While you may often be tempted by a large gain on financial markets, it’s crucial to explore income strategy options that offer consistent and monthly returns. This article looks into trading options for income, highlighting the best option strategy for income. Find out more about four key strategies designed for consistent income, which are ideal options for monthly and weekly income generation.

Key takeaways

- Some popular income strategy options are Covered Calls, Bear Call Spreads, Bull Put Spreads, and Iron Condors.

- If your approach is neutral to directional (bullish or bearish), a Bear Call Spread or a Bull Put Spread will be income strategy options to consider.

- An Iron Condor will grant you the possibility to earn from a neutral market phase.

- The Covered Call is a neutral to bullish income strategy option for an investor who wants to use options to generate income from stocks they already own.

A Focus on Income Strategy Options

Income strategy options are essential tools you should add to your financial trading kit. These strategies focus on earning regular profits from premiums received when selling options contracts. The best option strategy for income varies according to individual risk tolerance, market outlook, and the specific financial instruments involved.

Covered Calls, one of the most common income strategy options, involve selling call options on stocks that are already in your portfolio. This strategy enables you to collect premiums and potentially sell your shares at a higher price. It’s a simple yet effective approach to generate consistent income, particularly when the market is flat or slightly bullish.

Bear Call Spreads take a different approach. This strategy involves selling a call option with a lower strike price, while simultaneously buying a call option with a higher strike price. This limits potential losses while allowing for income generation, making it a viable option strategy for consistent income, especially in a bearish market.

Bull Put Spreads, on the other hand, involve selling a put option with a higher strike price and buying another with a lower strike price. This put options strategy allows you to earn income while capping potential losses, making it suitable for bullish markets.

Lastly, Iron Condors combine both Bear Call Spreads and Bull Put Spreads, creating a range-bound strategy. This strategy generates income as long as the stock price stays within a certain range, making it a popular options strategy for monthly income.

Whether you’re considering a weekly options income strategy or looking for a more long-term approach, understanding these income strategy options can elevate your trading experience. By consistently selling options contracts and collecting premiums, you can generate income from options trading on a regular basis. In fact, you could a weekly options income strategy among those we’ll discuss in today’s article and replicate it based on your trading style.

We’ve recapped all the strategies mentioned in the article in the table below:

Trading Options for Income: The Covered Call Strategy

Trading options for income using the Covered Call Strategy is a simple, yet effective approach. As part of your income strategy options, this method involves owning stocks and selling call options against those stocks to generate additional income.

Here’s how this income strategy option works: You own 100 shares of a stock and then sell an at-the-money or out-the-money call option contract on those shares. This contract gives someone else the right to buy your shares at a fixed price (the strike price) before a certain date. You receive a premium from the buyer of the option, which can serve as a steady source of income.

The benefits of the Covered Call Strategy are significant. It reduces risk by lowering your cost basis for the stock. The trade will cap potential gains, but it will also let you earn a profit even in the case the market is flat or slightly bearish. Those who consider the Covered Call as the best option strategy for income normally praise its risk-mitigating features.

If the stock price remains above the strike price of the call option, you will earn a capped profit. However, if the stock price falls below the strike price, the call option expires worthless, allowing you to keep the premium (which will reduce the loss recorded on the shares you own).

Whether you’re looking for a weekly options income strategy or an options strategy for monthly income, the Covered Call Strategy provides a consistent income stream, making it a key player in options strategies for consistent income.

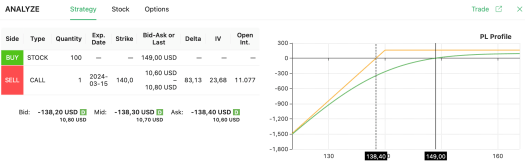

An Example of Covered Call

Let’s look into a practical example using Alphabet (GOOGL) to illustrate how income strategy options, specifically the Covered Call Strategy, can work in trading options for income.

Suppose GOOGL is currently priced at $149.00. You decide to buy some shares while aiming to limit your downside risk with a Covered Call Strategy. Our options screener suggests the potential of buying 100 shares and selling a $140 call contract.

This strategy requires GOOGL to close above $138.40 by the expiration date of the call option. If you examine the chart (refer to the image below), this level aligns with a recent support threshold, which interestingly was a resistance level just a few months ago.

It’s clear that volumes intensify around this threshold, indicating strong market interest and making crossing this level a challenge.

What we like about this strategy lies in its simplicity. As an investor, you’re essentially earning income from the premium received from selling the call option. This strategy fits the bill as one of the best option strategies for consistent income, be it a weekly options income strategy or an options strategy for monthly income.

So, if you’re seeking to generate regular income from your investments, this could be a viable trading idea to explore. By implementing this strategy effectively, you’re not only reducing your downside risk but also creating a consistent income stream.

The Bear Call Spread Strategy

The Bear Call Spread Strategy is another method within income strategy options. This credit spread option strategy targets bearish or neutral market conditions, aiming to profit from limited price movements in the underlying stock.

Unlike the Covered Call Strategy, which involves owning the stock, the Bear Call Spread Strategy focuses solely on options contracts. It doesn’t require you to own any shares of the underlying stock. This difference makes it a flexible strategy when trading options for income, especially if you don’t wish to commit to owning specific shares.

Here’s how it works: You sell call options at a lower strike price and simultaneously buy call options at a higher strike price. The premium received from selling the lower strike call options offsets the cost of buying the higher strike call options. The goal is for the stock price to stay below the lower strike price by expiration. If this happens, you keep the premium from the sold call options as your profit.

Whether you’re considering a weekly options income strategy or an options strategy for monthly income, the Bear Call Spread Strategy can be a good fit. It’s one of the best option strategies for consistent income, offering a balance of risk and potential returns.

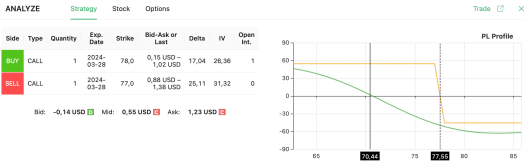

The Bear Call Spread – A Real-Life Example

Let’s consider Fortinet (FTNT), currently trading at $70.44. Suppose you think FTNT’s bull run is nearing its end, but you want to safeguard yourself if the stock price climbs higher. The Bear Call Spread Strategy could be your best bet.

Our options screener might suggest buying a $78 call and selling a $77 call. Essentially, you’d profit if FTNT closes below $77.55 by the expiration of your options.

Is this profitable scenario likely? A look at the chart (refer to the image below) might provide some clues.

FTNT’s price has been on an upward trajectory for the past three and a half months. You might anticipate a pause or even a reversal in this trend. Notably, $77.55 is a price threshold that FTNT reached previously, only to drop after a negative earnings report. It’s reasonable to assume that investors will pay close attention to this level, potentially creating a resistance that FTNT may find challenging to surpass initially.

If you believe in this scenario, your odds look good. This could be an excellent trading idea and a part of your income strategy options. Whether it’s trading options for income, seeking the best option strategy for income, or exploring option strategies for consistent income, this bear call spread example illustrates how these strategies can work in real-life scenarios.

The Bull Put Spread Strategy

The Bull Put Spread Strategy is a neutral-to-bullish income strategy option. It’s designed for a stable or rising market, allowing traders to profit from limited upward price movements of the underlying asset.

Differing from the Bear Call Spread Strategy, which is used in bearish or neutral market conditions, the Bull Put Spread Strategy is applied when you anticipate the asset’s price will remain above the higher strike price.

Here’s how it works: You sell put options at a higher strike price and simultaneously buy put options at a lower strike price. The premium collected from selling the higher strike put options helps offset the cost of buying the lower strike put options, thus generating income.

If the asset’s price stays above the higher strike price at expiration, both options expire worthless, and you keep the premium as profit. But, if the price dips below the lower strike price, losses will occur.

Whether you’re trading options for income, seeking the best option strategy for income, or pursuing option strategies for consistent income, the Bull Put Spread Strategy can be an effective part of your plan. It provides a defined risk-reward profile and can be tailored to various market conditions.

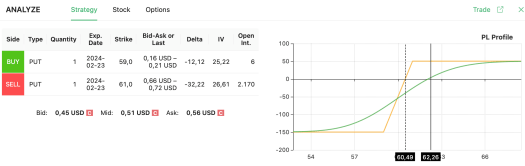

Understanding the Bull Put Spread with an Example

Let’s look at AstraZeneca (AZN), which is currently trading at $62.26, down from the $70 level a few weeks ago. If you anticipate this decline will halt, leading to a neutral or recovery phase, a bull put spread could be a viable income strategy option.

For instance, you may buy a $59 put and sell a $61 put. Essentially, you need AZN to close above $60.49 by options expiry for a profit.

Always review the stock’s price chart before trading. Currently, AZN’s price is lower than in previous months, indicating an oversold condition. This could be a promising trading idea when considering trading options for income.

The Iron Condor Strategy

The Iron Condor Strategy combines elements of the Bear Call Spread and Bull Put Spread strategies, making it a powerful income strategy option. It’s designed to profit from a range-bound market.

Here’s how it functions: You sell an out-of-the-money call and put option while concurrently purchasing a higher strike call and a lower strike put option. The key is to select different strike prices.

This income strategy option allows you to collect premiums from both options. If the underlying asset stays within a defined price range, you pocket the initial premium as profit. Even if you lose, you can only lose on one of the sides, so you get a higher potential profit to potential loss ratio. It’s a smart method when trading options for income, offering consistent returns (for instance, you could see this as a good weekly options income strategy).

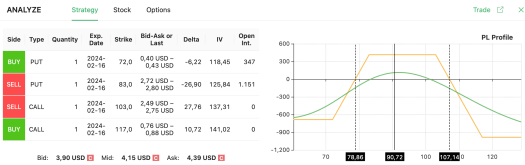

Example of How to Use the Iron Condor

Consider Shopify (SHOP), now trading at $90.72. Recently, it’s shown a strong upward movement. However, you believe the price rise will pause soon.

Here’s how to use the Iron Condor as an income strategy option:

- Buy a $72 put

- Sell an $83 put

- Sell a $103 call

- Buy a $117 call.

For a profitable outcome, SHOP needs to close between $78.86 and $107.14 by options expiry. Reviewing the stock chart, a pause in the current trend or even a reversal seems plausible. This method can prove effective when trading options for consistent, monthly, or weekly income. In general, you can see this approach as an interesting options strategy for monthly income.

So, which income strategy option is right for you? Never miss your market outlook when choosing:

- A neutral to directional market direction may work very well with credit spread options (i.e., either a bear call spread or a bull put spread, depending on your market outlook)

- You could choose to reduce the potential risks of owning stocks by evaluating the covered call strategy. It’s a smart way to produce additional income from the stocks you already own, and it’s a great option strategy for monthly income.

- For a more active approach, ponder the iron condor options strategy when anticipating a stable market with some volatility.