Sometimes you want to gain a little bit more flexibility in your options trading strategy. That’s where rolling options come into play. This is a method of adjusting or extending options contracts, helping you manage risk and possibly maximize profits or curtail losses. This guide will provide a clear introduction on how to roll options and why you may choose to do it.

Key takeaways

- Rolling options is a way to adjust or extend options contracts to manage risk and maximize profits or reduce losses.

- When rolling an option, you’ll aim to extend the expiration date or adjust the strike price, depending on your trading strategy and market conditions.

- There are three types of rolling options: rolling a position up (increasing the strike price), rolling a position down (decreasing the strike price), and rolling a position out (extending the expiration date).

Understanding Rolling Options

Rolling options are dynamic operations that can be useful in various market conditions. They allow investors to adjust or extend options contracts, providing a way to manage risk and potentially maximize profits or mitigate losses.

The main idea behind this strategy is to introduce flexibility to a generally inflexible context such as options trading. What this mechanism does is give traders the ability to adapt their positions according to market movements that were hard to predict once a trade was opened.

When rolling options, you are basically shifting from one option to another on the same stock. This could mean changing the strike price or expiration date of your positions. As we will see later in higher detail, there are three ways to roll up an option:

- Rolling an option up means moving the option’s strike price up. You can do this, for instance, when you own a long call and choose to cash in a part of your profits, or when you sell a call expecting a bearish or sideways phase while, instead, collecting a loss with the market moving against you (in this case, you’ll roll up your naked call to have more chances to earn a profit, adjusting your strategy to an unexpected – and hopefully for you, momentary – bullish movement).

- You might consider rolling an option down and decreasing your strike price in different scenarios. For instance, you may want to roll down a long put to collect some profits and maintain a bearish position. You may also want to roll down a naked put following an unexpected market decrease and confirm your sideways/bullish trading idea in this way, ideally increasing your chances of earning a profit.

- The third method, known as rolling out, extends the expiration date of your position. This is how to roll options when you need more time for the stock to move in your desired direction, helping you avoid assignment.

In general, you can roll call options or roll put options depending on your position and market expectations. In a rising market, you’d roll long call options up or put options up to benefit from price increases. Conversely, in a falling market, you’d roll put options down or call options down to potentially profit from price drops.

Another notable strategy is rolling covered calls. If you hold shares of a stock and have sold call options against them, you can execute a roll by buying back the short calls and selling other contracts with later expirations. This strategy can generate additional income and lower your cost basis in the stock (speaking of which, if you want to learn about an income strategy that involves covered calls, the wheel strategy may be something you want to add to your trading toolkit).

The option rolling technique allows traders to adjust their investment strategies according to market conditions, lock in profits, and manage risk. It’s a flexible approach that requires careful planning and understanding of the potential risks involved. However, when executed correctly, rolling options can be a great tool in your trading toolkit.

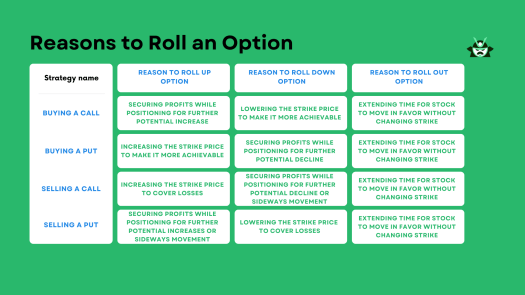

It is essential for you to know that there are pros and cons involved when rolling options. Before we begin, let us summarize the main reasons why you normally would roll an option in the table below:

Why Do Traders Roll Options?

Before we address more practical cases, we should address the main questions most of you may have: why do traders roll options? As you will see, it is all about flexibility and other potential advantages linked to a specific trading position.

Rolling options is a technique for adjusting the strike price or expiration date of an existing position. This allows you to adapt to changing market conditions, potentially enhancing your trading outcomes.

Consider a hypothetical scenario involving stock ABC. You have a call option with a strike price of $50, set to expire in one month. As the expiration date nears, ABC’s stock price has significantly increased. To capitalize on these profits, you might decide to roll the option, adjusting either the strike price or expiration date.

If you choose to adjust the strike price, you could use the call roll strategy. In practice, you could:

- Sell your current call option

- Buy a new call option on ABC with a higher strike price, such as $55.

The profit from the initial option can offset the cost of the new one, allowing you to potentially benefit from further price increases while taking part of the profits home.

Alternatively, you could roll the option by extending the expiration date. This is something you may want to consider, for instance, if the underlying stock price fails to move as expected (let’s say it remains below the desired level close to the expiration date). In such a situation, you could choose to extend the expiration date by selling your current option and purchasing another option with a later expiration date. This action can help you lock in profits if the trade has been successful so far, or it can provide you with more time in the position to allow the market to move further in your favor, regardless of your current position’s profitability.

There are two primary benefits to rolling options:

- Rolling options allows you to secure profits. When a position becomes profitable, rolling options lets you lock in gains and protect your investment.

- Rolling options also lets you take care of losses: if the stock price moves against you, rolling options to a later expiration date could help reduce your losses if the market eventually turns in your favor.

With this mind, you can now easily understand why we’re saying that traders roll options to adjust to market conditions and secure profits. Understanding how to roll options effectively is a key skill that can really help your trading strategy and potentially improve your overall trading outcomes.

Three Ways to Roll an Option

We have already mentioned the three types of rolling options above – rolling up, down, and out. Let us make one further step here and provide numbers to let you easily understand the impact of rolling options.

Rolling Up Options

Rolling up is a versatile strategy that can be employed in bullish, sideways, or even bearish market conditions.

When implementing this strategy in a bullish scenario, such as holding a long call option, you anticipate prices to continue climbing. For example, if you own a call option on a stock with a strike price of $50, and the stock’s price increases to $60, rolling up becomes an option. You could decide to sell the current option and purchase a new one with a higher strike price, perhaps $70.

Additionally, in scenarios where you have sold a naked call option and the market moves upward, rolling up allows you to adjust your position to potentially minimize losses or capitalize on changes in market sentiment.

Rolling Down Options

Rolling down is a dynamic strategy that can be applied in various market conditions, including bearish, sideways, or even bullish scenarios. When employing this strategy in a bearish market, such as holding a long put option, you anticipate prices to decline. For instance, if you hold a put option with a strike price of $100 and the stock’s price decreases to $80, rolling down becomes a valid operation to cash in some of your profits. In this case, you might sell the current option at a loss and purchase a new one with a lower strike price, perhaps $70.

Similarly, in scenarios where you have sold a naked put option and the market moves downward giving you a (hopefully temporary) loss, rolling down allows you to adjust your position to potentially increase your chances of success and reduce losses. Adjusting the strike price of the put option lower may enhance the probability of the option expiring worthless or being profitable if the market remains stable or experiences a moderate uptrend.

Rolling Out Options

Lastly, rolling out refers to extending the expiration date of an option. Say you own a call option on a stock with a strike price of $100, set to expire in a month. As the expiration date nears, the stock’s price hasn’t moved as expected. To give yourself more time for the stock to reach your target price, you can roll out by selling the current option and buying a new one with a later expiration date.

The idea works in the case you are selling a call option (naked call) as well. For instance, imagine you spot a stock on the market that you believe to be overpriced after a long bull run. Believing the price reversal is close, you sell an OTM call and observe the market. For the first weeks, the stock price fails to revert to a bearish phase, bringing your trade in a loss position. However, the core of your analysis has not changed: you still believe that the stock is overpriced and it is bound to correct downward soon. Therefore, selling the same call option (assuming it is still OTM) with a later expiration date gives you more time to earn a profit.

In the sections below, we’ll consider what to do when rolling either calls or puts on the market.

The Strategy of Rolling Long Calls

Now, let’s suppose you have a long call option and a couple of factors are making you think about rolling this option (the so-called “call roll strategy”).

Firstly, time decay is becoming a concern when you’re thinking whether to roll call options. As the expiration date approaches, your call option remains out of the money (OTM). Instead of letting time decay eat away your option’s value, rolling the option is an operation that can extend the expiration date. This gives the underlying stock more opportunity to swing in your favor, potentially converting your OTM option into a profitable one.

Secondly, the stock price is teasingly close to your strike price but hasn’t quite made it. In this scenario, you could roll the option to adjust the strike price to a more favorable level.

For instance, if your current strike price is $50 and the stock price is $48, rolling the option to a lower strike price, say $45, could increase the chance of the stock price reaching the new strike price, turning the option profitable.

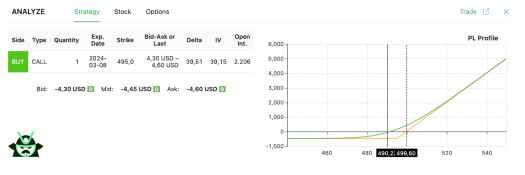

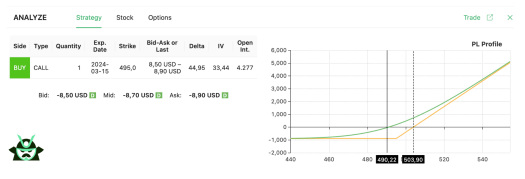

To illustrate these points, let’s look at a practical case with our options screener. In the first screenshot, we have a close-to-expiration call option that is still OTM for Meta Platforms (META). The current strike price is $495, and the stock price is $490.22.

By rolling the option, as shown in the second image, we buy a new call option with the same strike price expiring one week later. This adjustment gives us a better shot at the stock price, hitting the new strike price and the option becoming profitable.

However, rolling the option increases our overall breakeven price. This means that the breakeven price you see in the second image above should actually be incremented by the option premium of the first call.

You could also vary the strike price without changing the expiration date (or you could do both) to improve your chances of profitability. Just note that while rolling options offers flexibility and potential profit, it involves risks: if your rolling is based on a wrong trade idea, you will only increase your losses or reduce your profits.

The Strategy of Rolling Long Puts

Having clarified the call case, it won’t be hard to understand how to roll put options. Imagine you’re holding a long put option, and a couple of factors are pushing you towards considering rolling options. This time, we will look at an in-the-money (ITM) case, to give you another example of how flexible rolling options can be.

First of all, assuming the underlying stock price has moved lower for a couple of weeks, you have already earned quite a profit with your long put position.

Second, you don’t think that the bearish phase is close to an end, but you would like to cash in the profit you’ve earned so far while still keeping a bearish position.

If your current strike price is $60 and the stock price is $55, rolling the option to a lower strike price, like $50, could let you bring home your profits while benefiting from another bearish movement in the stock price.

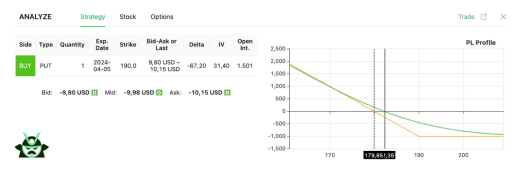

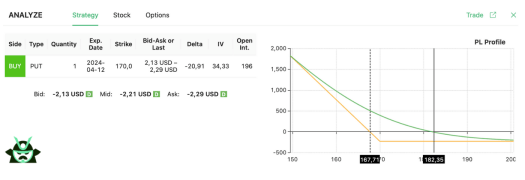

To illustrate, let’s examine a practical case just like we did before. Initially, we have a close-to-expiration ITM put option for Boeing (BA). Your current strike price is $190, and the stock is still trading at $182.35.

By rolling the option, as shown in the second screenshot, we buy a new put option with a lower strike price. Note that you may even combine the concepts of “rolling down” and “rolling out” an option here by simply buying a lower-strike put option (let’s say at $170) expiring later than your first contract (for instance, 1 week later). This adjustment lets us cash in the profits earned on the first trade while still letting us profit from further price decreases in BA. Here is the option (and its updated P&L profile) you could use to roll down your trade:

Does Rolling an Option Count as a Day Trade?

Before concluding, there’s another question that many people are asking online: Does rolling an option count as a day trade? This is a topic that sparks much debate among traders, primarily due to the SEC limitations in the US on the topic.

If you opened your original puts on a previous day and closed them as part of your roll, it’s not considered a day trade. A day trade typically occurs when you open a position and close it on the same day.

To help you keep this matter under control, many brokers provide a counter of day trades to avoid having your account flagged as performing pattern day trading. This way, you can continue rolling options without worrying about breaching day trading limits.