Every time the earnings season rolls around, an effective earnings option strategy becomes crucial. This article will guide you on the best option strategy for earnings, teach you how to trade earnings with options and explore the role of earnings play options.

Key takeaways

- Common earnings option strategies include long straddles, short straddles, short strangles, and iron condors.

- As a stock moves closer to its earning days, speculation grows together with its options’ implied volatility (IV). In most cases, after the earnings are announced, IV suddenly drops, leading to the so-called IV crush.

How to Trade Earnings with Options

When it comes to trading earnings with options, a well-crafted earnings option strategy is crucial. Understanding the best option strategy for earnings involves knowing when to employ different approaches like long straddles, short straddles, short strangles, and iron condors.

A long straddle, for instance, can help you profit from significant price movements regardless of direction. On the other hand, short straddles and short strangles work best when you expect minimal price fluctuations.

Iron condors, meanwhile, are ideal for range-bound markets. By mastering these, you can effectively harness earnings play options to maximize your potential returns. Let us look at each of these cases below.

To reiterate, the choice of earnings options strategy depends heavily on your market expectations. The following table summarizes the strategies we’re going to study in this article:

Long Straddles

A long straddle is a key component of a well-rounded earnings option strategy. It’s a versatile approach that can be particularly useful during earnings season when stock volatility tends to spike. This earnings option strategy involves buying a call and a put option on the same stock, with identical strike prices and expiration dates. This setup allows you to profit from significant price movements in either direction.

In essence, a long straddle is betting on volatility. It doesn’t matter if the stock price goes up or down as long as it moves significantly from the strike price.

If the stock price stays close to the strike price, the strategy could result in a loss as both options expire worthless. Therefore, this pre-earnings option strategy is best suited for situations where you expect big price swings (much bigger than expected by the market).

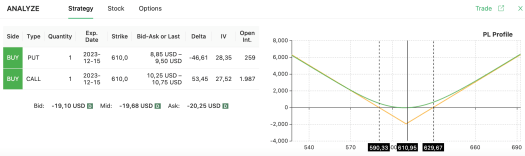

Let’s take a real-world example to illustrate the earnings option strategy using a long straddle. Imagine you’re examining Costco Wholesale (COST), which is currently trading at $610.95. You’re interested in profiting from its upcoming earnings announcement and have decided to implement a long straddle.

Using an option screener like Option Samurai, you find that buying both a put and a call at a $610 strike price might be a suitable approach (as shown in the image below). In simpler terms, for this strategy to be profitable, COST needs to either rise above $629.67 or fall below $590.33 by the time the options expire. This represents a roughly 3% movement in either direction.

To increase your chances of success, you should review how the market has historically reacted to COST’s earnings announcements. If the average price variation exceeds 3%, then this long straddle could potentially be a lucrative earnings option strategy.

Remember, the best option strategy for earnings is one that aligns with both the historical performance of the stock and your personal risk tolerance and market views. The key is to understand how to trade earnings with options and use this knowledge to make informed decisions about your earnings play options.

Short Straddles

A short straddle is another versatile earnings option strategy that can be particularly useful during the earnings season. This strategy involves selling a call and a put option on the same stock with identical strike prices and expiration dates. While long straddle profits are from significant price movements in either direction, short straddle profits occur when the price of the underlying stock trades in a narrow range near the strike price.

The ideal forecast for this approach is neutral or minimal volatility. This is because you, as the seller of the options, want them to expire worthless so you can retain the premium you received when you sold them.

If the stock price moves significantly away from the strike price, your potential losses could be substantial. Therefore, this earnings option strategy is best suited for situations where you expect the stock price to remain relatively stable.

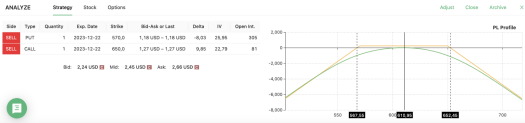

Once again, let us see a quick short straddle example on COST. Remember, COST was trading at $610.95 when this article was written. Suppose you believe the earnings news will pull the stock price back to $600, a psychological level you think the market will test post-announcement. So, you short a call and put at the $600 strike price (refer to the image below).

Looking at the stock chart, in simple terms, we need COST to stay close to $600, or at least between $575.40 and $624.60, by the time the two option contracts expire. If you think the market is generally accurate at pricing COST and that a large movement post-earnings is unlikely, a short straddle could add value to your portfolio.

This earnings option strategy can be particularly effective when you have an idea of a likely price threshold post-earnings (in this case, $600) and want to allow some room for the stock to fluctuate around this value. It is also important to note that you would probably close this strategy early, so knowing when to enter and having a view of the range is important. Therefore, understanding how to trade earnings with options and selecting the best option strategy for earnings can significantly impact your trading outcomes.

Short Strangles

The third case we want to look into is the short strangle, a crucial part of any robust earnings option strategy. This approach involves selling an out-of-the-money call and an out-of-the-money put option on the same stock with the same expiration date but different strike prices. The short strangle strategy is similar to the short straddle; however, it offers slightly more leeway for price movements.

Like the short straddle, the short strangle profits when the stock price stays relatively stable. By selling options that are out-of-the-money, you’re betting that the stock price won’t reach these levels by expiration.

If your prediction holds true, both options expire worthless, and you keep the premium received from selling them. However, if the stock price moves significantly, potential losses can be substantial. Therefore, this earnings option strategy requires careful risk management.

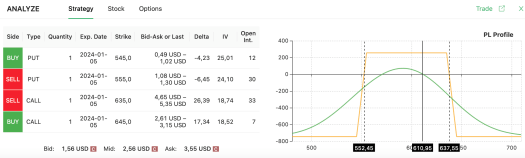

Consider COST once more. Suppose you’re eyeing potential profits from its earnings announcement, and you opt for a short strangle, which some may deem safer than a short straddle. Let’s keep this simple: you believe that COST will not swing more than 5% (up or down) post-earnings, prompting you to short a $570 put and a $650 call (refer to the image below).

Essentially, we’re saying the stock price at expiration needs to fall between $567.55 and $652.45. If you view this scenario as extremely likely, this could be a solid trade idea. Another small benefit of this strategy is that it is a relatively easy strategy to manage (roll, close one side, etc.) as there are only 2 sold options, and in most assets, the liquidity will allow you to manage the position with a relatively small friction.

However, it’s crucial to remember that selling options can lead to losses exceeding 100%, depending on the margin your broker accepts. Selling both calls and puts also increases the chance of a substantial loss when unexpected events happen.

Iron Condors

There’s another earnings option strategy you should know when it comes to trading during earnings season – the iron condor. An iron condor is a directionally neutral, defined risk strategy that profits when the underlying stock trades in a specific range through the expiration of the options. It involves selling an out-of-the-money call spread and an out-of-the-money put spread on the same stock. The goal is to have the stock price stay between the two spreads, allowing you to keep the premium received from selling them.

The beauty of this earnings option strategy lies in its ability to profit from minimal stock movement, time decay, and decreasing volatility. This makes it a popular choice for traders during earnings season, where unpredictable price swings can make other strategies risky.

However, like all strategies, iron condors aren’t without risk. If the stock price moves significantly, it could result in losses (that are usually bigger than the gains). Therefore, it’s crucial to monitor market trends and adjust your positions as needed.

Let’s again consider COST. You want to open a position to potentially profit from its earnings announcement, and you decide on a short strangle, having heard it’s safer than an iron condor. The potential for unlimited loss in simpler strategies is too risky for your liking. By using the options screener feature mentioned earlier, you find that you could buy a $545 put, sell a $555 put, sell a $635 call, and buy a $645 call.

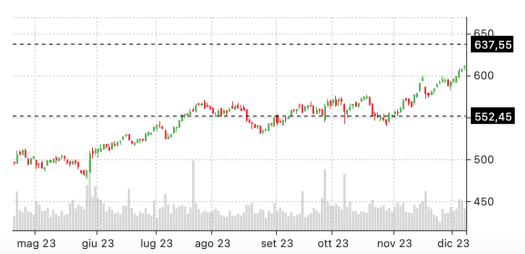

This might sound complex, but let’s simplify: the stock price at expiration needs to be between $552.45 and $637.55 (refer to the stock price chart below). The key difference compared to the previous short strangle scenario is that now your loss potential is capped.

This earnings option strategy can be an effective way to trade earnings with options. It could be considered the best option strategy for earnings if you’re seeking to limit potential losses. However, like all earnings play options, it comes with its own set of risks and rewards, so it’s crucial to understand these before entering a position.

How to Trade Earnings with Options – Is It Better to Stay Directional or Non-Directional?

When considering how to trade earnings with options, one critical question arises: should you stay directional or non-directional? In the volatile environment of earnings season, staying non-directional can often be a safer earnings option strategy. This approach involves avoiding big directional bets unless there’s a compelling reason to take a clear stance.

Many traders prefer to review historical data to inform their strategies. They might examine the average percentage movement of a stock after earnings and position themselves accordingly. For instance, if a stock’s average reaction to earnings has been a 5% shift in either direction, setting up a strategy that profits if the stock price moves less than 7% (up or down) could be profitable. This kind of non-directional strategy can offer a buffer against unexpected price movements, making it a popular earnings option strategy.

Of course, there is potential to make significant profits with a directional bias (you may wonder, for instance, “Do options lose value after earnings?”), but this approach requires more than just a hunch. You’d need solid reasons to justify your position, such as robust fundamental analysis, competitor news, or other relevant factors. This kind of well-informed directional play can sometimes be the best option strategy for earnings, but it also carries more risk.

Earnings Play Options – A Look at Different Trading Outcomes

When employing an earnings option strategy, there can be a range of outcomes after earnings are released. If the stock price stays within the anticipated range, your options might expire worthless, and you pocket the premium as profit.

Conversely, if the stock swings wildly, you could face losses if you did not choose to follow a long straddle strategy. It’s essential to have an earnings option strategy to manage these potential scenarios.

One tactic is rolling options. This involves closing your current position and opening a new one with a later expiration date, sometimes at a different strike price.

Rolling options can help manage positions that aren’t performing as expected, offering more time for the stock to move favorably and allowing you to collect additional premiums.

Trading earnings with options demands careful analysis and thoughtful strategy selection. Whether you’re using straddles, strangles, or iron condors as your earnings play options, understanding the possible outcomes and knowing how to manage your positions effectively is key.