The Zebra option strategy simplifies managing directional risk in the market and represents a nice way to replicate stock ownership without heavy investments. Whether you lean bearish with a put Zebra or bullish with a call Zebra, this approach strips away extrinsic value for a more cost-effective and risk-managed trading experience, mirroring the benefits of married puts or calls, but with a twist. Today’s guide will tell you more about this strategy family.

Key takeaways

- The Zebra option strategy replicates stock ownership without requiring a high capital outlay. You can set up a bearish (put Zebra) or bullish (call Zebra) strategy.

- The Zebra strategy removes extrinsic value, which results in a cost-effective approach to capitalizing on market movements and includes inherent risk management with an integrated stop-loss feature.

- These strategies look like a simple married put or married call, only without extrinsic value.

Understanding the Put and Call Zebra Strategies

Zebra strategies are not so famous, yet they offer a relatively powerful approach for those looking to leverage market movements without the full risk of direct stock ownership. The first thing you should know is that the term “Zebra” is an acronym for “zero extrinsic value back ratio spread.”

The main idea of zebra option strategies is to utilize zero extrinsic value back ratio spreads to achieve a near-100 delta, making them an attractive choice for both bullish and bearish positions (in other words, this is clearly a directional strategy).

To execute a put zebra, the trader needs to:

- Buy 2 ITM puts

- Sell 1 ATM put (which will remove all extrinsic value)

Here is how it looks:

On the other side, to set up a call zebra you will:

- Buy 2 ITM calls

- Sell 1 ATM call (which will remove all extrinsic value)

These setups allow traders to mirror the profit and loss potential of owning or shorting 100 shares, but with significantly reduced risk and capital outlay. As you may easily guess, the put zebra will give you a profit in a sufficiently bearish market when you expect the stock’s price to decrease. This zero extrinsic value back ratio spread strategy acts similarly to a married call, where the maximum loss is limited to the debit paid upfront, and we go short on 100 shares of the underlying company.

The call zebra works exactly in the opposite way. You’ll open it if you are bullish on a particular stock, anticipating its price to rise. It works more or less like a married put, with the maximum loss capped at the initial debit, and we have a long position of 100 shares on the underlying company.

To understand the difference between the put and call zebra option strategy, you’ll pretty much need to focus on their directional assumptions and ideal market conditions for profit.

Put zebras are good in bearish environments with low implied volatility, allowing traders to bet against a stock with minimized risk. Call zebras are best suited for bullish scenarios, again with low implied volatility, enabling traders to capitalize on upward movements without the full financial exposure of buying shares outright.

What’s in it for you? With a zebra option strategy, you gain the ability to profit from significant stock movements—up or down—with a predefined risk level. Think of a stock that has moved up by a lot recently, with many people debating over its potential to reach even higher levels and a potential for excessive speculation. In these cases, a call zebra can still let you earn very good profits if the stock’s bullish run goes on, while it will reduce your losses if things go bad.

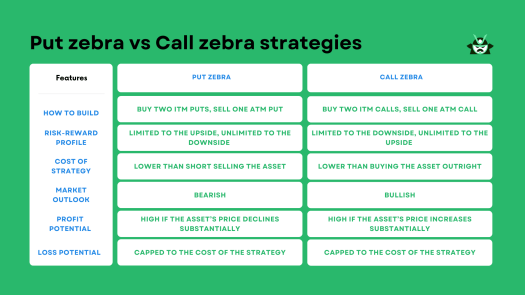

The table below will give you a quick comparison between a put and a call zebra option strategy:

How Zebra Strategies Relate to Married Calls and Married Puts

In the previous section, we mentioned that there is some sort of common ground between zebra strategies and married calls or puts. This is true, but the zebra option strategy stands out by offering a more cost-effective alternative to these traditional strategies.

The key difference lies in how a zebra option strategy avoids extrinsic value payments. When you set up a zebra strategy—be it a put or call—you’re essentially creating a position that mimics owning or shorting 100 shares of stock with a lower cost for you.

By buying two in-the-money options and selling one at-the-money option, you offset the extrinsic value completely. This means you’re not paying for the time value that typically comes with options.

Risk management is another good point to make about a zebra option strategy. Both married calls and puts include an element of protection for your stock positions, acting as a form of insurance against significant losses. However, zebra strategies go a step further by integrating this protective stop-loss feature directly into the setup. What we mean here is that this embedded stop-loss is achieved without requiring you to go long or short on any stocks, giving you a clear advantage over married strategies.

What about the time horizon of your investment? When considering long-term versus short-term investment horizons, zebra strategies offer flexibility that married calls and puts might not.

For short-term movements, a zebra can be set up with near-term expirations to capitalize on quick market shifts with limited risk. On the other hand, for those looking at longer-term positions, choosing zebra strategies with longer-dated options can mimic the experience of holding stocks due to a very high delta, but with reduced capital outlay and capped losses.

Its adaptability makes this zebra option strategy an attractive idea for traders and investors aiming for both short-term gains and long-term growth, offering a versatile tool in their investment toolkit.

So, in general, there are several upsides to married strategies, such as:

- You can base your strategy on a stock that has a dividend and earn the right to receive it

- You can risk less money in the trade.

We can say that what’s good about zebra strategies compared to the married setup is that:

- You will need less capital

- The breakeven price is closer

- The bear case is less risky.

An Example of Put Zebra

Let’s look at a practical example of the zebra option strategy in action, focusing on a put zebra setup with Tesla (TSLA) as our case study. Imagine you’ve been watching TSLA’s stock price trend downward over the past few months. You believe this trend will continue and want to capitalize on the potential further decline. However, you’re also keen on keeping your risk in check. This is where a put zebra option strategy becomes an attractive idea.

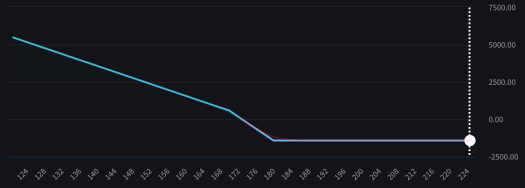

With TSLA trading around $170, you could buy two $180 puts (at $12.70) while selling one $170 put (at $5.60). Now, to better understand what we mean when we say that this strategy removes the extrinsic value, take a look at the numbers below:

- Intrinsic value of the $180 put = strike price – current price = roughly $10

- Extrinsic (time) value of $180 put = option premium – intrinsic value = roughly $2.70

- Intrinsic value of the $170 put = strike price – current price = roughly $0

- Extrinsic (time) value of $170 put = option premium – intrinsic value = roughly $5.60

Therefore, on one side, you are buying two options that have a combined extrinsic value of $5.40. On the other side, you’re selling an option with a $5.60 extrinsic value. If you subtract these values (because you’re buying one leg and selling the other), you will get with a near-zero extrinsic value for your strategy. You will rarely be able to bring this number perfectly to zero, but this is close enough to talk about extrinsic value removal.

Remember: this move is designed to mimic short-selling the stock without the need for a massive upfront capital investment or assuming unlimited risk. Note that, while we do not currently have this strategy in our options screener, we will soon launch a feature that will work like a custom scanner, giving you the opportunity to work with zebra strategies too.

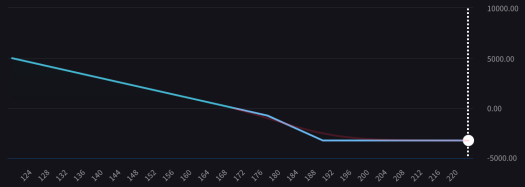

Here is what your P&L profile would look like:

What you may like about this setup is its risk-reward balance. Your losses are capped, specifically at $1,413 in this scenario, providing a safety net against market unpredictability.

The profit and loss (P&L) profile for this strategy is particularly appealing. While your losses are limited, your potential for gains remains open-ended. The higher TSLA falls below $180, the more profitable the trade becomes.

Note that for this strategy to break even, TSLA needs to close below $172.77 by the expiration of the options. If TSLA ends up above $180 when the options expire, you’ll face your maximum loss, which is a predetermined outcome you should be prepared for, given the strategy’s design. In any case, remember that options trading lets you benefit from different market scenarios, from bull to bear, and even in sideways markets (just think of what you can achieve with the iron butterfly option strategy.

An Example of Call Zebra

What about the opposite case, where we expect a stock price will move up? This is where the call zebra option strategy comes into play. Let’s use Nvidia (NVDA) as a real-world example to illustrate how this strategy works. With NVDA’s stock price on an upward trend for several months, you might want to bet on its continued rise but also cap your potential losses. A call zebra looks like a promising strategy under these circumstances.

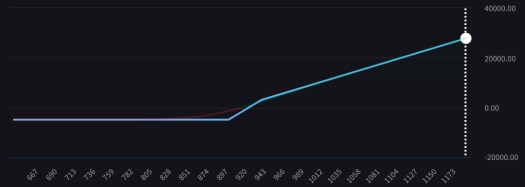

For instance, with NVDA trading at approximately $920, you could set up a call zebra by buying 2 $900 calls and selling one $940 call. This structure allows you to closely replicate the profit potential of having 100 shares of NVDA, but without the full financial commitment and with a predefined risk limit. Remember: another great way to limit your risk (usually with a very high profit ratio potential) is to follow the way we normally use the broken wing butterfly option strategy.

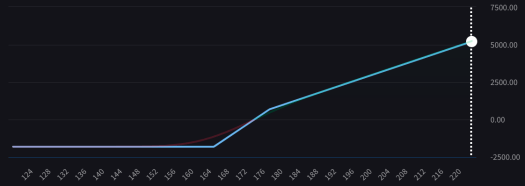

The profit and loss (P&L) profile for this strategy is shown below.

It effectively caps your losses at $4,875 (the amount you will lose if NVDA closes below $900 by the time your calls expire), giving you a safety net against adverse market movements. On the other side, you can see that the call zebra option strategy gives you the potential for unlimited returns if NVDA’s stock price continues to climb.

To break even on this trade, NVDA needs to close above $922.95 by the time your options expire. Beyond this breakeven point, your profit increases linearly with NVDA’s price rise, offering a lucrative opportunity if the stock performs well.

Therefore, the main appeal of a zebra option strategy compared to the mere idea of going long or short on a stock lies in its risk-reward profile, adaptable nature, and capital efficiency. As we mentioned above, the zero extrinsic value back ratio spread strategy can be even preferable to the classic married calls and puts in many cases, due to the fact that, as we have mentioned multiple times, you will never need to own a long (or short) stock position to execute a zebra strategy.

This is a great article and the main thing that caught my eye was eliminating extrinsic value. Meaning the cost is cheaper automatically to me, that’s where of the cost comes in, in price, what we think will happen going forward being priced in. Buying the 2 itm options then selling one to help finance the purchase. Lowing your exposure/risk ..