Option trades can be either an option buyers and enjoy unlimited profit potential and limited risk, or be an option sellers and enjoy higher probability of profit (though the profit is limited). There is a time for both strategies, and we have talked a little bit on the subject of buying options (for example: here and here). In this post we will start off our discussion into selling options: what does it mean, best practice strategies and what are advantages compared to buying options.

In the upcoming weeks you can expect several posts on the subject.

The edge of option Selling:

Option sellers have an edge mainly because of the time premium in the option. While we can’t predict the future move of an underlying, we can guarantee that time will pass. Since option sellers profit with each passing day (as the time premium shrinks) they increase their chance of profit. You can say that they profit “unless” something happens, while option buyers will profit “only if” a scenario happens.

There is overwhelming research showing that option sellers have an edge. However – It is very important to remember that options are usually priced correctly and you will need to have a bias on the stock in order to profit from the trade (it doesn’t matter how you analyse the trade, as long as you have a firm believe and a way to track and correct your assumptions).

The Research:

You can find many different sources and many different tests on this subject and some will help us understand the nature of selling options. I wish to start by revisiting a chart I displayed before:

Straddles:

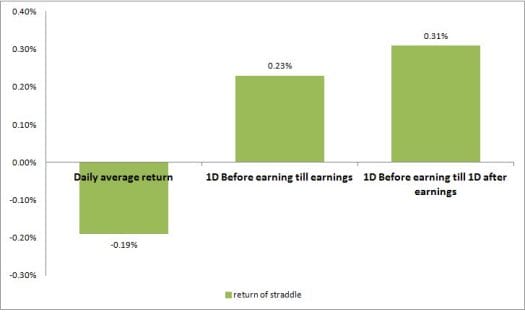

In the article “Anticipating uncertainty: Straddles around earnings announcements” the authors show the daily return of straddles (Short put and call on the same strike and expiration) on “regular” days and before earning announcements. What can we learn from this?

- We can see that buying straddles lead to a loss of 0.2% per day (seller profit that) on a ‘regular’ day.

- Buying straddles profit during earnings, so it is usually best to avoid holding short option positions during earning announcements.

CBOE Options Indexes

The CBOE has several indexes that correspond with options strategies, such as: covered-call index ($BXM), covered-call-2%-OTM index ($BXY), naked-put index ($PUT) Etc. I will expand the discussion into those strategies in the future, but it is important to show that those strategies out perform the market AND with lower volatility. The following exhibits are from research by Asset Consulting Group:

Highlights:

- Cash secured naked put showed the highest return and lowest volatility (the cash was invested in T bills and was the ‘secret’ of the excess return).

- Out-of-The-Money (OTM) Covered call was the second highest return but the highest volatility compared with the option indexes

- ‘Regular’ covered call out performed the S&P and with lower volatility.

Read the research:

Strangles

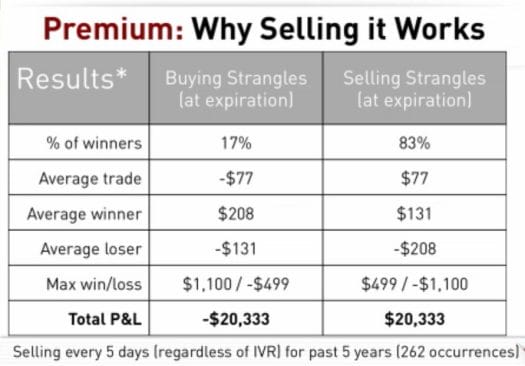

Another research, this time that was done by the guys at Tasty Trades was a strangle test:

They Sold a strangle (OTM Put and OTM call) on the S&P with 15 delta each with 45 days to expiration. They found that:

- Selling strangles had 83% success – even though that with 15 delta on each side we can expect about 70% success rate (we can use delta as an approximation for probability to expire in the money)

- Even though the win is smaller than the loss – the high probability was more than enough to make it profitable.

- Later in the video we can see that IV had even bigger impact on results (higher IV is better)

- The position profit or loss what not highly correlated with the market trend – was mainly related to the IV.

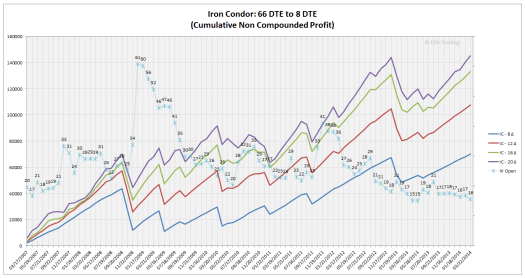

Iron condor

Iron condor is another popular strategy that is composed of strangles with protections. I was looking for an opportunity to mention DTR Blog, and I can’t mention icon condors without a mentioning his blog so it’s a good opportunity. DTR’s blog is full of back-tests into iron condors, almost every variable is tested and reported: delta, days to expiration, IV, unbalanced wings etc. I recommend reading there more.

It is important to mention that all of the tests showed this strategy to be profitable, and the majority of tests were preformed mainly as a quantitative way to learn how to better improve the position:

Read here about how to build the best iron condor strategy.

Summary

Option traders have an edge when selling options. In this article we examined the most popular strategies and showed their edge. In future articles we will expand and give specific tips on how to better manage the risk and increase you profits.

Go to Option Samurai