Profiting from options trading in all market conditions can be a challenge. But in bearish conditions, selling in the money call options can be a consistent way to both generate income and insulate against volatility. Selling call options in the money is an intermediate strategy, but one that can be learned quickly with the right knowledge and tools.

Key Takeaways

- Selling call options in the money can provide immediate cash flow through higher premiums and offer a safety cushion due to intrinsic value.

- Timing is key. Optimal conditions for selling in-the-money call options involve high implied volatility and a bearish or stagnant outlook on the underlying asset.

- Risks exist but are generally manageable, making this a potentially lucrative strategy for those looking to generate income from options trading.

Selling call options in-the-money is a strategy for intermediate traders with a unique risk-reward profile. Unlike out-of-the-money options, these options have intrinsic value, providing immediate premium and more profit potential.

Here, we’ll dive into when you should consider selling in-the-money call options, timing your trades, and an example to illustrate profit potential. Could you sell your call option and make money? Read on and find out.

Why Sell a Call Option In-The-Money?

Selling in-the-money call options is a solid strategy for a few reasons. In-the-money options command a higher premium compared to out-of-the-money options, providing immediate cash flow once sold. In-the-money options also have intrinsic value, providing a better hedge during volatile markets.

If you’re bearish on a stock and expect a price decline, selling an in-the-money gives you a more secure way to profit from this bearish outlook. The intrinsic value cushions you to an extent. Selling call options in-the-money is a relatively low-risk play and an effective strategy for steady income generation.

Turn bearish market conditions into opportunities. Use Option Samurai to maximize premiums and master selling in-the-money call options. Click the image below to grab our Black Friday deal and start profiting with confidence!

When Should You Sell a Call Option In-The-Money?

Timing is crucial when you’re selling an in-the-money call option. Ideally, you’d want to sell when implied volatility is high, as this increases the option premium and, therefore, potential profit. Market conditions also play a role. If you anticipate that a stock will remain stagnant or decline, that’s a favorable time to sell.

Be mindful of upcoming events like earnings reports or major announcements, as they can introduce additional volatility. So, when should you sell a call option in the money? Look for a combination of high volatility and a bearish outlook on the underlying asset for optimal results.

Could You Sell Your Call Option and Make Money?

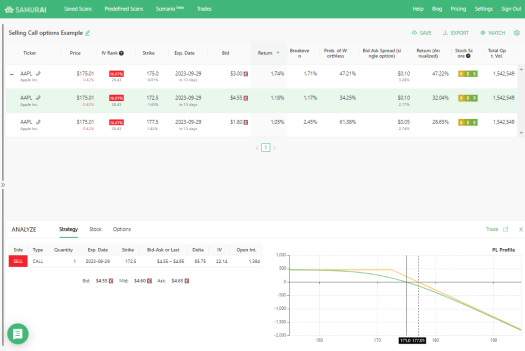

Let’s say you sell an in-the-money call option for Apple, which is trading around $175, at a $172.5 strike price. The premium you collect upfront is $4.55. When selling call options in the money, your potential for immediate profit comes from the option premium, in this case, $4.55 per share.

If we compare it with selling the out-of-money call option – like $177.5 – you only collect $1.8 per share. So, if you are right in your bearish outlook – you earn more from selling call options in the money.

However, we see that the breakeven point of selling in the money call options is only 1.17% above the current market price, while in the OTM example, it’s 2.45% away. So – OTM options give you more margin of safety.

It is important to note that risk-wise, those strategies are almost identical in their worst-case scenario (unlimited loss). So, in some cases, selling call options in the money will be a better choice because it offers higher profit when you are right.

If you’re looking for a more advanced scenario, you may want to refer to our article on selling call spreads.

Final Thoughts

Selling call options in the money can be a lucrative strategy, especially if you have a solid understanding of market conditions and timing. Selling call options in the money allows traders to collect higher premiums upfront, and be more profitable when they are right.

However, the stock price going up against your expectations is the primary risk to be aware of. Losses can occur if the price surges so you could consider buying a protective leg to cap them. But with the right market analysis, risk management, and trading tools, these risks can be mitigated.

For those eager to delve deeper into options trading, we invite you to explore our options scanner – Options Samurai – or dive into our resources in the blog. Expand your trading arsenal by understanding more about selling in the money call options and beyond.

I would love to see examples of where you can get yourself stuck and ways to maneuver around ITM spreads that you are looking to roll. Good strategies to not paying a ton to roll up and out.

Thanks for your comment! A typical situation where you might get stuck is when the underlying stock moves higher than your strike price, and rolling the call becomes too expensive. You could roll up and out the option (i.e., you aim for a higher strike + a longer expiration). For example, let’s say you sell an ITM call on SPY, which is trading at $570, and you sell the $565 strike call with high implied volatility (IV) because an important inflation report is due. Your rationale is that after the report, IV will crush, and the option’s price will drop. You collect a nice premium upfront, but after the news comes out, SPY rallies higher than expected, and the call moves deeper ITM. In this case, the decrease in IV risks to be more than compensated by the delta factor). Now, rolling becomes expensive. In this case, you could roll to a higher strike, say $580, and push the expiration out by a week.