This article outlines how the Iron Butterfly Option Strategy works, including the short iron butterfly and long iron butterfly variations, provides tips for successful trading with it, and explores features offered by Options Samurai that can enhance trades using this strategy. We’ll also have the time to explore an iron butterfly example, giving you a practical application of the strategy.

Key takeaways

- The Iron Butterfly option strategy (Ironfly) is a popular advanced trading strategy that options traders use. It provides low risk and high-profit ratio

- The Iron Butterfly option strategy is designed for declining Implied Volatility and stable underlying asset prices.

- The Iron Butterfly spread differs from a regular Butterfly spread in terms of strike prices and risk profiles.

How to Use the Iron Butterfly Option Strategy

The Iron Butterfly option strategy is a powerful tool used by options traders to capitalize on low volatility and stable underlying asset prices. It has a low and defined risk, Especially when compared to the potential profit, so users often use it to make bets on where the asset will be at expiration. To effectively implement this strategy, it’s essential to understand the steps involved, as we explain in the subsections below.

Selecting the Underlying Asset and Options Contracts

To use the Iron Butterfly option strategy effectively, the first step is to carefully select the underlying asset and the appropriate options contracts. Look for an asset with a relatively stable price movement and declining volatility, as this strategy thrives in such market conditions. Choose the strike prices that you expect the stock to move to at expiration, as this will be the point of maximum profit.

Constructing the Iron Butterfly Position

Once you have selected the underlying asset and the options contracts, the next step is to construct the Iron Butterfly position.

To implement the Iron Butterfly option strategy, you can start by selling both a call option and a put option on the same strike price. Simultaneously, buy a call option and a put option at the same distance from the strike price. This creates a position known as an Iron Butterfly.

While the symmetrical version involves all options having the same expiration cycle, it’s essential to note that the strategy can be customized to fit your specific expectations. You can use non-symmetrical variations to tailor the risk profile to your preference, and Options Samurai provides tools to assist you in achieving this.

An Example of an Iron Butterfly Trade

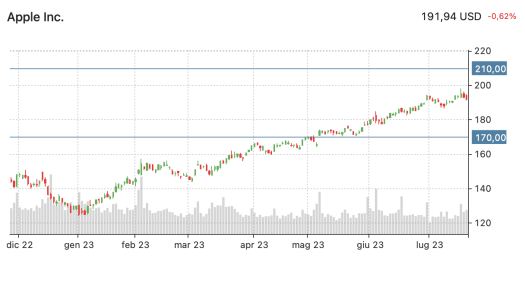

To better understand the workings of the Iron Butterfly option strategy, Let’s use an Example: Let’s look at Apple, which currently trades slightly above $190. Let’s assume the stock price will remain within a specific range, like $170 and $210.

Based on the expected price range for AAPL, you could opt for the following four options contracts, all with the same expiration date:

- Buy 1 Apple Inc. Put Option with a strike price of $185.

- Sell 1 Apple Inc. Call Option with a strike price of $190.

- Buy 1 Apple Inc. Call Option with a strike price of $190.

- Buy 1 Apple Inc. Call Option with a strike price of $195.

With these options, you would receive a net credit when initiating the strategy. The net credit is the difference between the premiums received from selling the $190 call and the $190 put and the premiums paid for buying the $185 put and the $195 call. The goal is to collect as much credit as possible as you will probably buy to close at the end.

The Iron Butterfly option strategy has specific profit and loss zones. The maximum profit occurs if Apple’s stock price is exactly at the $190 strike price of the sold call and put options. Conversely, the maximum loss occurs if the stock price deviates significantly from the protective strike prices ($185 and $195).

As the expiration date approaches, it’s essential to closely monitor Apple Inc.’s stock price. If the stock price remains within the range of the initial strike prices ($185 to $195), the trader can close the trade early to secure a profit. Most brokers allow closing an Iron Butterfly trade with a single order.

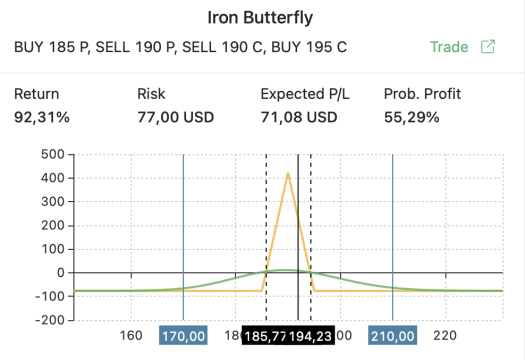

Evaluating the Scenario with the Samurai App

To assess the potential outcome of this Iron Butterfly option strategy, you can utilize the Samurai app. In this example, you have a 55% probability of achieving a 92% return on your investment.

The Samurai app allows you to experiment with different scenarios, strike prices, and expiration dates, giving you valuable insights into the strategy’s potential performance under various conditions.

As shown in the graph above, you can see various scenarios:

- Scenario 1 – Apple’s Stock Price is Below $185: When Apple’s stock price falls within the range of $170 to $185, the trader will incur a loss. The loss would be a result of the difference between the stock price and the sold call option at $190.

- Scenario 2 – Apple’s Stock Price is Between $185 and $195: The Iron Butterfly strategy achieves its maximum profit potential when Apple’s stock price remains precisely at the $190 strike price of the sold call and put options. In this range, the trader will realize the highest return and the options sold at $190 will expire worthless.

- Scenario 3 – Apple’s Stock Price is Above $195: If Apple’s stock price rises above the upper boundary of the expected range ($195), the Iron Butterfly strategy might not be as profitable. The trader would experience a loss due to the difference between the stock price and the higher strike call option ($195).

By executing the Iron Butterfly trade, we aim to benefit from the expected low volatility and limited price movement of AAPL within the specified range, capturing the maximum profit potential if our assumptions hold true.

What’s the Difference Between an Iron Butterfly Options Strategy and a Regular Butterfly Spread?

The Iron Butterfly option strategy and the Regular Butterfly Spread are two distinct options trading strategies, each with unique characteristics:

Iron Butterfly:

- Uses both put options and call options.

- Involves selling one at-the-money (ATM) call option and one ATM put option with the same strike price (short legs).

- Consists of buying one call option with a higher strike price and one put option with a lower strike price (long legs).

- It is a credit strategy.

Regular Butterfly Spread:

-

- Uses either all-call options or all-put options.

- For a call butterfly spread: buy one lower strike call option, sells two ATM call options, and buy one higher strike call option.

- For a put butterfly spread: buy one higher strike put option, sell two ATM put options, and buy one lower strike put option.

- It is a debit strategy.

Both strategies offer limited risk and reward potential, with maximum profits achieved when the underlying asset’s price remains close to the sold options’ strike price.

Traders often prefer executing calls/puts butterfly spreads with out-of-the-money (OTM) options due to bid-ask spread and liquidity considerations.

In summary, the Iron Butterfly option strategy uses both calls and puts and is a credit strategy, while the Regular Butterfly Spread uses only puts or calls and is a debit strategy. These strategies are designed to profit from minimal price movements in the underlying asset.

Short Iron Butterfly Option Strategy

The Short Iron Butterfly option strategy represents the more common variation of the Iron Butterfly and is widely used when traders seek to profit from minimal asset volatility. This strategy is often associated with a range-bound outlook, anticipating that the asset’s price will stay inside a specific range until expiration.

Unlike its counterpart, the Long Iron Butterfly, which may have a directional bias depending on the positioning of the strategy relative to the current stock price, the Short Iron Butterfly is considered more neutral in its approach.

When setting up the butterfly above the current stock price, it can be seen as having a bullish bias, while positioning it below the stock price can be viewed as bearish. However, the primary goal of the Short Iron Butterfly is to benefit from low asset volatility, regardless of its initial positioning.

Long Iron Butterfly Strategy

The Long Iron Butterfly option strategy is a mirror image of the Short Iron Butterfly option strategy. Basically, it aims to profit from high volatility and will show profit everywhere ‘except’ a very narrow range. However, the profit is very low compared to the max loss (meaning a low profit ratio).

Long Iron Butterfly is a marriage of bull call spread and bear put spread: Buy call and put on the same strike, and sell put and call the same distance. The maximum profit occurs if the stock price is above the highest strike price or below the lowest strike price at expiration. Due to the strategy’s complexity, relatively small profit potential, and higher costs, it is not ideal for most traders.

Advantages and Disadvantages of Using the Iron Butterfly Strategy

Let us mention the main pros and cons you should consider before using the Iron Butterfly Option Strategy.

Advantages of the Iron Butterfly Strategy

The Iron Butterfly option strategy offers several advantages to options traders:

-

-

-

- Limited risk with attractive profit potential: The Iron Butterfly option strategy boasts a well-defined risk-reward profile, offering traders the advantage of limited risk. The maximum risk is confined to the initial cost of establishing the position. Furthermore, this strategy often presents an appealing profit ratio, indicating the potential for higher profits compared to the risk involved. Traders can assess the risk-reward dynamics beforehand, making it easier to evaluate the trade’s attractiveness before implementation.

- Benefit from time decay within the profit range: The Iron Butterfly strategy capitalizes on time decay, primarily within the profit range. As time passes, the value of the options erodes, potentially resulting in a profit for the Iron Butterfly Options Strategy. However, it’s important to note that if the underlying asset price moves outside the profit range, the time decay can work against the trader, leading to potential losses.

- Can be used in a range-bound market: The Iron Butterfly strategy is particularly effective in a range-bound market, where the underlying asset price is expected to stay within a specific range. Traders can capitalize on the lack of significant price movement and generate profits from the options’ expiration.

-

-

Disadvantages of the Iron Butterfly Strategy

While the Iron Butterfly strategy offers benefits, there are also some considerations to be aware of:

-

-

-

- Limited profit potential: The Iron Butterfly strategy’s profit potential is confined. The maximum profit is achieved when the underlying asset price remains within the specified range at expiration..

- Small profit range: The Iron Butterfly strategy offers a very narrow profitable range for the trader. Although there is potential for profit within this range, it is relatively small. The trade becomes less profitable if the underlying asset price moves significantly beyond the anticipated range, making it crucial for traders to manage their positions diligently.

-

-

Tips for Trading with the Iron Butterfly Options Strategy

Successfully trading with the Iron Butterfly option strategy requires careful consideration and strategic decision-making. Here are some tips to enhance your trading approach.

Understand the Market Conditions

Before implementing the Iron Butterfly option strategy, it is crucial to understand the market conditions. Assess factors such as volatility, trend direction, and upcoming events that could impact the underlying asset. A clear understanding of the market conditions will help you align your Iron Butterfly with the current environment.

Properly Assess Risk-Reward Ratio

Evaluate the risk-reward ratio of your Iron Butterfly trade. Ensure that the potential profit justifies the risk taken. Strive for a favorable risk-reward ratio that aligns with your trading goals and risk tolerance.

Consider Adjustments and Exit Strategies

Be prepared to make adjustments to your Iron Butterfly position if the market conditions change. Monitor the performance of the trade and have predefined exit strategies in place. Consider potential adjustments like rolling the options, closing the position partially or fully, or adding protective options to manage risk.

Samurai – How to Enhance Your Trades with the Iron Butterfly Strategy

The Samurai app offers unique features that can enhance your trading experience with the Iron Butterfly option strategy. Here are some examples:

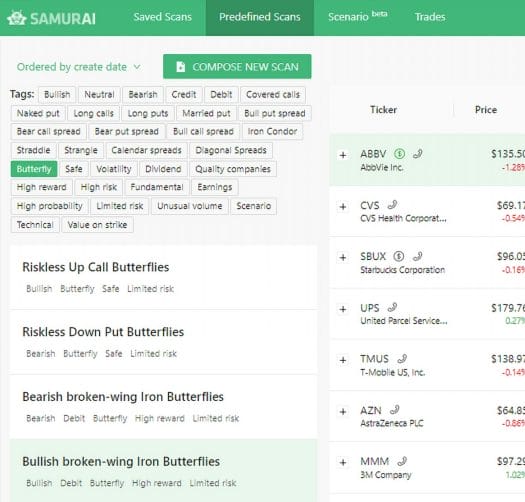

Butterfly Scans and Analyze Results

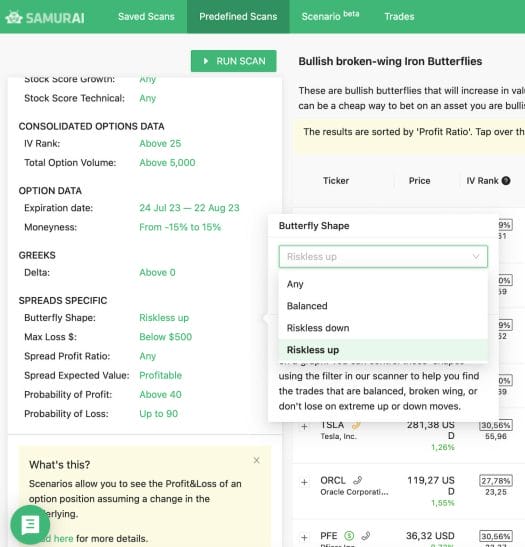

Options Samurai supports Butterfly scans within its app. By accessing the “Predefined Scans” section and selecting the “Butterfly” tag, you can explore various butterfly options predefined strategies. This can help you start your scan and give you ideas on what to look for.

The app also provides detailed results for each scan, including information such as tickers, prices, volatility ranks, expiration dates, Greeks, probabilities of loss and profit, and more. This allows you to identify potential trade opportunities and analyze them based on your preferred parameters.

Optimize the Butterfly: The Shape Feature

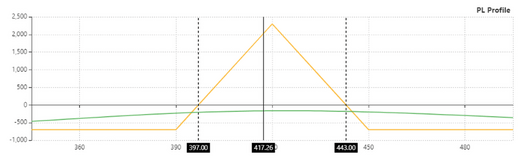

One of the standout features of Options Samurai is the “shape” filter. The shape refers to how the option strategy (in our case, the Iron Butterfly Option Strategy) appears on a profit and loss (P/L) chart.

The app provides four shape options:

-

-

-

- Any: This option scans for the optimal trade, regardless of the shape. It typically results in a broken-wing butterfly with a different loss profile for the calls and puts.

- Balanced: With this selection, the app scans all possible strategies, ensuring that the maximum loss is identical for both the calls and puts.

- Riskless Up: This option allows you to build a broken-wing butterfly strategy with a directional bias that cannot lose on the upside.

- Riskless Down: Similar to the riskless up option, this choice enables you to construct a broken-wing butterfly strategy with a directional bias that cannot lose on the downside.

-

-

By utilizing the shape feature, you can customize your Iron Butterfly option strategy based on your desired risk profile, directional bias, and potential profit opportunities. This can mitigate some of the risks (for example, if you want to protect from a large move up, you can choose the ‘riskless-up’ shape).

Read more about the shape feature in our dedicated article.

Conclusion: The Iron Butterfly Options Strategy

The Iron Butterfly strategy can be a powerful tool for traders who are looking to capitalize on range-bound markets. However, there are some considerations that must be taken into account, such as the limited profit potential and sensitivity to changes in volatility.

In order to maximize success when trading with the Iron Butterfly Options Strategy, it is important to understand market conditions, properly assess risk-reward ratios, and have exit strategies in place.

Sign up for a free two-week trial of Option Samurai to try all our features, including our Butterflies scanners, scenario, analysis, and more.

[…] August 23, 2023 @ 09:07 Shogun […]

Thanks