Option Samurai

Blog

Learn. Trade. Profit.

Understanding What Is an IV Crush and Its Implications for Options Traders

There are few certainties in the life of an option trader, but the fact that the implied volatility of an option will regularly crush…

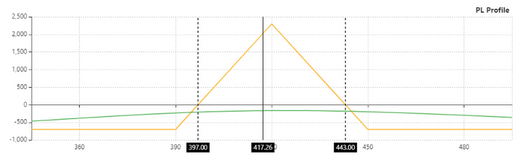

A Comparison of Cash Secured Put vs Covered Call [P&L and Examples]

When looking at a company you like, there are different ways to invest in it other than simply buying shares. This article explores cash…

New Version for Option Samurai! Q2 2024 🎈

Wow, we are already at the end of June and have finished the first half of 2024—how time flies! It’s time for our new…