Category: Unique

Use a Backtest to Build a 52-Week High or Low Options Trading Strategy [Free Backtest File]

When the trend is strong, there could be either trend-following or trend-reversal opportunities at a stock’s 52-week highs and lows. Using our backtest file,…

Gain a Market Edge with Leap Options: Long-Term Strategies and Stock Comparisons [Using LEAPS for Optimized Returns]

If you’re an options trader, you are familiar with the typical leverage offered by buying a LEAPS call option. This longer-term options strategy involves…

Run Your Own Bull Put Spreads Backtest [Data-Driven Option Strategy]

If the large potential loss of selling a naked put scares you, a bull put spread might be an alternative to consider. This strategy…

Options Trading Strategy Guide: Using ADX to Backtest Iron Condors

As an options trader, don’t you think it would be nice to have a way to know when a stock price is most likely…

Use the ATR Indicator to Refine Your Options Trading Strategy [Backtest Results]

When you trade options and want to understand how likely you are to profit, running ATR backtests is essential. This article will show you…

The Importance of Keeping an Options Trading Journal [Excel Template]

Successful traders have strategies and systems in place to consistently make profitable trades, but they also have something else that is often overlooked –…

A Backtested Approach to Using Bollinger Bands in Options Trading – Part 2

Following the results we showed in the first part of our series on Bollinger bands, let us show you through real-life examples how you…

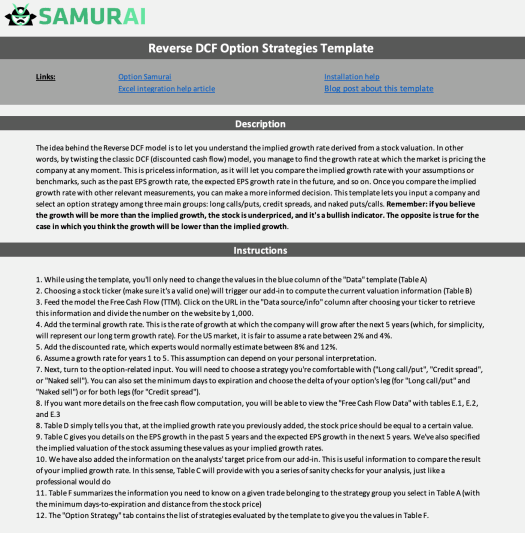

Reverse DCF Option Strategy Excel Template – Back Your Trading Decisions with Data-Driven Insights

Backing your options trading with a fundamental analysis can give you an edge in the market. You can achieve this result in only a…

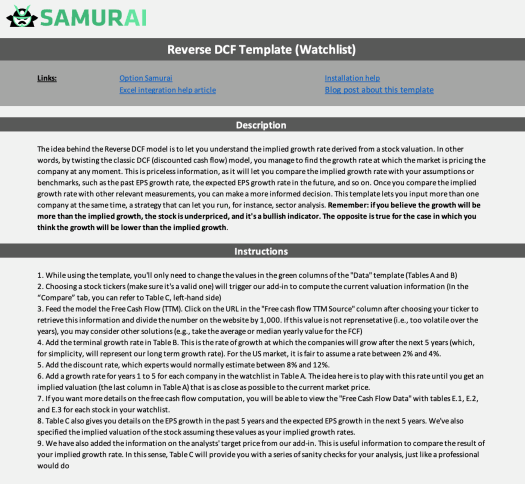

Reverse DCF Template – Finding Winning Companies with Comparative Analysis

When it comes to stock (and option) picking, a sector comparative analysis can give you very valuable insights into potential investment opportunities. This article…