If you’re looking for a relatively little-known strategy to benefit in a neutral to bullish market, the Jade Lizard options strategy might be your key. This technique cleverly combines selling a short put with a short call spread, aiming to remove upward risk. This short guide will look into the jade lizard options strategy, from what is it to how to use it.

Key takeaways

- The Jade Lizard options strategy is ideal for neutral to bullish market conditions. It combines selling a short put with a short call spread to maximize premium collection.

- The maximum profit of the Jade Lizard strategy occurs when the stock price is between the short strikes at expiration. The maximum loss will occur below the naked put option price.

What is the Jade Lizard Strategy in Option Trading?

The Jade Lizard options strategy is a way to trade options that combines selling an out-of-the-money (OTM) put with a call spread. This method is specifically designed for those who seek a balance between risk and reward, offering a unique advantage of no upside risk.

How does this happen? Traders will need to do the following:

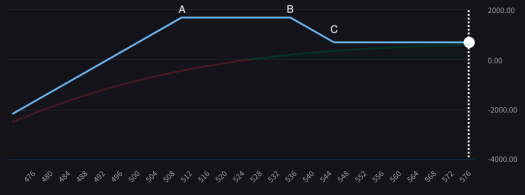

- Sell a put option at a lower strike price (OTM), corresponding to point A in the image below

- Sell a call spread (consisting of a sold call option at a higher strike price – point B below – and a bought call option at an even higher strike price – point C below).

Usually, you try to build this so that the premium collected is higher than the call spread’s max loss.

Here is what the strategy will look like on SPY (currently trading around $520, so we sell a $510 put, a $535 call, and we buy a $545 call):

This action allows traders to collect premiums from both the naked put and the call spread, leading to a net credit situation. This net credit represents the maximum profit achievable with this strategy.

Remember: your goal here is the premium collection. Traders should consider the opportunity to earn income from two different legs while managing risk effectively (as we’ll explain later, the risk for uncapped losses is something you can’t rule out).

Since the strategy combines elements that benefit from market stability or slight bullish trends, it is an excellent choice for those with a neutral to slightly bullish outlook on a stock.

Moreover, the way the Jade Lizard options strategy is built to appeal to traders who prioritize upward risk management. Given that the strategy inherently limits upside risk by its design, investors can rely on this strategy in various cases, such as trading solid stocks, or building long-term (i.e., with maturity dates far in time) trades.

The Jade Lizard options strategy offers a practical path for traders aiming to remove upside risk in those cases in which you are fairly confident that the market won’t enter a bearish trend.

When is a Jade Lizard Strategy a Good Idea?

If we look at the pros and cons of the jade lizard strategy, we can quickly understand when it is a good idea to use it (and when it isn’t).

Jade Lizard – Pros

- Particularly effective for when you have a neutral to bullish outlook on a stock.

- High implied volatility rank translates to more premium to collect.

- Limited upside risk if the stock price surges past the short call spread.

- Suitable for cautious optimists in range-bound markets.

- Can serve as an income-generating tool in sideways-moving markets.

Jade Lizard – Cons

- Unlimited risk to the downside.

- Not suitable for extremely bullish outlooks due to capped upside potential.

- Alternative strategies may be more appropriate for very bullish stances on stocks with high implied volatility.

- Requires understanding of market behavior, particularly in range-bound or sideways-moving markets.

- Timing of trade closure requires consideration to maximize profitability and adapt to market changes.

Should You Close Your Jade Lizard Trade Early?

When trading options, you should never disregard the possibility of closing your position early. This is especially true for credit strategies where your profit is limited, and this is also true for the jade lizard options strategy.

Whether to lock in profits or minimize losses, understanding when to exit is key. The decision is primarily influenced by market conditions and your individual strategy goals. For instance, if you’ve reached 50% of the maximum profit sooner than expected, buying back the options for a net debit less than the initial credit can be a smart move. This step would ensure you secure gains before any market reversal.

Active trade management is crucial in responding to unexpected market movements. If the stock price pushes through the short call spread, there’s an opportunity to roll up the short put for additional credit.

Given there’s no upside risk with the jade lizard, this adjustment enhances your position without added risk. Conversely, if the stock drops and tests the short put, rolling down the short call spread to collect more credit can help mitigate losses without increasing your exposure to upside risk.

However, not all scenarios are recoverable. If losses on the short put escalate, sometimes the best course of action is to close the entire position. This move prevents further financial drain, underscoring the importance of knowing when to cut losses (it goes without saying that you should always try to avoid the case in which your broker closes your position due to insufficient margin).

What we are saying is that the jade lizard options strategy requires a balance between strategic patience and decisive action. Keep following the market, day after day, and act in case you need to protect profits or minimize a loss.

The Potential Outcomes of the Jade Lizard Strategy

As is often the case, the easiest way to understand how a new option strategy works is by examining it in action. The jade lizard options strategy offers an interesting approach to options trading, particularly when applied to a stock such as Nvidia (NVDA), currently trading at around $905.

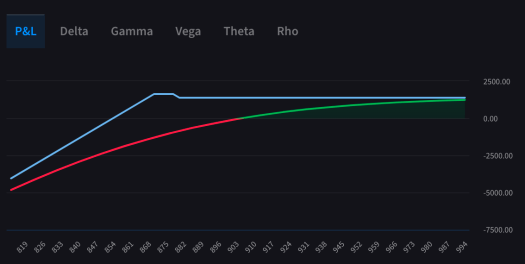

Note that our options screener currently does not feature this strategy, but we are building a custom strategy screener where you will be able to add the jade lizard. In building a jade lizard, you might sell an $870 put, couple it with selling an $877.5 call, and hedge by buying an $880 call. Here is what the P&L profile of your strategy will look like:

Two things can happen, as we explain below.

Scenario 1: The stock price closes below the strike price of your naked option

In this scenario, it’s straightforward: your gains decrease in a straight line, similar to what you’d see with a standard naked put. The moment NVDA dips below your breakeven point—the premium collected minus the $870 for the naked put—you’re in the red.

In case we have not stressed this enough, remember: do not underestimate the likelihood of the market turning against you in a strategy with potentially uncapped losses.

Scenario 2: The stock price closes above the lowest strike price of your spread

Your peak profit hits if NVDA lands between the naked put strike and the call you’ve sold after adjustments. Climbing above this range still nets you a profit, but at a slightly lower level due to the loss recorded on the call spread. Yet, this is more than balanced out by the gains from your naked put. This is, most likely, the jade lizard options strategy’s unique advantage: taking away the upward risk in your trading so that you only need to worry about the lower bound of your strategy.

If you understand these outcomes, you can be ready to try out this strategy (perhaps in the form of paper trading, if you’re still not sure about the step from theory to practice).

Adding a Twist: The Reverse Jade Lizard Strategy

But what if you don’t think a stock will move up, and you’d like to build something similar to a jade lizard strategy in a bearish/sideways market?

The reverse jade lizard is your go-to method. This strategy combines an out-of-the-money short call with an out-of-the-money bull put spread. Crafted correctly, the reverse jade lizard carries no downside risk, making it ideal for stocks that seem overbought and/or have high implied volatility.

Essentially, it flips the jade lizard options strategy on its head: while it eliminates the risk of losing money if the stock falls, the reverse jade lizard will come with the negative side of potentially unlimited losses if the stock unexpectedly surges.

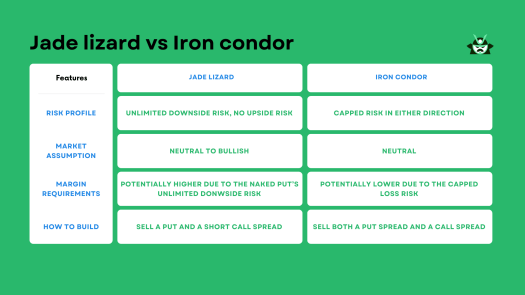

Jade Lizard vs Iron Condor

The last question we want to answer here is how the jade lizard options strategy stacks up against the iron condor. Both strategies involve selling options to pocket premiums, and they lean towards a neutral to bullish market stance with defined risk and reward. In both, the idea is while you get premium from both calls and puts side, you can only lose in one of them.

However, the jade lizard combines a short put with a short call spread, eliminating upside risk. This aspect makes it especially appealing in neutral to bullish markets, allowing traders to maximize premium collection while being shielded from losses if the market climbs.

Instead, the iron condor strategy sells both a put spread and a call spread, capping losses but also limiting gains, making it ideal for range-bound markets. Its structure offers potentially lower margin requirements, making it a conservative choice for those wary of significant market shifts.

You will go for an iron condor when you anticipate a relatively sideways market (even though you can always set a very wide iron condor to allow for some movement on either side without pulling at your heartstrings). On the other hand, you’d be more likely to go with a jade lizard when you want to take advantage of neutral or even slightly bullish markets and think that the chances for a downward move are relatively low.