Lately, I’ve been trading leap options and long-term options as I see that those options are often mispriced due to the large volatility of stocks over the long term.

I wanted to share an interesting idea I saw with TEVA – the biggest generic drug manufacturer. In the last 18 months, Teva has been in a clear downtrend, going from $65 to about $31 today (losing more than 50%).

The reasons for this decline are well-documented and deserved. TEVA was growing stronger on the promises of the synergies from recent M&A deals it made (the largest so far). When the market saw that not only the synergies are not as expected, but also had troubles with the merger, the market sent the stock to a free fall.

But that was in the past. After the CEO was replaced and at the current level, most of the bad news is already priced, and the positive plans Teva is planning for 2017 can start to unfold.

The main reasons to be optimistic about Teva:

- The stock is Cheap – Analysts expect $4.81 EPS for 2017. At the current price level, the PE is 6.44 whereas other drug manufacturers are at 20-30 PE

- The analysts’ target price is $40, about a 30% increase from today.

- Wall St. sees value in the company. During the last conference call, analysts started to inquire about spin-offs in Teva – which means they see hidden value in the company.

- Teva has a strong pipeline of products for 2017 – the results of the recent acquisitions.

I believe that, fundamentally, Teva will go up in 2017. However, it is still in a downtrend, so it’s like catching a falling knife. To protect myself, I’m looking at a limited risk – unlimited reward trade. In this case very simple: Buying a call.

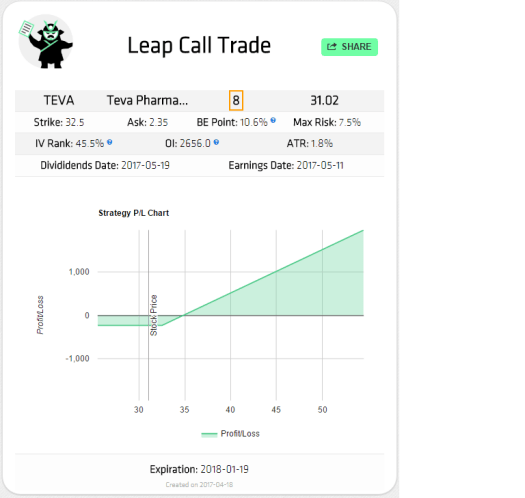

We can buy Call Strike 32.5 for Jan 2019 at less than $2.35 per option. You can find more trades like this using our Options Screener.

The stats for this trade:

- Max risk 235$ (7.5% compared to the stock – like having a stop-loss of 7.5%)

- Reward, if the stock goes to $40 by expiration (9 months), is $750 or 319% profit on risk.

Summary

Teva is in a downtrend and could continue downward in the short term. However, if you believe that fundamentally the stock is strong, then at the current price, the stock is very attractive. A long call trade provides us with a maximum loss of 7.5% and a maximum profit of more than 300% compared to the risk.

(Disclaimer: The author plans to initiate a trade on Teva)

You can see other trade examples for long calls: