When it comes to selecting the best pre-earnings option strategy, it’s all about aligning with your trading style. This article will go through several essential tips that will help you understand when buying options before earnings can be beneficial. With the help of a few examples, we’ll analyze several strategies you can build for your pre-earnings trades.

Key takeaways

- The best pre-earnings option strategies include diagonal call spreads, calendar call spreads, and long straddles.

- To capitalize on the speculation premium, the short-term leg of your strategy will usually expire before the earnings announcement, while the long-term will have a later maturity.

- Diagonal call spreads involve buying a longer-term call option and selling a shorter-term one, while calendar call spreads utilize options with different expiration dates but the same strike price.

- Long straddles represent a more aggressive approach, as they involve buying both a call and put option at the same strike price in anticipation of significant price volatility after earnings.

Understanding a Classic Pre-Earnings Option Strategy

A pre-earnings option strategy involves buying options before earnings are announced. It’s a method traders use to capitalize on expected earning events. Most often, we can expect price swings and IV crush, post-earnings, and speculation premium pre-earnings.

The core of this strategy is anticipation: you’re predicting how the market will react to the earnings report. Anticipation is very important in options trading as it provides an opportunity to profit from volatility rather than the direction of the stock price alone.

From calendar/diagonal spreads to straddles, there are various pre-earnings option strategies at your disposal. Let us look at each of them in detail.

Calendar Call Spread

The Calendar Call Spread is a pre-earnings option strategy where you buy and sell a call at the same strike price but with different expiration dates. This type of spread is also known as a horizontal or time spread.

Remember: you sell the nearer expiration date, referred to as the front-month option, and purchase the further expiration date, known as the back-month option. This lets you capitalize on the fact that time decay is higher on short-term options. In fact, when opening a time spread, you will generally want to put the main event (in our case, the earnings announcement) between the two expirations of the options legs.

Incorporating an earnings timing strategy can further enhance potential profits. By selling before earnings and buying after earnings, you can take advantage of the speculation premium for the bought leg.

Since the market often holds its breath for major news, there tends to be limited significant movement before earnings. This anticipation period creates an opportunity for traders to profit from the speculation premium on the bought leg. It’s a strategic approach that acknowledges that the market behaves differently for options before and after significant announcements, So as traders – we try to profit from it.

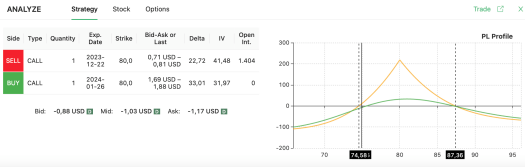

Let’s illustrate this with an example. Suppose you’re eyeing Micron Technology (MU) before its earnings are released. The stock is currently trading at $74.96. Given MU’s historical behavior after past earnings announcements, you believe that the $80 level could be an achievable target.

To implement this strategy, you would first identify two expiration dates for two call option contracts at the $80 strike price. However, it’s crucial to note, particularly when applying this strategy to pre-earnings, that the short-term option—the front-month one—should expire before the earnings announcement. This deliberate timing is essential as it enhances the decay benefits associated with short-term options.

You sell the front-month option that expires sooner and purchase the back-month option that expires later. This strategic move allows you to capitalize on the fact that time decay is higher on short-term options. In fact, when opening a time spread, you will generally want the main event (in our case, the earnings announcement) between the two expirations of the options legs.

For instance, using an option screener like Option Samurai may highlight the suitable contracts for this strategy.

Now, if you look at the MU stock chart, you’ll see that your maximum profit occurs at $80. However, you would still make a profit if the stock price falls within the range of $74.58 to $87.36.

Therefore, if you’re slightly bullish on MU, given its earnings history, this trade could be an attractive option. It allows you to potentially profit from price fluctuations without needing the stock to move significantly in either direction.

Diagonal Call Spread

The Diagonal Call Spread is a more advanced pre-earnings option strategy, offering the flexibility to select any strike price and expiration date for buying and selling options. With this approach, you’re essentially setting up regular spreads, but your sold leg has a closer expiration to amplify time decay.

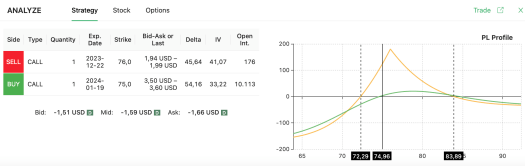

Let’s stick with our MU example, as we did before. To implement this strategy, you would establish a sell leg with a $76 call and a buy leg with a $75 call, each having different expiration dates.

How do you select the expiration dates? Keep in mind the golden rule we mentioned above: always make sure that the earnings date is between the two expiration dates.

Your ultimate goal here is to reach a $76 value to maximize your profits at expiration. However, you can still turn a profit if MU’s price fluctuates between $72.29 and $83.89. This earnings option strategy gives you more leeway to experiment with expiration dates and strike prices compared to the Calendar Call Spread.

So, if you’re an experienced trader who comprehends well how a particular stock trades and how the market responds to events like earnings announcements, the Diagonal Call Spread could be an ideal strategy for you. It’s complex, but it offers a great deal of versatility and potential returns, especially when you’re buying options before earnings.

Long Straddles

Long Straddles is a pre-earnings option strategy that involves buying both a call and a put option at the same strike price and expiration date. This strategy is typically used when you anticipate high volatility in a stock’s price after an earnings announcement.

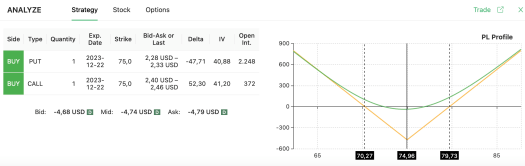

Again, let’s take Micron Technology (MU) as an example. With the stock is trading at $74.96, let’s say you predict substantial price swings post-earnings. Therefore, you would buy both a call and a put at a $75 strike price with an expiration date immediately after the earnings release.

Consider that you won’t necessarily have to wait until the expiration date of the two options to earn a profit. In fact, as you’re moving to take advantage of the typical pre-earnings speculation premium we described earlier, you could very well decide to close your trade before the expiration if you’re happy with your profit. If you do not find yourself having a profit before the earnings, you will need a higher-than-expected price move in MU to have a positive return.

To make a profit from this strategy, you would need considerable volatility. Specifically, for this operation to be profitable, the stock would need to be either above $79.73 or below $70.27 at expiration.

This strategy is neutral, meaning it doesn’t matter if the stock price goes up or down as long as it moves significantly. If you’ve observed that MU’s average price movement after earnings exceeds the 6% change needed to make a profit (considering the current price of $74.96 and the two thresholds mentioned), then this could be a viable strategy.

In essence, the Long Straddles strategy allows traders to potentially profit from major price movements when buying options before earnings, regardless of the direction of the move.

When examining the three strategies we’ve discussed, it becomes apparent that while they share a common goal, they differ in their approach. The choice between a calendar or diagonal spread and a straddle is influenced by your expectations regarding stock movement and volatility.

When initiating a position, it’s crucial to note that calendar and diagonal spreads are designed for scenarios where you prefer to avoid excessive volatility (from this point of view, they may look like simpler alternatives to more advanced approaches such as the iron condor earnings strategy). The strategy is constructed with the intention of taking advantage of time decay rather than significant price fluctuations.

As the short leg of these spreads approaches expiration, you have the option to leave the second leg open, transforming the position into a different strategy.

Conversely, a long straddle is more suited when you anticipate substantial volatility. In this strategy, you actively seek significant price movements, either up or down, and the success of the trade depends on the extent of the price swing.

A noteworthy aspect of the calendar and diagonal spreads is that, traditionally, you close the entire position when the short leg expires. This approach is distinct from leaving the second leg open and pursuing a different strategy.

Therefore, in the context of calendar and diagonal spreads, minimizing volatility is preferable, while in a straddle, embracing volatility is inherent to the strategy.