $131.93-$149.07 range (~12.2% profit range). Notice that the scanner can find unbalanced Iron Condors to help you maximize the profit potential using the most recent options prices.

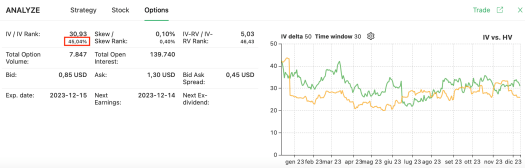

It’s important to remember that implied volatility often decreases due to the IV crush phenomenon after the earnings announcement. This means that the green line representing implied volatility on your chart will likely drop, while the orange line depicting historical volatility (HV) may experience a surge.

Note that the IV rank of our options is 45.04%, meaning that IV is lower than the average of its historical data. Ask yourself whether you’re confident that LEN is going to experience less volatility than the market anticipates. If so, then this might be a good opportunity for an iron condor earnings trade.

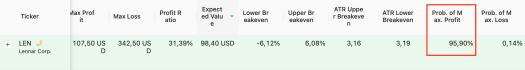

Another aspect you want to consider is Option Samurai’s probability of maximum profit computation. By analyzing the options prices using the Black & Scholes, the tool tells you that there’s a 95.9% chance of obtaining the maximum profit with this strategy.

This strategy hinges on the nature of IV being mean-reverting. By “mean-reverting,” we mean that implied volatility tends to return to its historical average over time. Even better, you’ll spot frequent cases in which an increase (or decrease) in IV anticipates a decrease (or increase) in HV.

Earnings Volatility Crush Iron Condor

With this in mind, consider that IV normally crushes right after an earnings announcement, which can lead to an increase in historical volatility. By understanding this behavior and using the Short Iron Condor strategy smartly, you can potentially profit from earnings volatility while effectively managing your risk (you have limited risk, so your max loss is capped).

The Short Iron Condor strategy is a powerful tool in options trading, especially during earnings announcements. It capitalizes on the typical earnings IV crush phenomenon, providing ample opportunities to make money on an iron condor during an earnings report. The key is to understand the workings of implied volatility and the IV crush phenomenon and use these to your advantage.

Note that the loss potential for an iron condor is limited, but the profit potential is also capped. This strategy works best when you expect relatively low volatility and a high IV rank before the earnings report (in fact, we may label it as a pre-earnings option strategy)

If you are not comfortable with the capped earning potential and unlimited loss risk of a short strangle, an iron condor may be a suitable alternative during earnings season.

Putting the Profit Probabilities on Your Side

Risk management and setting appropriate profit targets are crucial when using the iron condor earnings strategy. It’s essential to remember that earnings reports can sometimes surprise traders, leading to larger-than-average market responses. In these situations, your choice of range for your iron condor setting is fundamental. A well-chosen range can significantly improve the likelihood of profitable outcomes.

The iron condor earnings strategy allows you to take advantage of the earnings volatility crush with iron condors, potentially yielding profits. It also provides an answer to the question, “How do I make money on an iron condor during an earnings report?” This strategy presents opportunities in both bullish and bearish market scenarios.

To summarize, the iron condor earnings strategy offers several benefits. However, it requires careful risk management, setting appropriate profit targets, and a keen understanding of market volatility during earnings reports.

If you look up “earnings volatility crush iron condor” online, you’ll find several resources on the topic. As a general takeaway, do not be afraid to use a tool like Samurai to determine i) the right expiration date for your options and ii) the right range to optimize the probability of maximum profit. With these strategies in place, you can capitalize on earnings volatility while minimizing risk and maximizing profit potential.