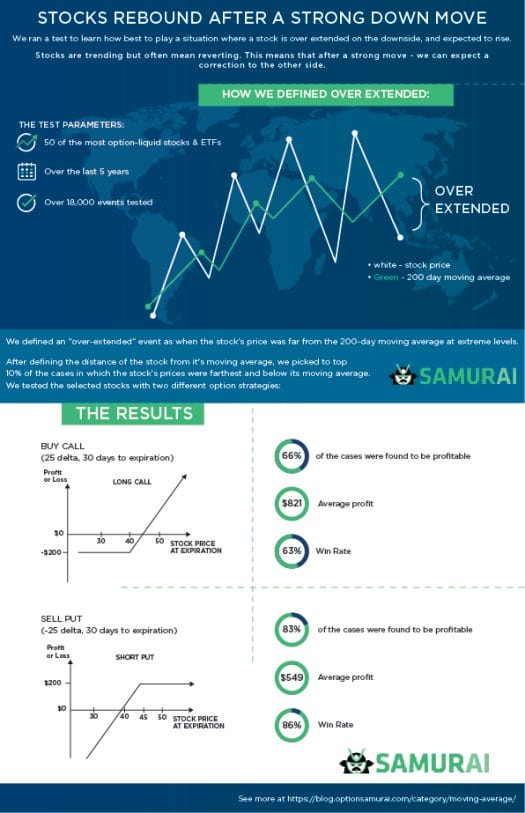

As traders we are constantly on the look to understand the market’s tendency and how to act on it. One way is by examining how stocks behave after they are oversold. We believe this is an essential part of the trader tool box and are working hard on the next generation of SamurAI which will include a powerful statistic engine to validate entry and exit signals and patterns in the options market.

We are still developing the engine and product, but they already allow us to generate some powerful insights into the market. In the coming months we will share some of the insights we receive. We are happy to introduce to you the first report.

Keep following our blog for more posts deep diving into this method. You can also follow us on twitter or join our newsletter.

[…] How to trade over extended stocks […]