When traders face a turbulent market, implementing a well-chosen high volatility option strategy can turn chaos into profit. In this guide, we’ll delve into three strategies for trading in high volatility options: the Long Call, the Long Put, and the Long Straddle. Discover the best options strategy for high volatility and explore effective volatility trading strategies.

Key takeaways

- The Long Put, Long Call and Long Straddle are some effective strategies for profiting from high-volatility situations

- By using the IV rank, you can easily spot options with low implied volatility and, hence, a potentially underpriced premium

- A high volatility option strategy will require the stock to move significantly for as long as you choose to keep the trade open

Best Options Strategy for High Volatility

A high volatility option strategy can be a trader’s best friend when market fluctuations are high. The concept of high volatility refers to rapid and significant price movements, which can offer more opportunities for profit.

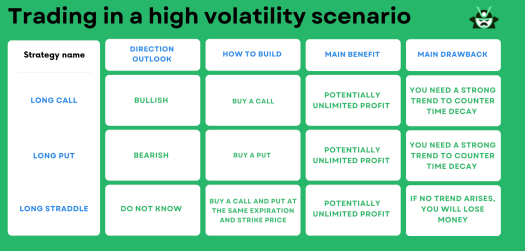

Key strategies include the long call, where you bet on prices rising; the long put, betting on prices falling; and the long straddle, a bet on significant price movement in either direction.

Keep in mind that you will need to make an educated guess on the timing of your operation and the market volatility. Specifically, you will need to get the best timing for opening your position to counter the time decay effect that erodes the value of your options. Furthermore, you will need to see a volatility higher than the market expectation (represented by the IV/IV Rank).

Each strategy uses options in unique ways to take advantage of volatility. In the following sections, we’ll delve deeper into these strategies, giving you the tools to navigate and profit from high volatility markets. We summarized the main aspects you should know about these strategies in the table below:

Ready to profit from market swings? With Option Samurai, you can easily find and execute high-volatility strategies like Long Calls, Puts, and Straddles. Click the image below to grab our Black Friday deal and master volatility trading today!

Opening a Long Call Position

A Long Call is a key part of a high volatility option strategy. Essentially, you’re buying the right to purchase a stock at a set price within a specific timeframe. You’re betting on the stock’s price rising above the strike price before the option expires.

This strategy shines in high volatility markets because larger price swings can lead to greater profits.

Here’s why: if the stock’s price soars, your call option allows you to buy the stock at the lower strike price, then sell it at the current higher market price. The difference, minus the premium you paid for the option, is your profit.

Thus, a Long Call is considered the best options strategy for high volatility when you anticipate an upward trend. It’s a fundamental piece of any option volatility trading strategies toolkit, providing a direct way to capitalize on market volatility. In the next sections, we’ll explore more volatility trading strategies.

Example of a Long Call Strategy

Imagine you’re eyeing a stock that analysts predict will grow in price. For instance, Fedex (FDX), currently trading at $253.58. You believe this is a bullish opportunity and decide to employ a high volatility option strategy.

A Long Call strategy fits the bill perfectly. Here’s how it works: you buy a call option, in this case, a $270 call expiring in over two months. This gives you the right, but not the obligation, to buy FDX shares at $270 per share anytime before the option expires. Note that an options screener like Option Samurai will let you know that analysts believe the stock price will move to $295.70.

If FDX’s price rises above your break-even point of $274.65 (strike price plus premium paid), you’ll start making a profit. With this high volatility option strategy, higher the price goes, the more profit you make. Considering the first analysts’ target, this could be a very promising trade.

You may wonder whether the Long Call strategy is the best options strategy for high volatility. Well, if you expect high volatility and a strong upward trend, the uncapped earnings possibility certainly puts this strategy among our top choices for this scenario (note that, instead, if you’re looking for a low volatility option strategy, a debit spread may be a better choice). It’s a key part of any option strategy for volatility and plays a significant role in option volatility trading strategies, offering potential profits in volatile markets.

Opening a Long Put Position

A Long Put is another effective high volatility option strategy (and, if you play it safe, it may turn out to be a low risk option strategy). When initiating a Long Put, you’re buying the right to sell a stock at a predetermined price within a specific timeframe. This strategy becomes particularly useful when you anticipate the stock’s price to drop below the strike price before the option’s expiry.

Here’s the process: if the stock’s price does indeed fall, your put option empowers you to sell the stock at the higher strike price, not the lower market price. The difference between these prices, minus the premium paid for the option, becomes your profit.

So, a Long Put proves to be one of the best options strategies for high volatility, especially when a downward trend is expected. It’s a key component in an option strategy for volatility and forms an integral part of any toolkit for option volatility trading strategies, allowing traders to profit from market turbulence.

Example of Long Put Strategy

Suppose you’ve analyzed the analysts’ opinion on FDX and believe the bullish sentiment is misplaced. You anticipate that the stock will decline to around $220 in the coming weeks. In this case, a high volatility option strategy like a Long Put could be your best bet.

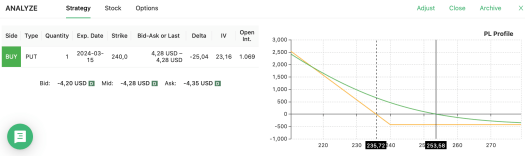

The Long Put strategy involves buying a put option, which gives you the right, but not the obligation, to sell the underlying stock at a predetermined price (the strike price) before the option expires. Here, you might buy a $240 put on FDX.

To make a profit, you need FDX’s price to fall below your break-even point of $235.72 (strike price minus premium paid). The further it falls, the higher your potential profit.

Is this the best options strategy for high volatility? If you’re expecting a decrease in the stock price and an increase in volatility, you’ll realize that this is one of those trades offering the best combination of easy implementation and effectiveness. It’s an effective option strategy for volatility and a vital part of option volatility trading strategies, allowing you to profit from downward market movement.

The Long Straddle Strategy

Let’s be honest, sometimes it is far from clear whether a stock price will move up or down. This is where the Long Straddle, a high volatility option strategy, comes into play. It involves buying a call and put option with the same strike price and expiration date.

Why use this high volatility option strategy? Well, when you expect a major price movement but are unsure of the direction, a Long Straddle allows you to profit from both an upward or downward swing. If the stock price moves significantly in either direction, one of your options will become profitable, covering the cost of the other.

The Long Straddle is often considered the best options strategy for high volatility due to its potential for high returns in uncertain markets. It’s a key part of any option strategy for volatility and is central to option volatility trading strategies, providing an avenue to profit from increasing market volatility. Once again, it is important to note that for this strategy to be profitable, you need to be correct on timing and also see the volatility be higher than the market expects.

Example of Long Straddle Strategy

In situations where you anticipate a significant price move in FDX but are uncertain about the direction, a high volatility option strategy like a Long Straddle might be your best course of action. It’s an example of volatility trading strategies that can work well when you expect high price volatility but don’t know if the stock will go up or down.

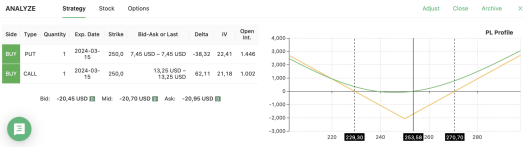

A Long Straddle involves buying a call and a put at the same strike price and expiration date. In this case, you might buy a call and a put with a $250 strike price expiring in over two months.

For this high volatility option strategy to be profitable, FDX’s price must move significantly – either above $270.70 (for the call to be profitable) or below $229.30 (for the put to be profitable) by the time the options expire.

This strategy is often considered the best options strategy for high volatility when you expect large price movements but are unsure of the direction. It’s an effective option strategy for volatility, allowing you to potentially profit from significant price swings in either direction.

Remember, this scenario is not as uncommon as you might think. For example, if you’ve read the analysts’ reports on FDX and formed your own opinion on the company, you may have logical grounds to anticipate a significant stock price movement in the coming weeks. However, taking a step back and considering the broader perspective, you may think it is reasonable to assume a 50/50 chance of both a bear and bull trend, hence a non-directional trade like this high volatility option strategy may be the right choice here.

Helping Yourself with the IV Rank

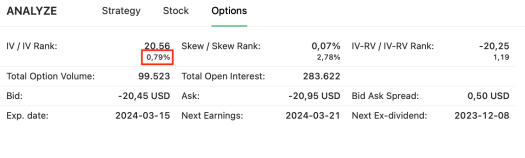

Understanding the Implied Volatility (IV) rank is crucial in implementing a high volatility option strategy. The IV rank measures how cheap or expensive an option is. For instance, if a stock has an IV rank of 80%, it means that the current IV is higher than 80% of its values from the past year. In simpler terms, the current IV is high, and the option premium is likely overpriced.

This insight can help you spot underpriced options with a low IV rank, which can be a key part of the best options strategy for high volatility. A low IV rank could indicate an undervalued option, potentially offering a profitable opportunity. In fact, mentioning FDX in our examples was not done by chance: the current IV rank for FDX is only 0.79% as shown below, leading to a potentially undervalued premium:

Understanding this concept and using it to your advantage can significantly enhance your option strategy for volatility. It’s a valuable tool within your repertoire of option volatility trading strategies, assisting you in navigating and profiting from volatile markets.