March has started, and we are happy to announce our new version of Samurai. This version continues to improve our Excel and Google Sheet integration that lets you build custom workflows and formulas using our data.

This is the 24th version we’ve released in two years 😀 We are proud we were able to keep this steady pace of improvements. Know that we in Samurai continue to work to improve your edge in the market.

This version addition:

- Excel desktop support – You can now install the app on Excel desktop versions, improve your existing Excel workbooks, and create new ones.

- Floating option formula – To keep your workbook up to date, you can use unique formulas for options data that will import data using ‘floating’ variables such as days-to-expiration, moneyness, deltas, and more. For example, instead of asking for AAPL 158 strike, you can ask for an AAPL option that is 1OTM – This will always return the first OTM option and will change with the market conditions.

- More improvements to the Excel & Sheets integrations – better stock selector, improvement for different languages encoding, and more.

- Bug fixes and improvements to the app

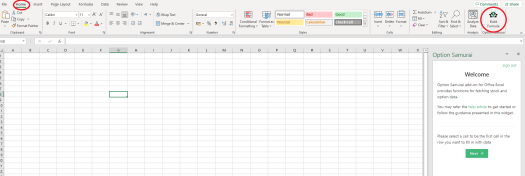

Excel desktop support

After Excel online and the Google Sheet support – we are now happy to announce we currently support desktop versions of Excel. Check out the installation article for a step-by-step guide and the knowledge base article for more details.

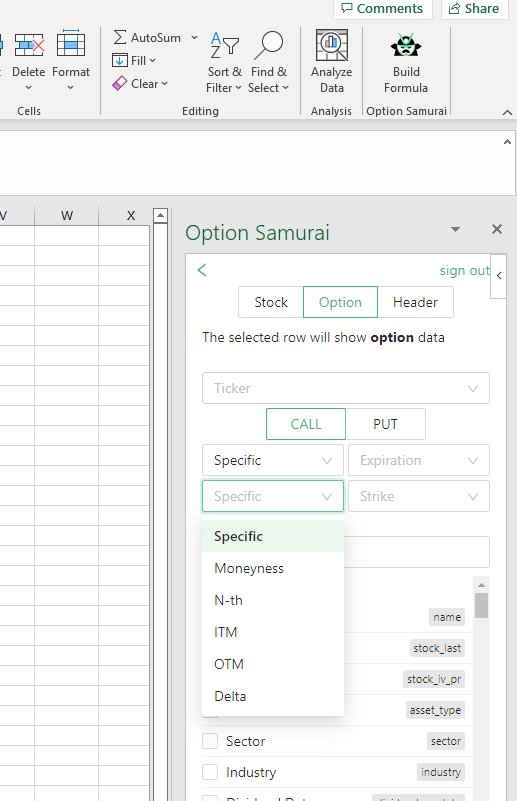

Floating option formula

Options are temporary derivatives, and they expire constantly. Also, for many use-cases, the relative parameters of the options are more important than the objective parameters. Meaning – often option with 30 days to expiration is more important than a fixed date such as April 8th, 2022.

This is why we now allow you to import option data to Excel and Sheets using relative formulas such as: Days to expiration, deltas, moneyness, strike ITM or OTM, etc. Like many functions in Excel, you can use these parameters with other cells, which will allow you to create advanced formulas and workflows.

For example, you can use for spreads with strike distance/moneyness distance between legs, selling puts with target deltas, covered calls with the first OTM strike, poor man’s covered calls, and much more.

Read more in our knowledge base to see how it works. An example template will be released this month as well.

Improvements to the Excel & Sheets integrations, bug fixes, and app improvements

We continued to improve the app based on feedback and requests from you. We appreciate our community and encourage you to reach out with feedback.

The version is now live and available to use.