When you hear talk about in-the-money or out-of-the-money options, it’s the concept of option moneyness at play. This simple yet vital concept in options trading describes the relationship between the current market price and the strike price of an option. Understanding moneyness of options can help you spot the intrinsic and extrinsic value of your investments. This article will explain what moneyness is in options, from its definition to its three categories: in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM).

Key takeaways

- Option moneyness describes the connection between the current price of the underlying asset and the strike price of the option.

- There are three categories of option moneyness: in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM).

- The main difference between these categories is the relationship between the current market price and the strike price, which impacts an option’s intrinsic and extrinsic value.

What is Moneyness in Options?

Let us start by defining option moneyness, a critical concept in options trading. It refers to the relationship between the current price of an underlying asset and the strike price of an option. Moneyness is the concept of “how much in the money” an option is. In fact, option moneyness is categorized into three types: in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM).

An ITM option implies that the current market price of the underlying asset is higher (for a call option) or lower (for a put option) than the option’s strike price. This means exercising the option would result in immediate economic benefit.

An ATM option happens when the current market price is very close to or equal to the strike price. While this may not have high intrinsic value, it can have significant time value.

An OTM option, on the other hand, has no intrinsic value and is not beneficial to exercise.

Intrinsic and extrinsic values are fundamental to understanding what is moneyness in options:

- The intrinsic value represents the difference between the strike price and the current market price of the underlying asset (the rule changes if you’re dealing with a call or a put, as you may learn in our intrinsic value article), essentially the value an option would have if it were exercised immediately.

- Extrinsic value, however, is the part of the option premium that is not intrinsic value. It takes into account factors such as time value and volatility premium.

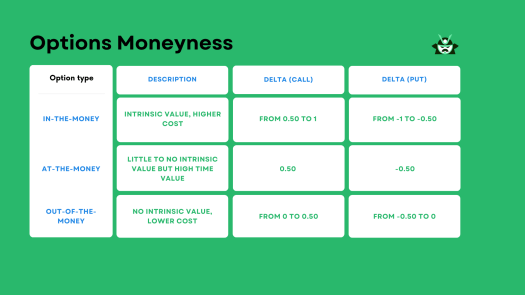

The option moneyness definition also links to another important concept in options trading: delta. Delta (for those who are not familiar with the Black-Scholes model) measures the sensitivity of an option’s price to a $1 change in the underlying asset’s price.

A high absolute delta value indicates that the option is likely to move nearly one-for-one with the underlying asset, usually when it is deep ITM. Conversely, a low absolute delta value suggests minimal impact from changes in the underlying asset’s price, typically when the option is far OTM.

Before we proceed, here’s a quick table on the main fact about ITM, ATM, and OTM option, this table will help you quickly understand the implications of an option’s moneyness and delta:

Understanding Option Moneyness, Intrinsic Value, and Extrinsic Value

Option moneyness, intrinsic value, and extrinsic value are the three great concepts to know if you want to start trading options.

Intrinsic value for a call option equals the stock price minus the strike price. For a put option, it’s the opposite – the strike price minus the stock price. This value represents the immediate economic benefit an investor would get if they were to exercise the option right now.

Extrinsic value, on the other hand, is the portion of the option premium that exceeds the intrinsic value. It accounts for factors such as time until expiration and volatility in the market. For both calls and puts, it’s calculated by subtracting the intrinsic value from the option premium.

Now, let’s look at how option moneyness affects these values. The moneyness of options is determined by comparing the current market price of the underlying asset with the option’s strike price. If an option is in-the-money (ITM), it means it has both intrinsic and extrinsic values. This is because the market price is either above the strike price for a call or below it for a put.

Out-of-the-money (OTM) options, however, only carry extrinsic value. That’s because the market price of the underlying asset is below the strike price for a call or above it for a put. As such, there is no immediate benefit to exercising the option, hence no intrinsic value.

If you understand these concepts, you’ll already be one step ahead many self-defined gurus in option trading. Why does this matter? Let us tell you more in the section below.

Why Does Option Moneyness Matter in Options Trading?

Option moneyness is a key concept in options trading that helps to assess the risk and reward profile of an option. It’s the market’s way to tell you all you need about the profitability potential of an option. And what is an option trade if you do not take into account your profit (and loss) potential before investing?

In-the-money (ITM) options, with their intrinsic value, are more likely to remain profitable if exercised. However, they tend to have a higher cost, which will increase the amount of money you’ll need to open a trade. Out-of-the-money (OTM) options, while having a higher risk of expiring worthless, will come with lower cost, offering a less expensive route to market participation.

At-the-money (ATM) options may not exhibit high intrinsic value but can be rich in time value, providing opportunities for traders who are neutral on the market’s direction or those employing time decay strategies (for instance, you may buy an ATM long call and earn good money on a slight price increase).

Option moneyness also impacts the delta of a call/put contract, which measures the sensitivity of an option’s price to changes in the underlying asset’s price. A high absolute delta for ITM options suggests a stronger reaction to price movements in the underlying asset, while a low absolute delta for OTM options indicates a lesser impact.

These insights from option moneyness can help traders align their strategies with their market outlook and risk tolerance. For instance, a bullish trader might opt for ITM or ATM calls, while a risk-averse investor might prefer OTM options due to their lower cost.

In conclusion, understanding what is moneyness in options allows traders to make informed decisions, tailor their strategies to market conditions and personal risk tolerance, and ultimately increase their chances of success in the financial markets.

A Look at Option Moneyness Through 3 Real Examples on MSFT

Let’s take a look at examples of option moneyness with Microsoft (MSFT) to better understand the concept.

Trading In-The-Money (ITM) MSFT Options

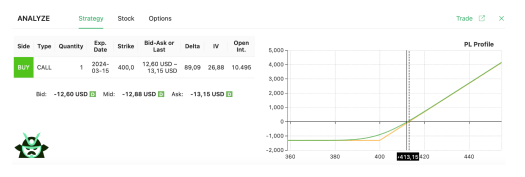

First, consider an in-the-money (ITM) option. MSFT is trading at $412.31, and you’re optimistic about the stock’s trajectory. You might choose to buy a $400 call option, as you can see in our options screener.

As you see above, this option has intrinsic value ($12.31) and extrinsic value. The intrinsic value of an option is calculated by subtracting the strike price from the current stock price. The extrinsic value, typically under $1 for options nearing their expiration date, is the remaining portion of the option premium. To profit from this, MSFT must close above $413.15 within 3 days.

Trading At-The-Money (ATM) MSFT Options

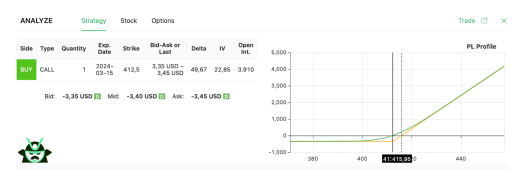

Next, let’s explore an at-the-money (ATM) option. With MSFT still at $412.31, a $412.5 call option can be considered ATM.

Look at the picture above: this option has no intrinsic value, but a small upward shift in MSFT’s price could quickly change that. If MSFT surpasses $415.95 before the option expires, it moves into the money, increasing the cost and potentially yielding a significant return.

Trading Out-The-Money (OTM) MSFT Options

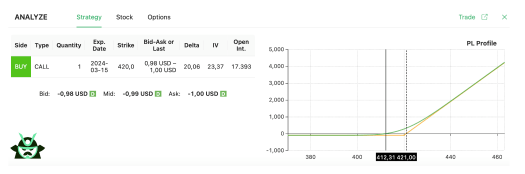

Finally, consider an out-of-the-money (OTM) example with a $420 call option that expires in 3 days.

This option, with bid-ask values around $1 (as you can see above), has no intrinsic value and only extrinsic value, also known as time value. As the expiration date is close, even this extrinsic value is low. For this option to become profitable, MSFT would need to close above $421 by the expiration date.

The table below will summarize the comparison among these three different strategies:

The Relationship Between an Option’s Delta and Its Moneyness

We had the chance to talk about delta earlier, but let’s now focus on its connection with the concept of option moneyness. Once again, keep in mind that delta measures how much an option’s price will change for a $1 change in the underlying asset’s price.

When the delta is close to 1 for call options or -1 for put options, it indicates the option will move nearly dollar-for-dollar with the underlying asset. This typically happens when the option is deep in-the-money (ITM).

Out of the money (OTM) options, on the contrary, will have a lower delta, lower than 0.50 for a call or lower than -0.50 for a put, as they move more slowly with the underlying asset.

As you may guess, instead, at-the-money (ATM) options will have a delta of 0.50 (call) or -0.50 (put).

Therefore, in terms of moneyness definition, there are a few things you’ll now learn to spot on the options market:

- You now know that an ITM option has a higher intrinsic value but also a more significant delta, meaning that it will be more sensitive to price changes in the underlying asset.

- When it comes to OTM options, the delta is lower, implying that they will move more slowly with changes in the underlying asset’s price. Since these options only have extrinsic value, what you really need to worry about here is time decay.

- ATM options, finally, will exhibit a delta of 0.50, giving you more significant price sensitivity than OTM options, but less high exposure to price changes than ITM options.