Do options lose value after earnings? This article will break down how and why options might lose value post-earnings in the simplest terms possible. The content will help beginners and experienced traders looking for a refresher.

Key takeaways

- Options usually lose value after earnings, especially if the news shared by the company falls below market expectations.

- In general, the closer the option maturity date is to the earnings announcement, the greater the impact of the event on its value.

- In most cases, IV will go down after the earnings (“IV Crush”), often leading to a decline in the option premium.

Proximity to Earnings and Its Impact

Earnings announcements can play a big role in the value of options. The closer the expiration date is to the announcement, the more the event can affect the price of your option.

Think of it like a seesaw – the earnings announcement is the pivot point, and your option is on one end. Consider a call option: if the announcement is positive, your option might shoot up in value. On the other hand, if it’s negative, your option could lose value quickly. This effect is most pronounced right after the announcement.

The opposite is true for a put contract. If the market reacts negatively to the news, you may see an increase in the option value (and vice versa).

So, do options lose value after earnings? Yes, options can lose value after earnings, especially if the news is not what investors were hoping for. But remember, they can also gain value if the company reports good news. It’s all about the balance between expectation and reality.

Look for how the market reacts to EPS, forward guidance, and any other relevant news. These are the main indicators of how options will perform post-earnings.

Understanding the IV Crush

IV Crush is a sudden drop in Implied Volatility (IV) that can drastically reduce the price of an options contract. This phenomenon often occurs around earnings announcements. As traders anticipate these announcements, they drive up demand for options, inflating their IV.

After the announcement, uncertainty dissipates, and IV plummets – hence the “crush.” This can cause option prices to fall significantly, even if the underlying stock price doesn’t move.

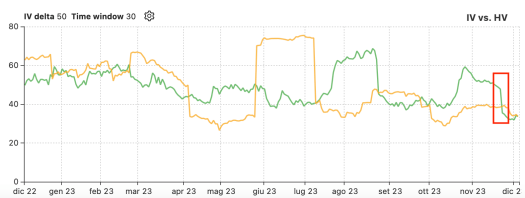

For example, NVDA options have recently experienced an IV crush after the latest earnings announcement, as you can see below from our option screener.

The drop in implied volatility, highlighted in red, was the market’s way of digesting the earnings announcement and realigning its expectations to the news. As NVDA approaches the next earnings announcement, IV will likely move up again as speculation will increase.

The Role of Speculation

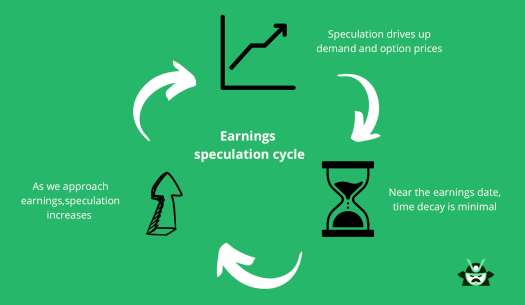

As earnings approach, speculation ramps up, often inflating options value. Traders bet on potential stock movements, driving up demand and option prices. This means that there is minimal time decay in options in the days leading to the earnings event. This “speculative premium” – which translates into higher IV – can greatly affect your earnings option strategy.

Understanding this dynamic between speculation and options value is crucial for successful options trading. Be mindful of these market nuances to make informed decisions.

Do Options Lose Value After Earnings?

In conclusion, if you’re wondering, “Do options lose value after earnings?” you should consider that the value of options can indeed decrease post-earnings primarily due to factors such as proximity to earnings and the phenomenon known as IV Crush. As we approach earnings, speculation can inflate the value of an option.

Furthermore, you should consider that the typical strong reaction of investors to earnings can easily push an option either out of the money or into it, a fundamental aspect to consider before entering a trade.