While many strategies in options trading rely on a perfectly symmetrical setup, the broken wing butterfly option strategy introduces a degree of asymmetry to manage directional risk. This method changes the traditional butterfly spread to offer potentially higher returns with controlled risk. In its credit and, especially, debit form, this strategy represents a potential great addition for your trading toolkit. Let’s learn more about this strategy in today’s guide.

Key takeaways

- The broken wing butterfly option strategy is a trading setup that modifies the traditional butterfly spread for potentially higher returns with managed risk.

- In its credit form, it’s a great strategy in markets that are slightly directional with options having a high implied volatility, as a high IV rank will correspond to a high premium you can collect.

- In its debit form, you can have a high profit-to-loss ratio, building a very cheap option strategy with a directional bias.

First Things First: What Is the Regular Butterfly Option Strategy

Before looking at the broken wing butterfly option strategy, it’s essential to understand what constitutes a standard Butterfly strategy.

It’s a risk-managed, non-directional options strategy aimed at providing investors with potential profit when the volatility of an asset changes. This strategy combines elements of both bear and bull spreads, offering limited risk and capped profit potential. In an ideal scenario, you will want an asset’s price to remain stable before the expiration of the options, ensuring maximum payoff under these conditions.

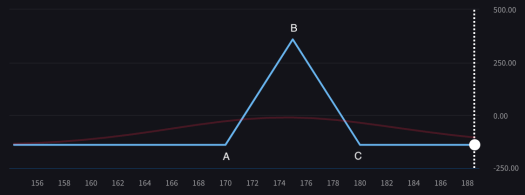

So, how do you build a butterfly option? It’s quite easy, here’s what you need to do:

- Leg A: You buy a lower strike call (or put)

- Leg B: You sell two higher strike calls (or puts)

- Leg C: You buy an even higher strike call (or put)

Note that you want to build a symmetrical strategy here: the strike of leg b should stand at the middle of the other two strike prices., building the strategy’s typical “butterfly” shape:

Note that you’ll want the stock price to close at the strike prices of the leg B. In the worst case scenario (below the strike price of leg A or above that of leg C), your losses will still be capped.

Breaking the Symmetry – What’s the Appeal of the Broken Wing Butterfly Option Strategy?

Many traders like the symmetry of the standard butterfly strategy, so why would you want to “break” this structure?

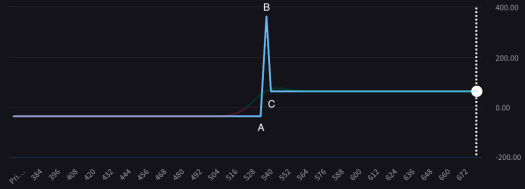

The broken wing butterfly option strategy tweaks the conventional approach to give you an edge. Here’s how you do it:

- Leg A: You buy a lower strike call (or put)

- Leg B: You sell two higher strike calls (or puts)

- Leg C: You buy an even higher strike call (or put), but in a way that the strike prices of leg B are no longer at the mid-point between legs A and C

Here is how it looks:

What stands out about the broken wing butterfly spread is how it changes the original butterfly: low cost paired with high-profit potential that reduces or even eliminates risk on one side of the trade.

This asymmetric advantage makes the call broken wing butterfly (as shown above), including its variant, the put broken wing butterfly, not just a defensive play but also a great bet on market direction (perhaps one of the cheapest ways to bet on a direction with options).

For traders asking, “What’s in it for me?”, the answer is easy to find. It’s a cost-effective way to speculate on market movements, combining the protective benefits of the traditional butterfly with an improved risk profile.

In essence, the broken wing butterfly option strategy allows traders to aim for significant returns without exposing themselves to undue risk. This mix of safety and potential profitability (you could easily build a broken wing butterfly with a profit-to-loss ratio higher than 1,000%) is what makes the broken wing butterfly an attractive choice for those looking to get more from their options trading activities without taking on excessive risk.

Credit or Debit – Which Side Should You Choose?

A little known fact about the broken wing butterfly option strategy is that it can be both built as a credit and as a debit trade.

Most traders lean towards setting it up as a credit strategy. While this is not our top choice, this approach works well for many. Think of it like a ratio spread but with defined risk.

This strategy combines a debit spread and a credit spread, where the credit part is wider and fully pays for the debit spread part. Going for a net credit means aiming to increase your chances of making a profit without spending any money upfront.

So, if the whole spread expires worthless, you’re not losing cash. Generally, traders enter this trade for a tiny credit, and you may very well choose to close the trade for half of the maximum profit. This happens when the option nearest to the stock price becomes in-the-money (ITM) as the expiration date nears. To estimate this, just take the distance between your nearest long option and the short options and divide it by two.

However, we really prefer the debit version of the broken wing butterfly. This setup allows for a trade with an impressive profit-to-loss ratio, still cuts out risk in one direction, and usually only needs a slight stock movement to achieve maximum profit.

Our next look involves two specific strategies from our options screener: the “Riskless Up Call Butterflies” and the “Riskless Down Put Butterflies”. These perfectly match the debit broken wing butterfly strategy, offering very attractive profit-to-loss ratios.

Bullish Case – Riskless Up Butterfly Example

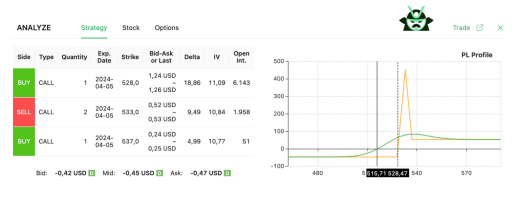

An example will help us explain the effectiveness of the debit broken wing butterfly option strategy. Let’s begin with a bullish market scenario.

Consider the SPDR S&P 500 ETF Trust (SPY), a popular choice among traders for its liquidity and representation of the U.S. stock market. With SPY positioned at $515.71, employing the broken wing butterfly could give you profitable opportunities. Through our option screener (we have a scan called “Riskless Up Call Butterflies” that you may want to check out), you could choose to do the following:

- Buy a $528 call.

- Sell two $533 calls.

- Buy a $537 call.

This trade sets a breakeven point at $528.47. Should SPY’s price dip below this threshold, your losses are limited to a mere $47, making this strategy appealing for its protective downside, as you see below.

What we like here is the trade’s bullish potential, compared to the small loss we may face. If SPY hits exactly $533 at expiration, you could have a maximum profit of $453. Beyond this level, though profits decrease, you won’t face a loss in the bullish scenario (remember that, if you’re ok with a limited loss and want an uncapped profit potential, the zebra option strategy may be another great trade idea to consider).

Your profit will decrease until SPY reaches $537, and above this level, you will still have the guarantee of a decent $53 earning (which is still more than what you risked losing). This characteristic effectively eliminates upward risk, which is probably the main advantage of the broken wing butterfly spread.

Given SPY’s historical bullish trajectory, betting on its continued ascent doesn’t seem far-fetched. The $528.47 target may well be within reach. However, it’s crucial to keep an eye on the market.

Wall Street is susceptible to sudden shifts driven by macroeconomic factors or unexpected political developments. Such events can trigger a market downturn, reducing your profit likelihood.

So, what did we learn about the bullish broken wing butterfly option strategy?

- Your maximum profit will occur if and when the underlying security hits the short strike price.

- The loss risk is limited to a fraction of your maximum profit, giving you a high reward-to-risk ratio.

- You can use this strategy when stock prices are steady or trending up with decreasing implied volatility.

Remember that there are many good trade ideas that can work in a bullish scenario, just as we explained with the jade lizard options strategy.

Bearish Case – Riskless Down Butterfly Example

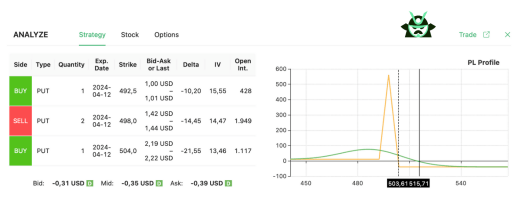

As you may guess, we can build a similar trade compared to the one we mentioned earlier for a bearish scenario (this would be a “put broken wing butterfly”). Focusing, once again, on SPY, a broken wing butterfly option strategy, can give you interesting opportunities.

Suppose you do the following, expecting a downward correction:

- Buy a $492.5 put.

- Sell two $498 puts.

- Buy a $504 put.

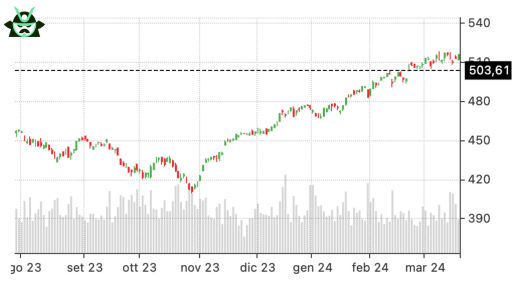

The number to watch here is $503.61—your breakeven price (as you see in the profit and loss profile above). Should SPY’s price hover above this threshold, you’re looking at a minimal loss of $39 with this broken wing butterfly spread.

But what happens to your put broken wing butterfly if the market moves down, like you anticipate? Your profit peaks at $561 if SPY settles at $498 at expiration. Dip below this level and your gains will decrease until SPY reaches $492.5, beyond which you will still pocket a modest $11 (which should be enough to cover an average trading fee, at least). Note that with a relatively simple trade, the downward market risk is completely eliminated.

Given SPY’s bullish trajectory in recent months, skepticism towards a continued rise on your side may be understandable.

This may work for a Presidential Election year, for instance, which is historically known for market underperformance. The $503.61 breakeven doesn’t seem so distant in such cases, making our broken wing butterfly option strategy something to consider.

So, once again, what did we learn about the bearish broken wing butterfly option strategy?

- The underlying security needs to hit the short strike price for you to make maximum profit.

- You can accept a limited loss in exchange for a relatively high reward-to-loss ratio.

- This strategy performs well when prices are steady or trending down with declining implied volatility.

What we learned today is that you can easily remove either upside or downside risk from your trades with the broken wing butterfly option strategy, as long as you’re willing to sacrifice some of the potential profits. Now, if this sounds like a familiar rhetoric, that’s because it is. Option trading has always been about finding the balance between risk and reward – but with broken wing butterflies (especially in the debit form), you can achieve this balance more strategically.

HOW ABOUT AN OUT OF THE MONEY CALL CALENDAR FOR THE BULLISH STRATEGY AND OUT OF THE MONEY PUT CALENDAR FOR THE BEARISH STRATEGY

Yes, we also have a couple of predefined scans on the website for calendar spreads, and we set the moneyness of the call calendar above the stock price for the call/bull case (and below the stock price for the put/bear case). Also, in this case, our scans look for large differences in IV between the trade legs. But the thing about broken wing butterflies is that they can sometimes give you a profit ratio that is much larger compared to calendar spreads + remove the directional risk on one side. Thanks for your comment